DTCC Listings Signal Operational Readiness

The 21Shares Sui ETF (TSUI) and Polkadot ETF (TDOT) have appeared on the DTCC clearing list. Inclusion establishes plumbing for settlement and trading if regulatory approvals follow.

While not a green light to launch, the step indicates backend preparation is advancing. Market participants view DTCC visibility as an intermediate milestone on the road to market.

SEC Still Holds The Gavel

U.S. Securities and Exchange Commission approval remains mandatory before trading can begin. Recent process improvements have shortened timelines, but outcomes are never guaranteed.

Analysts see improving odds amid a friendlier review cadence. Nevertheless, issuers must meet disclosure, custody, and market‑structure standards to secure clearance.

Recommended Article: Ondo Finance Sees Regulatory Clarity As Key Catalyst For Crypto Growth

Market Reaction: Brief Pops, Cautious Follow‑Through

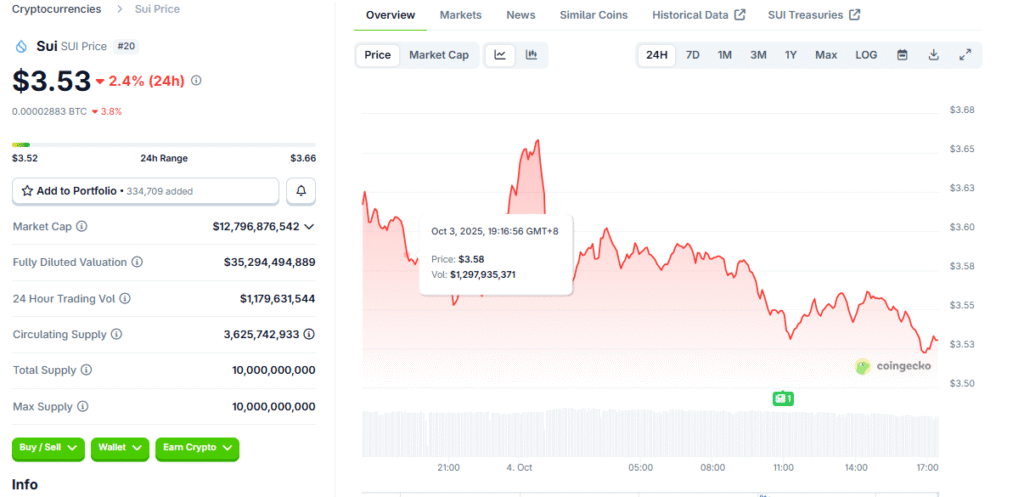

Sui and Polkadot prices both ticked higher on the news before giving back gains. The fade reflects broader uncertainty across risk assets and headline‑driven tape.

Traders remain on alert for definitive regulatory signals. Durable price shifts typically require formal approvals and a clear launch schedule.

Why DTCC Matters In The Pipeline

DTCC listing lays essential operational groundwork. It helps intermediaries validate readiness, connect workflows, and pre‑stage post‑trade processes crucial for smooth debuts.

For institutions, mature clearing infrastructure reduces friction and compliance hurdles. That lowers barriers to participation once funds are live.

Competitive Context: Beyond Solana

While Solana is widely tipped to lead next approvals, parallel progress continues elsewhere. Polkadot and Sui products position issuers to move quickly if windows open.

Diversified ETF shelves help capture differing investor preferences across ecosystems. Breadth can also support healthier, less crowded flows post‑launch.

What Could Accelerate Timelines

Clear guidance on token classification, custody assurances, and surveillance agreements improves approval prospects. Strong market‑maker participation plans also bolster readiness.

Constructive dialogue between issuers and regulators has shortened cycles in recent months. Continued momentum could bring multiple products to market in close succession.

Bottom Line: A Step Closer, Not The Finish Line

DTCC inclusion is meaningful progress but not destiny. Eyes remain on the SEC for the decisive call.

If approvals arrive, Polkadot and Sui ETFs could broaden access and institutional participation. Until then, the market will trade headlines while plumbing gets built.