BONK Builds Strong Base Near Support Levels

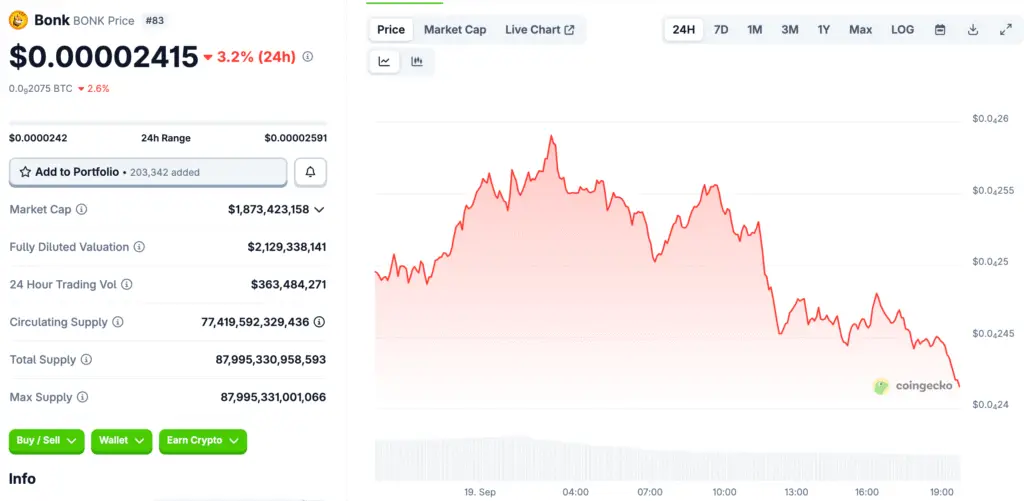

After a sharp drop of 60%, BONK stabilized at $0.000024, which shows that traders are still interested in buying. This support level shows a place where traders strongly defended their positions, stopping the market from going down any further for now.

The appearance of a double-bottom pattern shows that people are feeling more confident again, as this technical formation often means that bullish breakouts are on the way. Technical traders often look for entry points into possible rebound opportunities with limited risk when they see these kinds of signals.

Technical Indicators Point Toward Strengthening Momentum

The Moving Average Convergence Divergence (MACD) indicator turned positive, which means that short-term charts are showing that bullish sentiment is gaining ground. This shift from oversold territory shows that bearish pressure is fading, which lets accumulation slowly rebuild market confidence.

Analysts see MACD levels rising above zero as proof that selling pressure has dropped a lot in the last few sessions. If this indicator keeps going, it could support the idea that BONK should try to move up more toward areas of stronger resistance.

Exponential Moving Average Faces Crucial Test

The price of BONK is now testing the 20-day Exponential Moving Average, which is an important line that separates bullish continuation from a new consolidation. If BONK closes above this resistance level, it could make people more optimistic and push the price toward short-term goals of $0.000028 or higher.

If BONK can’t keep up the momentum beyond the EMA, it might have to test recent demand levels around $0.000022 again. If this happens, it would make bullish conviction less strong, which shows how important it is to confirm volume when trying to break out of moving average thresholds.

Recommended Article: Sharps Technology and BONK Partner to Power Solana Expansion

Falling Wedge Pattern Signals Possible Upside

A breakout from the falling wedge pattern suggests that BONK may be getting ready for a long recovery after a long period of bearish correction. This pattern has historically shown that selling pressure is running out and that markets may be ready to move up again.

Now that the breakout has been confirmed, short-term targets are between $0.000028 and $0.000034, depending on how the overall crypto market feels. For momentum to continue, the overall market needs to be stable, which means that Bitcoin and Ethereum need to be in good shape for performance to continue.

Community Sentiment Boosts Market Confidence

People are still talking about BONK on social media, which is making more people interested as trading volumes rise across exchanges. Community-driven excitement often helps meme tokens a lot, and BONK keeps getting free online promotion.

More liquidity on exchanges shows that sidelined traders are slowly getting back into positions, which makes BONK’s chances of recovery more credible. This, along with a renewed sense of hope, shows that BONK is still relevant to speculative retail traders who want quick price changes.

Possible Risks That Could Stop BONK from Recovering

Even though technical indicators are pointing up, BONK is still at risk if support near $0.000020 fails when selling pressure stays high. If this level is lost, short-term traders might panic, and prices could drop toward the $0.000016 support zones.

Meme tokens are still very volatile assets that often swing between extremes based on speculation instead of real-world fundamentals. Investors need to stick to their plans and be patient when they look for speculative opportunities in BONK trading environments. They also need to focus on managing risk.

BONK’s Bullish Recovery Targets $0.000041

In very bullish situations, BONK could go back up to $0.000041, which would make up a large part of the losses it had during its last correction. If momentum keeps going, BONK’s status as a community-driven token could improve as the broader market gains confidence.

For now, BONK has stabilized well, and indicators and sentiment suggest that it will slowly get stronger again. For growth to continue, the market needs to stay stable, which means traders need to keep trusting the market, and larger cryptocurrencies need to be in good shape to affect BONK’s path.