PEPE Price Drops After a Strong Start in January

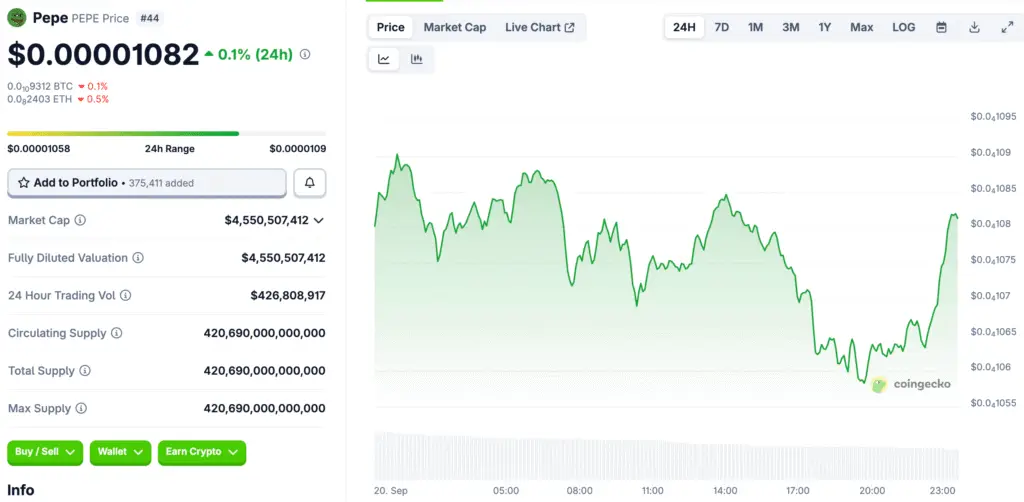

PEPE started 2025 at $0.0000193, thanks to momentum from late 2024. But by September, it had dropped to $0.0000100, almost half of what it was worth. Even though the price dropped a lot, the token stayed above its March lows, which suggests that it is consolidating rather than crashing in recent trading sessions.

So far this year, it looks like classic meme coin cycles. There were big corrections and long sideways moves after rallies that were based on hype. Investors are still cautious but paying attention to whether resilience above key support levels will lead to new breakouts.

Consolidation Provides Hope for Near-Term Recovery

PEPE stayed above the $0.0000010 support zone, showing some strength during months of volatile trading. Analysts point out that long-term consolidation often sets the stage for new upward rallies, especially in speculative altcoin markets.

If momentum picks up, a breakout above $0.0000015 could lead to $0.0000020. This possible rise shows hope in a tough year, as buyers wait for signs of a stronger recovery trend.

RSI Nears Oversold Levels, Suggesting Possible Bounce

The Relative Strength Index is currently around 34.9, which is close to the oversold level. Technical indicators show that recent drops may have worn out sellers, which could lead to bullish reversals.

Analysts see oversold conditions as signs that buyers might come back into the market. This setup has led to small rebounds in the past, so PEPE’s short-term outlook is better than it would be otherwise, even though there are still a lot of unknowns.

Recommended Article: Pepe Price Prediction Eyes $0.00003 as Whale Activity Grows

PEPE 2025 Shows Sharp Highs and Lows

CryptoRank data shows that PEPE lost a lot of value in January and February, and then it dropped again in March. In April and May, things got better, but the next few months were hit or miss. Volatility is still a big part of what makes PEPE a meme-driven cryptocurrency.

If you had put $5,000 in in January, it would have dropped to about $3,073 by September. Even though there were losses, rebounds in the middle of the year showed that partial recoveries were possible, which made long-term community supporters more cautiously optimistic.

CoinCodex Forecast Suggests Small Gains Possible

CoinCodex predictions said that a $5,000 investment made in January could grow to $5,091 by the end of September. This small rise shows that things are stable, since PEPE is holding steady instead of going down more during consolidation.

Even though returns are still low, the data shows that the company is strong. Analysts say that even small gains can make investors feel better about the market again, especially in highly speculative assets like meme coins, where mood can cause big changes.

Market Analysts See Bullish Short-Term Signals

Trader Rai, a crypto analyst, found bullish momentum for PEPE/USDT on shorter timeframes, with the price staying above important support. If momentum stays strong, this technical pattern suggests that more upward movement is possible.

PEPE recently bounced back by 5.15%, which made traders more hopeful. Targets have been set at levels of resistance, which makes it easy to see where to enter. People who watch the market think this setup might be a good time to buy.

PEPE Shows Signs of Strength Despite Staying Below January Highs

PEPE is still far below its January highs as September comes to an end, but technicals suggest that it could bounce back. Analysts say that buyers could gain control and prices could go up by 50% to 100%. Optimism is slowly growing.

There are still a lot of risks, but community support, technical signals, and forecasts give us reasons to be cautiously optimistic. PEPE’s ability to stay strong in the face of market fluctuations is one reason why it continues to get attention in the world of speculative meme coins.