Ethereum Stands at a Crucial Market Crossroads

Ethereum’s market is confronting a period of intense uncertainty, with traders divided on its future trajectory. Volatility has surged as ETH hovers near key technical levels, forcing investors to reassess strategies carefully. Some remain optimistic about eventual recovery, while others anticipate deeper corrections ahead.

This crossroads reflects broader dynamics shaping the crypto landscape. Macro factors, institutional behavior, and shifting retail sentiment are colliding, creating a complex environment for Ethereum. Traders must weigh these elements carefully to navigate potential opportunities and risks during this transitional phase.

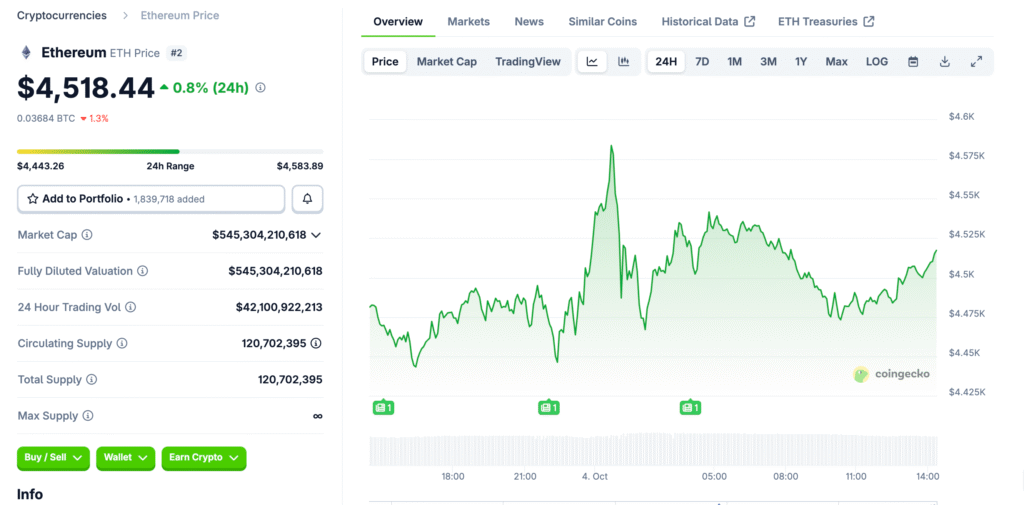

Price Hovers Near Pivotal Technical Thresholds

Ethereum currently trades near the crucial $4,350 level, a zone that has become the focal point for market participants. Nearly $1 billion in short positions hang in the balance, potentially triggering cascading liquidations if volatility spikes further. Traders are monitoring this zone closely for decisive breakouts or breakdowns.

A successful defense of this level could stabilize markets and provide a launchpad toward previous highs near $4,800. Conversely, failure to hold could accelerate bearish momentum, forcing leveraged traders into rapid unwinds. This technical tension underscores how delicately balanced Ethereum’s near-term outlook has become.

Institutional Investors Deepen Their Commitment

Despite volatility, institutional investors are demonstrating growing confidence in Ethereum’s long-term prospects. Companies like BitMine Immersion have accumulated over $10.6 billion worth of Ether, signaling significant strategic commitment. These moves indicate that large players view current turbulence as an opportunity rather than a deterrent.

Institutional flows are further evidenced by substantial inflows into Ethereum-based ETFs. Over $547 million has entered these investment vehicles recently, highlighting sustained appetite among corporate investors. This contrasts with waning retail enthusiasm, illustrating how institutional capital increasingly shapes market dynamics.

Economic Forces Shape Ethereum’s Environment

External economic factors are exerting meaningful influence over Ethereum’s price behavior. Fears of a potential U.S. government shutdown initially weighed on sentiment, driving volatility higher. However, those worries have subsided somewhat, as markets expect that any closure would likely be partial and manageable.

Meanwhile, renewed strength in technology equities, driven by partnerships involving OpenAI and Nvidia, has boosted overall risk appetite. These macro tailwinds have spilled over into crypto markets, providing Ethereum with some relief from persistent selling pressure. Economic currents remain pivotal drivers for ETH’s near-term direction.

Accumulation Trends Reveal Strategic Positioning

Institutional players are continuing to accumulate Ether even amid market turbulence, reflecting a strategic long-term view. Some investors are increasing holdings while others trim positions temporarily due to ETF-related outflows. This divergence reveals sophisticated approaches rather than panic-driven decisions.

Data suggests that accumulation patterns are particularly strong among entities with extended investment horizons. These players appear willing to absorb short-term volatility in exchange for exposure to Ethereum’s potential future growth. Their behavior contrasts with short-term speculators reacting more sensitively to price swings.

Recommended Article: Ethereum And Remittix Set Stage For Explosive Growth In Q4 2025

DeFi Versus Institutions: A Strategic Dichotomy Emerges

Ethereum’s ecosystem is witnessing a fascinating split between DeFi-native participants and institutional investors. Traditional institutions are expanding their positions, embracing compliance and structured strategies. Conversely, many agile Web3 startups remain cautious, responding defensively to macroeconomic shifts and regulatory uncertainty.

This dichotomy highlights Ethereum’s unique position at the intersection of decentralized innovation and institutional adoption. As these groups pursue different strategies, their combined actions will shape liquidity flows and price behavior in unpredictable ways. Understanding this tension is essential for informed decision-making.

Volatility Demands Careful Investor Navigation

The current environment demands disciplined strategies from investors operating in Ethereum markets. Price swings remain sharp, influenced by both technical triggers and broader macro narratives. Managing exposure and timing becomes crucial for minimizing downside risks while capturing potential upside opportunities.

Long-term participants focus on broader structural trends, while traders emphasize tactical positioning. Both groups must remain vigilant, as sudden shifts can disrupt even well-planned strategies. Navigating Ethereum’s turbulence requires a balance of conviction, flexibility, and keen awareness of market signals.

Ethereum’s Future Hinges on Strategic Adaptation

As Ethereum confronts this volatile phase, its trajectory will be shaped by how stakeholders adapt. Institutional flows, regulatory developments, and macroeconomic shifts will interact to define ETH’s path forward. Investors who understand these forces may be better positioned to capitalize on emerging opportunities.

Whether Ethereum surges past resistance or faces prolonged consolidation remains uncertain. However, the growing role of institutions provides a stabilizing counterweight to short-term volatility. Ethereum’s journey continues, shaped by evolving strategies and market forces that will define its future landscape.