ADA Price Drops as Selling Pressure Stays Strong

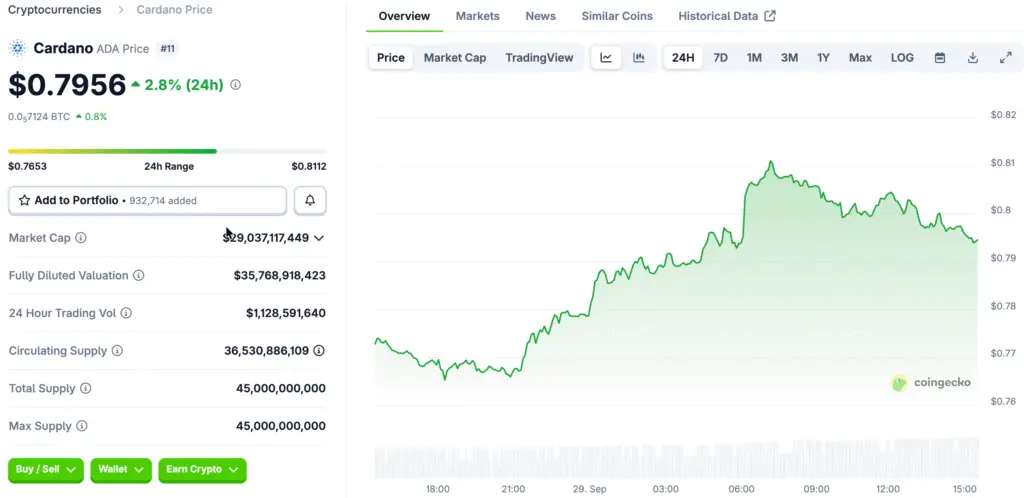

As bearish sentiment grows in the market, Cardano’s price fell to $0.79, continuing its recent downward trend. Traders are keeping a close eye on ADA’s actions as it tries to stay above important short-term support levels.

The $0.80 barrier has been hard to break through again and again, which has added to the bearish momentum. People in the market are becoming more careful because they know that Cardano’s technical structure is still weak under constant downward pressure.

The $0.80 Resistance Zone Stops Bullish Breakouts

The $0.80 zone is immediate resistance, turning down bullish attempts over and over again and effectively stopping Cardano’s recovery. Several attempts to break out have failed, making this important level a short-term ceiling that controls the direction of prices.

If the price stays above $0.80, it could be the first sign of a bull market, which could lead to $0.85 and $0.90. Traders stress that breaking through this resistance is necessary to convincingly turn around the current bearish sentiment.

Short-Term Momentum Moves Toward Bears

ADA’s recent failure to rise above its 50-day moving average of about $0.86 shows that bearish control over short-term price action trends is growing. Technical charts show ADA holding steady below resistance, which means that bullish energy is fading and selling interest is steadily rising.

This change toward bearish dominance makes it harder for bulls to keep prices stable around important levels. The weakening momentum means that bearish traders are currently in charge of ADA’s short-term direction within set resistance levels.

Recommended Article: Cardano Whales Sell $500M as ADA Struggles Below $0.82

Important Support Levels Set ADA’s Medium-Term Structure

ADA’s immediate support is near $0.73, which is also where its 200-day moving average is. If this level breaks, traders think that $0.71 will be tested again as a key secondary defense before prices drop even more.

If these supports aren’t kept up, selling could speed up toward $0.62 and maybe even $0.55. Market participants think that this support cluster is necessary to keep ADA’s medium-term bullish structure intact even though the market is currently bearish.

ADA Drop Below 200-Day SMA Could Accelerate Bearish Momentum Ahead

From a technical point of view, ADA is currently stuck between support at $0.73 and resistance at $0.80. These levels are important because they will determine which way the market will go next, depending on whether or not there is a breakout.

The indicators show that ADA is trading below its 50-day SMA but still above its 200-day SMA. If it drops below the 200-day level, it would be a very bearish sign that could speed up the downward trend in the next few sessions.

Market Sentiment Is Still Cautiously Neutral

Even though prices are low, Cardano is still getting a lot of attention from the ecosystem because there are a lot of active development projects on its blockchain network. But the overall market is weak, which makes it hard for ADA to build up any real bullish momentum right now.

If Bitcoin stays stable, ADA might rise from its current levels toward resistance zones. On the other hand, if the market stays weak, ADA could fall below important support, which would quickly change people’s minds about how long they expect the market to stay bearish.

ADA Price Action Will Decide If Bulls Regain Control or Bears Dominate

Traders are keeping a close eye on ADA for signs of a breakout above resistance or a breakdown below important supports. These movements will decide if bullish forces take back control or if bearish momentum keeps going for longer.

During this period of consolidation, market analysts stress the importance of being patient and managing risk wisely. How ADA does in the next few days, whether it can get back to $0.80 or stay at $0.73, will probably affect the rest of the crypto market.