Confidence Declines Sharply Across Industries

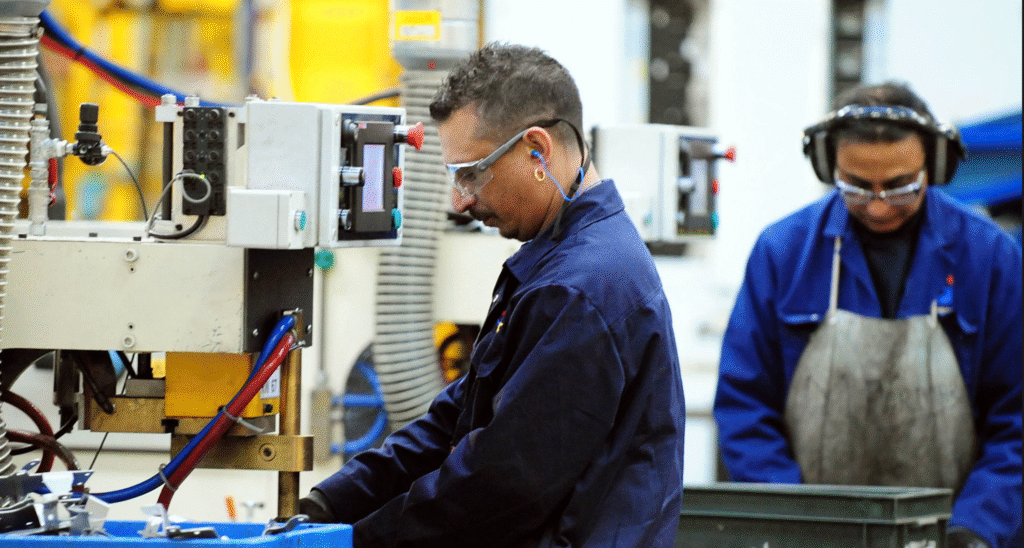

Business confidence in the UK has fallen to its lowest level on record, reflecting mounting concerns over rising costs. A survey of business leaders highlighted that labour and energy expenses are weighing heavily on operational outlooks.

September’s decline follows a brief summer rebound, indicating persistent economic fragility. Executives report worsening conditions across most sectors, raising alarms about growth prospects heading into 2026.

Labour Costs Drive Growing Anxiety

Labour costs remain the top concern for UK businesses. Persistent wage pressures have pushed cost expectations to record highs, forcing companies to rethink hiring strategies and operational budgets.

Economists warn that these pressures could squeeze margins further, particularly for small and medium-sized enterprises. Rising employment expenses add uncertainty to an already challenging economic environment.

Energy Prices Add to Economic Strain

Energy prices are another key factor undermining business confidence. Companies continue to face elevated energy costs, increasing production expenses and affecting profitability.

This combination of labour and energy challenges has created a difficult landscape. Businesses are struggling to maintain stability while adapting to shifting market dynamics and cost structures.

Recommended Article: US UK Tech Deal Raises Questions On AI’s Future Direction

Inflation Concerns Remain Elevated

Bank of England policymakers have expressed caution about inflation’s persistence. Deputy Governor Clare Lombardelli warned against assuming recent inflation shocks will dissipate quickly, citing ongoing food price increases.

MPC member Catherine Mann echoed these concerns, suggesting that the UK’s inflation rate has become more entrenched than previously expected. Sticky inflation complicates monetary policy decisions and business planning.

Fiscal Policy Under Pressure

The chancellor’s recent conference speech highlighted the need for fiscal credibility to support economic recovery. Business groups urge the government to deliver a growth-focused budget in November that addresses mounting cost concerns.

Without decisive fiscal measures, businesses fear prolonged uncertainty. Policy clarity and targeted support could help restore some confidence among UK companies facing cost pressures.

Diverging Views Within the Central Bank

Bank of England policymakers remain divided on how persistent inflation will be. Some favour caution, warning that strong inflation could limit further interest rate cuts, while others take a more optimistic stance.

Sarah Breeden argued that current inflation pressures reflect temporary external shocks unlikely to persist into 2026. This divergence adds complexity to monetary policy signals, affecting market expectations.

Businesses Brace for Challenging 2026

With inflation uncertainty, high costs, and weak confidence, businesses are preparing for a tough year ahead. Leaders emphasise the need for strategic adjustments and government action to support economic resilience.

Restoring confidence will require coordinated efforts from policymakers, businesses, and financial institutions. The coming months will be critical for determining whether the UK can stabilise its economic outlook.

Structural Challenges Require Long-Term Solutions

The UK’s business environment faces structural cost challenges that cannot be solved overnight. Sustained policy action and innovation will be needed to address these issues effectively.

Rising costs highlight vulnerabilities within the economy, but they also present opportunities for modernisation. Long-term solutions may include investing in technology, improving energy efficiency, and reforming labour practices.