Dogecoin Price Update Highlights Trends in Market Rotation

Dogecoin is trading at about $0.2680, having moved between $0.2319 and $0.2976 in the past week, which is a sign of its usual volatility. Even though a lot of people are buying, resistance near $0.30 is still making it hard for prices to go up. Technical signals also show that people are taking profits on short-term charts.

Dogecoin is still a popular memecoin, but its momentum mostly depends on hype cycles. Investors are looking into more and more options with stronger fundamentals. Mutuum Finance is one of these alternatives that investors are looking at as they think about growth prospects beyond meme-driven speculation stories.

Mutuum Finance Presale Gets Stronger in Round Six

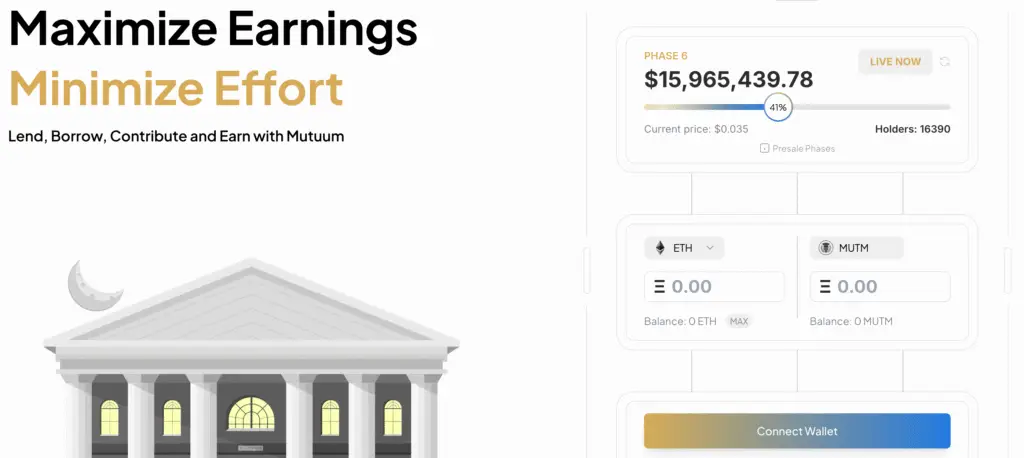

In stage six of the Mutuum Finance presale, tokens cost $0.035. More than $15.85 million has been raised thanks to investor interest. More than 16,340 investors have already signed up, showing that there is a lot of interest. The excitement for stage seven is also growing quickly.

The presale’s steady progress shows that people believe in Mutuum’s utility model. It has real lending and borrowing features, unlike projects that are just hype. Investor involvement shows that more and more people are aware of this difference, making Mutuum a real contender among new blockchain protocols.

Price Discovery Accuracy Strengthens Mutuum Finance Fundamentals

Chainlink oracles help Mutuum Finance make sure that the prices of ETH, MATIC, and AVAX are correct for all of its borrowing, lending, and liquidity services. Composite feeds, decentralized exchange averages, and fallback parameters are all part of backup systems that help keep things stable in markets that are always changing.

This process lowers systemic risks and makes things more reliable. Accurate pricing keeps borrowers and lenders safe, keeps liquidity healthy, and stops manipulation from happening. These kinds of protections set Mutuum Finance apart, giving investors confidence and boosting institutional trust through clear methods of ensuring data reliability.

Recommended Article: Mutuum Finance Presale Gains Momentum as Pepe Market Stalls

Risk Controls Protect Investors During Market Volatility Periods

Collateral management separates allowances based on how stable the assets are. Safer assets have more freedom, while riskier assets must follow stricter rules. Reserve multipliers range from 10% to 35%, which protects against volatility without making it too hard to use diversification strategies all the time.

The partnership with CertiK makes defenses even stronger. Mutuum started a bug bounty program with prizes of up to $50,000 to encourage people to find security holes. Independent evaluations offer the best protection, which builds trust among participants and shows that Mutuum’s decentralized ecosystem is open and honest.

Liquidity Management Supports Long-Term Protocol Stability

Mutuum Finance uses proportional reserve factors across different types of collateral to lower concentration risks while keeping the distribution of opportunities and exposures balanced. Stablecoins and ETH are good collateral because they support liquidity and let higher-risk assets join in structured ways.

This mixed model makes the most of both safety and opportunity. Mutuum makes sure that systems stay healthy over time by combining resilience with flexibility. These kinds of models give investors peace of mind, which sets Mutuum apart from projects that put speed ahead of safety or don’t have enough institutional-grade protection features.

Mutuum Finance Utility Distinguishes It From Meme Tokens

Dogecoin is all about speculation, but Mutuum offers decentralized lending and borrowing solutions that give participants real value. This useful feature attracts investors looking for long-term opportunities in DeFi that are based on real contributions and not hype cycles.

By making real financial products, Mutuum is able to get the attention of users who are tired of projects that don’t offer any real value. The growing interest in presales shows that there is a demand for utility-driven models, which will help them keep going after the short-term hype cycles that happen all the time.

Investors Eye Mutuum Finance $1 Ambitious Target in 2025

If adoption and momentum continue through future presale stages, analysts think Mutuum Finance could reach its $1 goal by 2025. Stage six participation shows that more and more investors think this platform is more scalable and resilient than its competitors.

The momentum keeps growing. Mutuum Finance is a real competitor, not just a hyped one, because it has raised $15.85 million and passed CertiK security checks. As Dogecoin’s price keeps changing, more and more investors see Mutuum Finance as a real growth candidate in the next global crypto cycles.