HYPE Tests Crucial $50 Support Zone

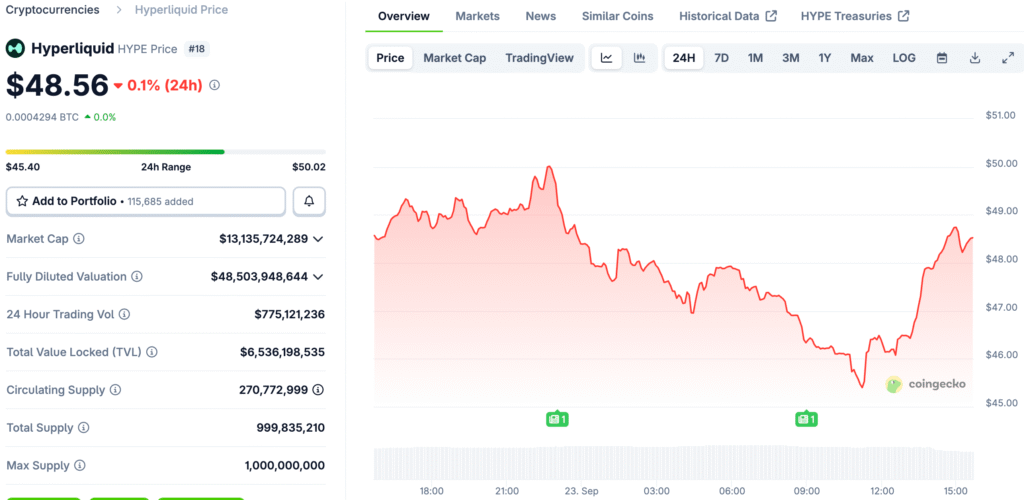

After weeks of strength, Hyperliquid has come back to a key price level close to $50. Recent pullbacks have changed the tone and slowed down momentum. Market participants are now paying close attention to how bulls try to protect important support.

If it doesn’t hold, it could go back even further. Some analysts say that this area could decide whether HYPE stabilizes or keeps going down. Bulls need to show strength here to stop losses from getting worse.

Bears Regain Control After Structural Break

After breaking below its previous structure, HYPE fell into a weaker setup. The drop was a bearish retracement that went against bullish momentum. Analysts said the price could go back up to $52–$54 before more selling.

Crypto Chiefs said that sellers have the upper hand right now. If bulls don’t protect the $50 mark, it looks like prices will keep going down. There is still a chance that the market will test recent lows again before it starts to recover.

HYPE Tests Lower Bollinger Band as Traders Defend $48–$49 Zone

The daily chart shows that HYPE is testing the lower Bollinger Band. The price action shows a sharp drop, with almost 5% lost during the day. Volume trends show that there is still a lot of selling going on at support levels.

Big Cheds, an analyst, says that protecting $48–$49 is important to keep the overall uptrend going. If this area stabilizes, it could lead to recovery. Failure could strengthen bearish control and make bigger drops more likely.

Recommended Article: Hyperliquid Support Strong at $55 as $60 Test Nears

Analysts Debate Redistribution Setup

Technical readings point to possible redistribution instead of just consolidation. Khan, the analyst, says that there are similarities to Wyckoff patterns, but they are leaning toward the bear side. If bulls don’t win, sellers may drive prices down to $38 or even $42.

For now, HYPE is between $49 and $50. A recovery above $52 would be a good sign. If that doesn’t happen, downside targets are more likely to happen as selling continues.

Liquidity Remains High Despite Pullback

Even though there have been losses, trading is still strong. There was a volume of more than $569 million in one day. This liquidity shows that there is still interest at important price levels.

Analysts say that strong participation could help bulls if the mood changes. But a lot of volume also gives sellers power if the market stays bearish. Traders are still being careful because volatility is still high.

Competitive Pressures Add Headwinds

HYPE has to compete with other projects like ASTER in addition to chart dynamics. Changing capital flows make it even harder to defend support. People in the market keep an eye on whether HYPE can get attention again.

Analysts say that getting back to $52 quickly is important to fight off competition. If you don’t do this, you could make things worse. To bring back confidence, bulls need to act quickly.

HYPE Faces Key Test at $50 as Bulls Fight to Prevent Breakdown

Defending the $49–$50 range is very important for the short-term outlook. A strong defense could stop the pressure and start the bullish momentum again. A breakdown would show $45 support before going deeper.

Traders stress confirmation by reclaiming higher resistance. Without it, the bearish bias stays strong. The next sessions will show if HYPE stays stable or goes lower toward important targets.