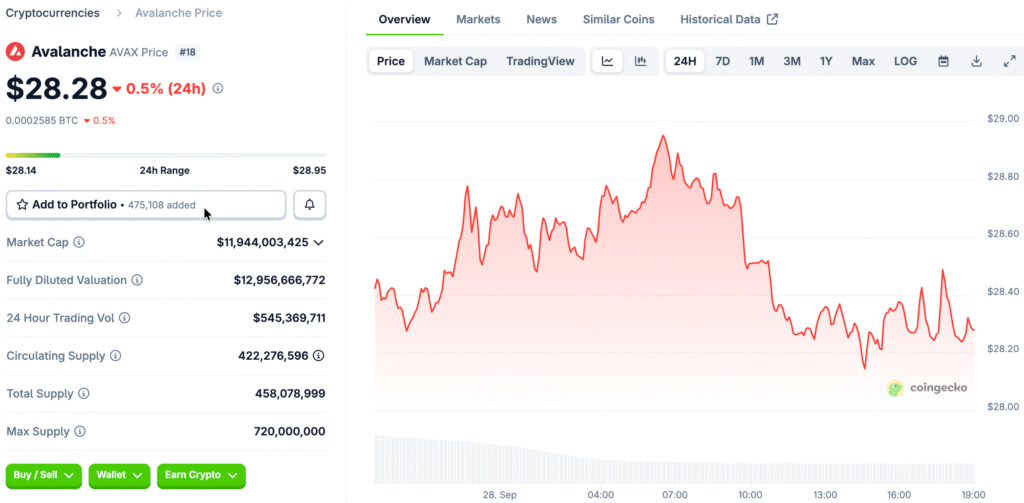

AVAX Price Drops Quickly Over the Week

The price of Avalanche’s native token, AVAX, has dropped a lot in the last week, going down 18%. The token is now worth about $27.72, down 8% in the last 24 hours. This is because there is more selling pressure in the crypto markets as a whole. AVAX has tried to stay above $30, but it has repeatedly tested weak support around $27.65, which makes people worry about more downside risk.

This drop happens at a time when news from institutions hasn’t been able to provide a real cushion. The larger crypto market has also become bearish, with major assets like Bitcoin, Ethereum, and Solana losing double digits, making AVAX’s problems even worse.

Institutional Acquisitions Announced but Market Unmoved

Earlier this week, AgriFORCE Growing Systems changed its name to AVAX One and said it wants to raise $550 million to buy Avalanche tokens. Anthony Scaramucci of SkyBridge Capital and Brett Tejpaul of Coinbase Institutional are two well-known people who support the project. The goal is to raise more than $700 million worth of AVAX.

Even with this strategic push, traders haven’t been very excited. The market’s momentum is still negative, and there haven’t been any big inflows to counteract the constant selling pressure. This muted response shows that investors are cautious, even though institutions are involved.

Technical Resistance Levels Highlight Uncertainty

AVAX is having trouble getting back above $30.28, which is a technical level of resistance. The number of trades has dropped to about 121,896 tokens, which means that fewer people are taking part in recent sessions. Even though the volume is going down, it hasn’t led to bullish momentum yet.

Market-wide weakness makes the hesitation even worse. This week, Ethereum, Solana, and Dogecoin all fell by double digits, and Bitcoin fell by another 6%. This makes it hard for AVAX to try to recover.

Recommended Article: Avalanche Price Rebounds as Analysts See 14x Growth

AVAX Price Changes with the Market

Right now, the crypto market is going through a time of high volatility and risk-off sentiment because of macroeconomic uncertainty and tighter liquidity conditions. These larger trends have made it even harder for alternative Layer-1 tokens like AVAX to go up.

Interest from institutions alone has not been enough to fight these problems. Avalanche may still have trouble getting back to important technical levels and getting long-term buying support if the overall mood of the market doesn’t change.

Institutional Support Could Strengthen Long-Term Outlook

Even though the market is going down right now, Avalanche’s long-term fundamentals are still strong thanks to strategic moves by institutions. AVAX One’s plans to buy things could eventually make the market more liquid and give institutions more credibility, which would set the stage for future growth.

If these efforts work, they could help bring Avalanche’s ambitious ecosystem roadmap and the current level of market confidence closer together. But this change will probably take some time, and it might not have an effect on short-term price changes right away.

Bearish Territory Stays in the Short Term

AVAX is still in bearish territory for now, and it’s not clear what support levels will be in the near future. Traders are keeping a close eye on whether the $27.65 level can hold up against more selling pressure. If the price drops below this level, it could start a bigger correction that tests lower price levels.

On the other hand, if the price stays above the $30.28 resistance level with higher trading volume, it would be a sign of recovery. Until that confirmation comes in, the market outlook is cautious.

Avalanche’s Next Move Hinges on Market Stability and Institutional Plans

Avalanche’s next step will depend on the market as a whole stabilizing and the success of institutional plans like AVAX One. The project is still pushing for business integrations and real-world uses, but market sentiment is still the most important thing for short-term performance.

AVAX could see more bullish momentum if institutional inflows rise and macro conditions get better. Until then, outside market forces and how confident investors are are likely to have a big effect on the token’s price.