Kaspa Supply Tightening Strengthens Bullish Market Momentum

The circulating supply of Kaspa has shrunk significantly, which means that holders are becoming more confident and short-term selling pressure is going down. Since late 2023, the percentage of dormant supply has steadily risen, which has made the market much more resilient.

Around 28% of all Kaspa coins were not being used in late 2023. By November, this number had risen to 40%. It stayed there until mid-2024, when it shot up to over 61%. Such long periods of inactivity show a strong tendency to accumulate, which limits the supply available for speculative trading on all exchanges.

Dormant Kaspa Coins Reflect Growing Long-Term Holder Conviction

Kaspa holders show their strong commitment by keeping a large part of their assets inactive, which is a sign of a positive long-term outlook. This pattern of accumulation limits supply, which often leads to big price increases when the market is good and liquidity changes.

Long-term dormancy levels above 60% usually mean that medium-term investors are very sure that prices will rise significantly. When circulation slows down, it creates scarcity effects, which make it more likely that there will be stronger rallies when demand suddenly rises in important price ranges that traders watch.

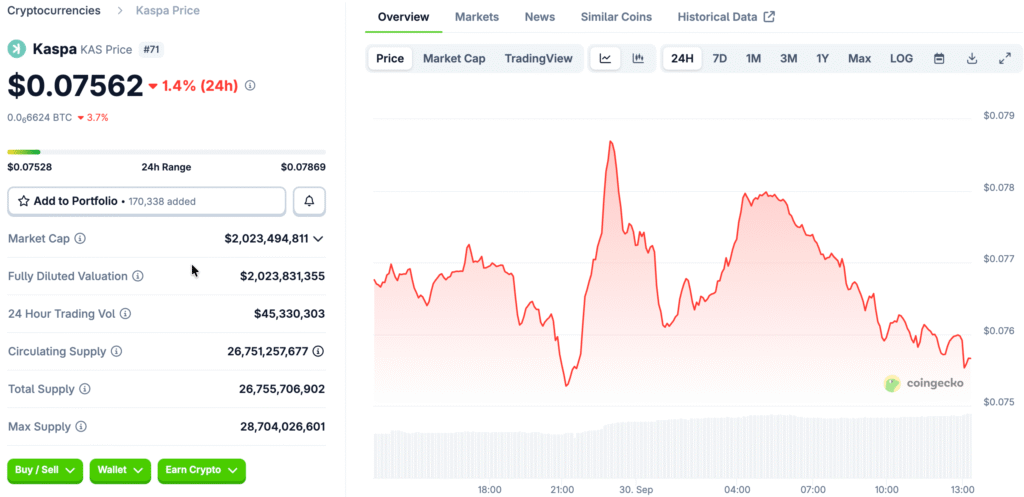

Kaspa Price Behavior Reveals Consistent Range-Bound Trading Patterns

Kaspa’s price history shows a number of different rallies and corrections within a wide trading range that has been set up over several market phases. The coin rose quickly from $0.03 to $0.13 in late 2023, then went through several stages of consolidation where volatility was lower.

After rising at first, KAS fell to $0.07–$0.09, then rose again to $0.17, where it found resistance. Prices stayed between $0.07 and $0.12 for most of 2024. This was because of ongoing accumulation and changing conditions in the broader market that affected short-term speculative sentiment.

Recommended Article: Kaspa Price Prediction: KAS Tests Key Support for Rebound

Support and Resistance Levels Guide Active Kaspa Trading Strategies

Traders keep a close eye on certain Kaspa support and resistance zones that have historically affected how people buy and sell during different liquidity phases. Support is still mostly between $0.07 and $0.08, which has drawn buyers’ attention during pullbacks over the past few months.

Resistance levels at $0.12 and $0.17, on the other hand, have stopped bullish momentum in the past, making upper trading boundaries that are easy to see. These technical indicators give traders structured reference points to find breakout opportunities or accumulation ranges that help them make strategic entry decisions.

Kaspa Liquidation Heatmaps Highlight Key Price Trigger Zones

Kaspa Daily’s liquidation heatmap shows areas with a lot of liquidity where price changes could happen very quickly if traders are forced to act. There is a big cluster around $0.072–$0.073 and another important zone higher up between $0.090 and $0.092. These are likely to be volatility triggers.

Shorter layers between $0.080 and $0.083 could serve as temporary pivot points that help prices move in the short term. If prices drop to around $0.075–$0.076, cascades could quickly push prices down to $0.072. On the other hand, if it breaks above $0.083, it could move toward $0.092, which would start trading based on momentum.

Kaspa Technical Setup Suggests Imminent Directional Breakout Potential

Kaspa’s combination of limited supply, set trading ranges, and clearly defined heatmap zones makes it likely that there will be a lot of movement in one direction. These kinds of convergences often happen before breakout scenarios, which are when outside factors or sudden changes in demand happen without warning.

Traders expect prices to move near these levels because short covering and new buying pressure can combine in a big way. If Kaspa breaks through either cluster decisively, market watchers think there will be spikes in volatility. This could be a sign of the next sustained rally phase that targets historical resistance levels.

Traders Keep an Eye on Important Levels for Future Kaspa Price Changes

People in the market are paying attention to whether Kaspa can stay above $0.07–$0.08 while also breaking through $0.083 resistance soon. If this works, prices could go up to $0.09 or even higher as technical signals line up and the amount of money in circulation goes down.

If the breakout lasts, it will probably draw in momentum traders, which will increase volatility and liquidity. With supply at record highs and demand rising, any sudden rise in demand could cause prices to rise quickly, rewarding those who positioned themselves strategically ahead of strong bullish continuation patterns.