Elizabeth Warren Escalates Binance Scrutiny

Senator Elizabeth Warren has stepped up her attacks on Binance, pointing to the company’s admission in 2023 that it broke the Bank Secrecy Act. Binance had to pay $4.3 billion in fines, leave the U.S. market, and agree to strict rules for compliance. As part of the settlement, founder Changpeng Zhao stepped down and went to jail.

Warren says that political ties are still a big problem, even though the exchange has already been punished. She keeps bringing up problems that haven’t been solved that call into question Binance’s ability to follow long-term financial rules and regulations.

Political Ties Between Binance and Trump Interests

Warren has talked about how Binance is connected to Trump’s businesses, which could be a problem for investors and regulators. Reports say that World Liberty Financial, which is linked to Trump companies, is involved in investments in Abu Dhabi that go to Binance operations.

Critics say that these kinds of connections give some people too much power in discussions about U.S. economic and political policy. Warren’s point of view makes the issue seem both political and regulatory. She says that letting these kinds of connections go unchecked could hurt institutional transparency and make people less sure that the crypto industry is being watched properly.

Mutuum Finance Presale Momentum Builds

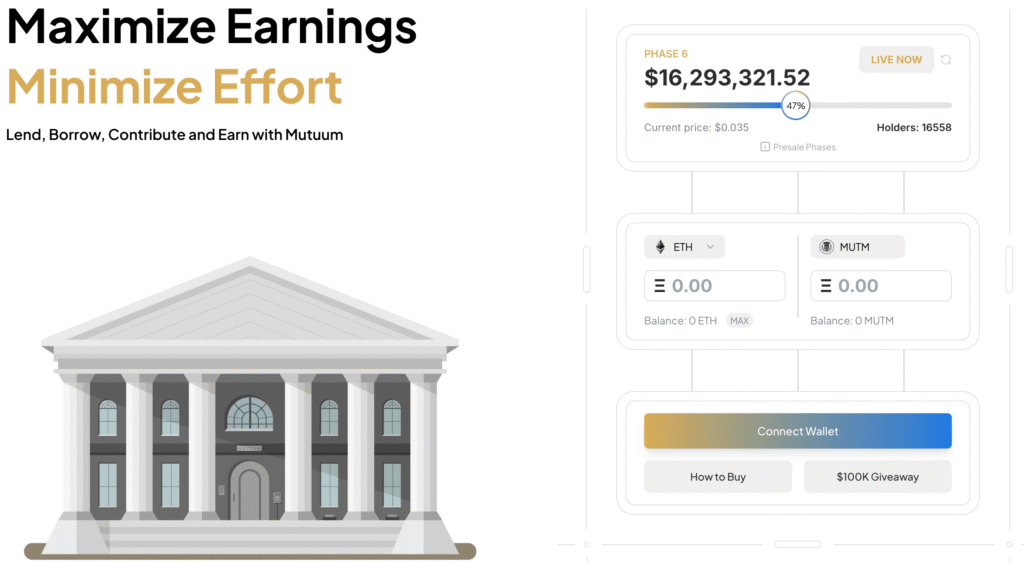

Warren is putting pressure on Binance, but Mutuum Finance (MUTM) is doing well with its ongoing presale phases, which are getting a lot of attention. As Phase 6 moves forward, the project has raised more than $16,050,000 and gotten 16,450 holders.

Tokens are now selling for $0.035, which is a 250% increase from the price at the start of the presale. The steady growth shows that people believe in its DeFi vision and investor-focused structure. Early adopters show that investors trust the project’s security, ability to grow, and planned delivery of new financial features.

Recommended Article: Mutuum Finance Price Forecast Gains Traction as Presale Surges

Strong Returns and Presale Pricing Structure

At $0.035 during Phase 6, buyers get early access before prices go up to $0.04 in Phase 7. The token is set to launch at $0.06, which will give early investors a lot of paper profits. The price of tokens goes up with each presale stage, giving people who buy in early better multipliers for their entry.

This method makes people feel like they need to act quickly while still keeping a structured sense of anticipation for the eventual exchange listing. Investors see this strategy as a long-term way to reward loyalty and encourage people to make financial commitments early.

Mutuum Finance Lending Protocol Development

Mutuum Finance is creating a decentralized lending system on Ethereum that will eventually work on many other blockchain networks. Token holders will be able to borrow stablecoins against things like ETH while still owning and keeping them. The project got a score of 90 out of 100 from CertiK, which made it more credible to investors and institutions.

Mutuum also started a $100,000 giveaway, with ten $10,000 prizes for people who met the requirements. These projects show a balance between technical progress and getting people involved in the community, which is meant to encourage long-term use.

Utility Features Enhance Adoption Potential

Mutuum Finance uses both peer-to-contract (P2C) and peer-to-peer (P2P) lending systems to make the most of efficiency and liquidity. Overcollateralization rules and borrowing limits help lower the risks that come with lending volatile assets. Chainlink oracles help with accurate valuations, and fallback systems make the platform more reliable when the market is unpredictable.

These protections make things more stable in the long term and make users trust both retail and institutional participants more. This kind of layered protection also makes it easier for institutional actors to work together to find reliable decentralized financial infrastructure.

Mutuum Presale Attracts Cautious Investors Seeking Stability and Profits

As Warren puts more pressure on Binance, investors are carefully looking at safer options in new DeFi projects like Mutuum. MUTM’s presale framework gives you stability and the chance to make money that many centralized exchanges don’t offer these days. Presales are appealing to cautious but ambitious crypto investors when the market is unstable.

The growing demand for Mutuum shows that it has strong momentum and makes it more appealing in today’s changing financial market. The story shows how decentralized projects are getting more attention while centralized exchanges are coming under more political and regulatory scrutiny.