Hyperliquid Draws Parallels to Solana’s Early Journey

Cathie Wood thinks Hyperliquid has a lot of potential, just like Solana did in its early years. It quickly drew the attention of investors and developers. She talked about the protocol’s growth and potential, which was similar to Solana’s early rise in performance and plans for expanding its network.

Her comments made it clear that Hyperliquid is becoming more important in decentralized exchange markets and is able to compete with other players. She was excited about how quickly it was changing, how well it fit into the market, and how it could fit in with new crypto stories around the world.

Bitcoin Remains the Core of Cathie Wood’s Thesis

Even though there is more competition, Wood said that Bitcoin is still the most important part of her investment strategy and her overall view of cryptocurrencies. She talked about Bitcoin’s monetary features, fixed supply, and ability to withstand problems, which set it apart from other blockchain networks in a big way.

Wood says that Bitcoin is the foundation of the whole ecosystem and that its dominance is unlikely to go away anytime soon. Even though she knows about new technologies and trends in decentralized finance platforms that allow for more variety, her main focus is still on Bitcoin.

Ethereum and Solana Still Hold Strategic Positions

Wood talked about how Ethereum powers decentralized finance, smart contracts, and blockchain apps that are good enough for businesses all over the world. She praised its development ecosystem, strong community, and growing scalability solutions, which make it a key part of the infrastructure.

In the same way, Solana is still an important asset in ARK’s portfolio because of strategic investments and treasury exposure. She talked about its amazing speed, new ways to make it more scalable, and partnerships that make it one of the best blockchain networks that is currently changing the crypto markets.

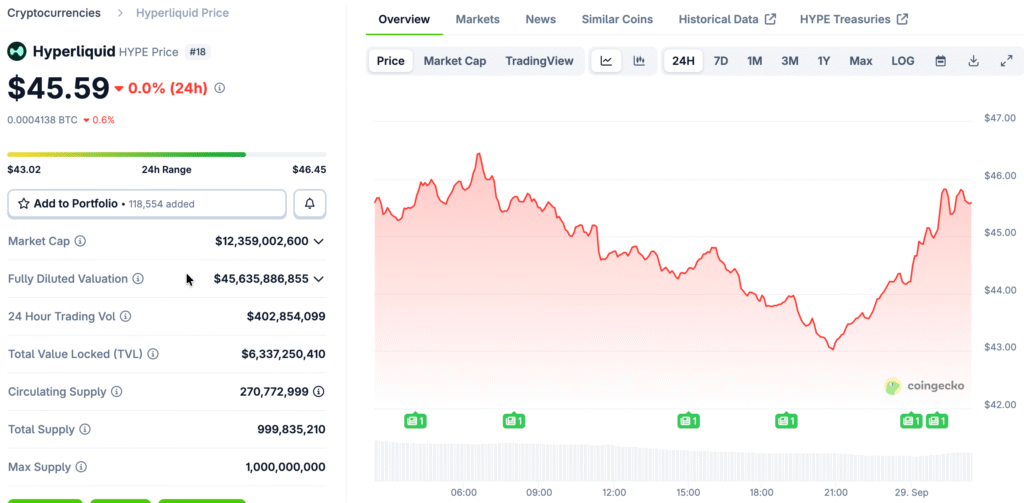

Recommended Article: Hyperliquid Retests $50 Support Ahead of Token Unlocks

Hyperliquid Joins the Race for Perpetual DEX

Hyperliquid is becoming more popular as competition between decentralized exchanges for perpetual futures heats up, and it is aggressively challenging established leaders. Its new protocols, deeper liquidity, and faster speeds have quickly caught the attention of both retail and institutional traders.

The rise in Hyperliquid’s volume and open interest is similar to what happened on the Solana network before, which got investors excited. If market conditions stay good and developers keep working on improving the platform, analysts think this momentum could lead to more growth.

Decentralized Exchanges Attract Retail and Quant Traders

More and more retail traders are looking into decentralized exchanges like Hyperliquid because they have lower fees, faster execution, and possible airdrop incentives. These platforms let you take part in growing ecosystems without having to rely on traditional centralized intermediaries.

Semi-professional quant traders are also moving to decentralized exchanges in search of algorithmic strategies that work well in open, efficient on-chain environments. This move is part of a bigger trend toward self-custody, faster settlement, and the use of new trading infrastructure on blockchain networks all over the world.

Institutions Still Prefer Centralized Platforms for Access

Institutional participants still rely heavily on centralized exchanges for regulatory compliance, fiat on-ramps, and operational convenience currently. These platforms offer institutional-grade services, deep liquidity, and the brokerage support needed for large-scale trading operations without any problems.

However, as new technologies come out faster, the performance gap between decentralized and centralized exchanges keeps getting smaller. Advanced order-book decentralized exchanges like Hyperliquid are getting better at meeting the speed, liquidity, and user experience standards of centralized platforms.

Hyperliquid Comparison by Cathie Wood Draws Global Market Attention

Cathie Wood’s opinions often have a big impact on the way the market works, how investors feel, and how institutions plan. Her comparison of Hyperliquid and Solana has drawn more attention to new decentralized exchange technologies in crypto communities all over the world.

Wood shows a balanced investment strategy by keeping Bitcoin as her main thesis while also recognizing new protocols. This view focuses on basic assets and strategically picks out high-potential technologies that will shape future decentralized financial systems.