Rise of Tokenized Stock Platforms

Tokenized stock platforms are growing quickly. They let investors buy small amounts of traditional stocks through blockchain technology. xStocks and Ondo Global Markets have become well-known leaders in this growing field among their competitors.

Both projects started in 2025 and have similar plans, but they are very different in how they are carried out and how appealing they are to the market. The competition shows how infrastructure choices and partnerships for exchanges affect how quickly people adopt digital assets.

Comparing Core Features of xStocks and Ondo

Both xStocks and Ondo offer tokenized U.S. stocks and ETFs that are fully backed by the underlying equities and have custodial protections. This lets users keep access to real-world assets while also getting liquidity from the blockchain.

But xStocks came out first and works with more chains, such as Ethereum, BNB Chain, Solana, and TRON. Ondo is currently only available on Ethereum, but it plans to add support for other blockchains soon in order to increase scalability.

Assets and Rules for the Market

Ondo entered the market with a wider range of options, offering over 100 stocks and ETFs at first, with plans to have 1,000 assets by the end of the year. On the other hand, xStocks only offers about 60 stocks right now, which shows that they are taking a more cautious approach to rolling out their service.

The rules are also different: xStocks uses EU custodians under Swiss law, while Ondo uses U.S.-registered companies. This difference may affect how much investors trust the company, especially if they are institutions looking for clear rules.

Recommended Article: Ondo Finance Rises as Fed Rate Cut Lifts DeFi Sector

Exchange Listing Momentum

Exchange listings have been very important in making tokenized stock platforms more visible and popular. xStocks is now listed on seven major exchanges, such as Bybit, KuCoin, Kraken, and others.

Ondo is behind with four listings, but it is still supported by important platforms like Gate.io, LBank, and MEXC. Ondo has fewer listings, but its reputation and institutional-focused liquidity channels help it.

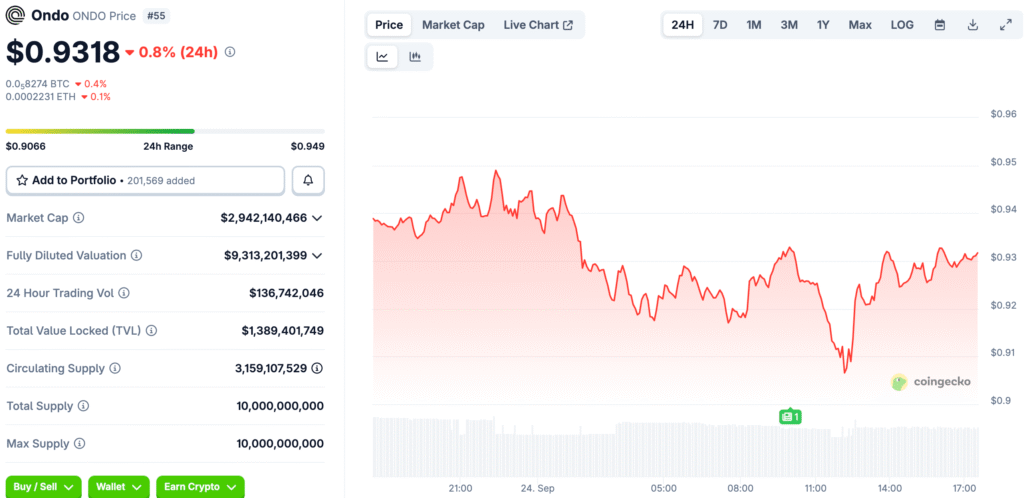

The TVL Gap Between Ondo and xStocks

In its first month of business, Ondo has locked up almost $260 million in Total Value Locked (TVL). xStocks, on the other hand, is behind with about $60 million, even though it has a wider range of listings.

This gap shows that Ondo has a strong institutional base that brings in a lot of money, while xStocks’ focus on retail hasn’t reached the same level yet. The difference shows how the depth of liquidity affects investor confidence and adoption.

Ondo Enhances Liquidity Efficiency With Easier Token Minting and Redemption

Ondo focuses on liquidity efficiency by making it easier to mint and redeem tokens, which reduces slippage in secondary markets. Arbitrageurs can more easily stabilize Ondo prices across venues, which makes spreads tighter.

But xStocks has had problems with liquidity fragmentation, and sometimes tokens trade at big premiums to the assets they are based on. Its many listings on different exchanges have made it easier to see, but they have also made liquidity too thin, which makes arbitrage less effective.

Retail vs. Institutional Adoption

xStocks has made itself a platform that is easy for retail investors to use by focusing on accessibility and a wide range of exchanges. This fits with its plan to get everyday crypto investors who want to invest in stocks.

On the other hand, Ondo uses its existing relationships with institutions and infrastructure to serve bigger capital allocators. Its model makes it the leader in liquidity, which is attractive to professional traders and banks.

xStocks and Ondo Both Shape the Future Landscape of Tokenized Equities

The battle between xStocks and Ondo shows two different ways to use tokenized equities: making them widely available to retail investors or making them very liquid for big institutions. Depending on how the market changes, both strategies have strengths that could lead to future growth.

As tokenized assets grow up, long-term winners will be determined by investor trust, the presence of exchanges, and the efficiency of liquidity. Both xStocks and Ondo are helping to shape the future of tokenized finance, whether it’s for individuals or businesses.