ADA Builds Momentum Amid U-Pattern Formation

Analysts say that Cardano’s U-pattern charting has drawn attention because it looks like a bullish reversal signal. This rounded bottom suggests that the recent drops may lead to a rise in value again. People in the market say that this structure shows a change in mood.

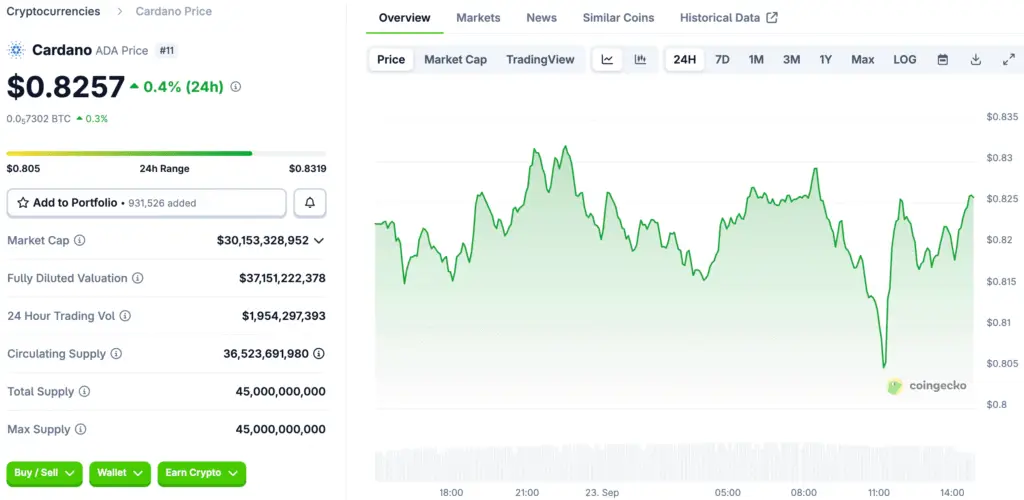

ADA is currently trading for about $0.85 and has a market cap of about $30.5 billion. A 6x rally could bring valuations close to $200 billion. This would also raise prices to between $5.11 and $5.58.

Technical Indicators Support Bullish Thesis

Traders often use the rounded bottom as a technical pattern. It usually means that the selling pressure has run out and the market is slowly recovering. When there is a lot of volume, these kinds of patterns often happen before long-term uptrends.

Traders are excited about this formation on Cardano because they think it will break out. Analysts think that going above $3.10, ADA’s previous all-time high, would boost confidence. This could start a trend of more people using it.

Historical Context Highlights Potential Upside

In January 2022, Cardano reached its highest price ever, $3.10. Going above this level would show strong bullish conviction and support from the industry. Reaching this milestone could spark interest in the mainstream again.

Investors remember that ADA has been volatile in the past, with periods of high momentum. If history is any guide, this setup could come before another big rally. But these kinds of moves need good conditions in the wider markets.

Recommended Article: Cardano Price Prediction Targets $1 Breakout and $6 Range

Market Risks Remain Significant for ADA

Even though there is hope, the risks that come with volatility are still high. In decentralized finance and NFTs, Cardano hasn’t yet reached the same level as Ethereum. In the short term, this difference could slow down ADA’s growth.

Recent changes of more than five percent in a single day show how risky it is. Analysts say to be careful and stress the importance of good risk management. Technical patterns alone may not be enough to keep gains going without more adoption.

Development Roadmap Strengthens Investor Confidence

People are excited about Cardano’s future because it keeps getting better, like with the Vasil hard fork. Improvements in scalability and interoperability could make it more competitive. These changes give investors faith in long-term growth.

Supporters stress that technical signals must be backed up by strong fundamentals. A healthy ecosystem will help prove that bullish predictions are correct. Analysts think that Cardano’s roadmap is important for backing up high valuations.

Cardano’s Long-Term Success Hinges on Adoption and Real Utility

ADA needs to be used by more people for it to do well in the long run. Institutional participation, decentralized applications, and network usage are all important things that need to happen. If these things don’t happen, momentum may stay uncertain and unsustainable.

If Cardano keeps getting more users and activity on its blockchain, the predictions become more believable. If not, ambitious goals could stay just that: ideas. Investors keep a close eye on development milestones to see if they are gaining traction in the real world.

Cardano’s U-Pattern Hints at Gains, but $200B Cap Needs More Fuel

The U-pattern for Cardano shows that people are technically optimistic, but charts alone won’t get it to a $200 billion cap. Adoption, upgrades, and good macro conditions all need to be in sync. ADA can only realistically handle a 6x surge after that.

Experts say that you shouldn’t rely too much on speculative formations. Still, the setup shows that there is a chance for big gains if the right conditions are met. As ADA consolidates, investors are still keeping an eye on things, balancing excitement with caution.