Ethereum Strengthens Its Position Through Key Network Upgrades

Ethereum’s network has undergone significant upgrades, making it more scalable and enabling new opportunities. The Fusaka upgrade introduced PeerDAS, doubling the size of blobs and supporting Layer 2 ecosystems.

Institutional investors remain interested in Ethereum’s role in decentralized finance, with ETF applications demonstrating confidence and increased blockchain activity. Ethereum’s role as a backbone for tokenizing real-world assets strengthens its position as a top infrastructure platform for global finance.

ETF Filings Boost Ethereum’s Institutional Appeal Rapidly

There has been a huge increase in ETF filings, which has made Ethereum more credible in traditional finance circles around the world and helped it gain widespread use. Large inflows show that investors are very interested, which strengthens Ethereum’s position as a leading platform in the rapidly changing global crypto financial markets.

Progress in regulations around ETFs is creating positive momentum that could bring in new money from institutional investors around the world who don’t want to take risks. Ethereum’s integration with legal investment vehicles sets the stage for market growth and long-term price increases.

Remittix Emerges as a Powerful PayFi Blockchain Contender

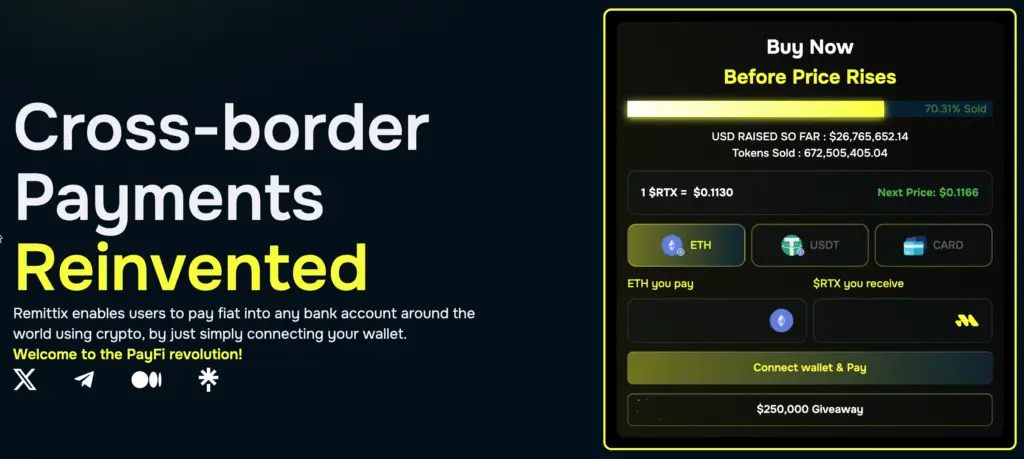

Remittix is a crypto-based platform that enables quick money transfers from crypto to banks in over 30 countries, providing real-time exchange rates. Its PayFi model addresses real-world payment issues, making RTX a valuable link between blockchain technology and traditional financial systems.

The project’s adoption has sparked interest from investors and analysts, as it has a clear use case, distinguishing it from speculative tokens with no real-world applications. This makes it more appealing to strategic early adopters.

Recommended Article: XRP and Remittix Partner Up as Payments Market Heats Up

Big Fundraising Highlights How Much Investors Trust Remittix

Remittix has raised over $26 million through its presale, indicating strong investor confidence in its new payment system. The funds will aid the company’s global growth, accelerating partnerships with banks and payment service providers.

This strong fundraising performance indicates high demand for Remittix, positioning it for rapid market entry in 2025, when the crypto market is expected to be robust. Analysts predict continued presale momentum will attract institutional investors, increasing liquidity and adoption in strategically important jurisdictions.

Key Adoption Drivers Strengthen Remittix’s Market Outlook

Remittix’s strategic partnerships will link banks and PSPs directly to crypto payments, making international transactions easier and more open around the world. Its usefulness in the real world lets freelancers and businesses get paid right away, and blockchain integration makes cross-border financial transactions work better.

Remittix’s ambitious plan to cover payments around the world is shown by the fact that it got a lot of traction with forty cryptocurrencies and thirty fiat pairs at launch. CertiK verification makes people feel safer, and referral incentives make it easier for both retail and institutional investors to spread the word about the service.

Ethereum and Remittix Attract Different Types of Investors

Ethereum is appealing to institutional investors who want clear rules, a strong infrastructure, and a mature ecosystem in the changing world of blockchain. It is a popular choice for large capital allocators looking for long-term exposure because it has a lot of liquidity and has been able to withstand tough times in the past.

On the other hand, Remittix attracts opportunistic investors who want to make a lot of money by getting people to use it and by making strategic payment integrations in markets that don’t get enough attention. The stability of Ethereum and the innovation of Remittix make it possible to have a balanced portfolio exposure in the fast-changing crypto market.

Why Remittix Might Have More Room to Grow than Ethereum

Remittix is in a unique position in the global payments market, which means it has a lot of room to grow compared to Ethereum, which is already established but growing slowly. RTX fixes important problems by making it easy to switch between fiat and crypto. This gives it a lot of disruptive power in payment systems around the world.

Experts say that Remittix could make a lot of money when the market is going up because it is being adopted quickly in many parts of the world. Ethereum is still important, but Remittix’s focused use case and lean growth strategy give aggressive investors looking for big gains a lot of options.