Pepe Coin Holds Position as Meme Market Matures

Pepe Coin trades steadily around $0.000012, which shows that it has a well-established place in the meme token category. Experts say that PEPE’s best rallies are now firmly in the past, even though it was once very popular. It looks like future performance is closely linked to cycles in retail.

Analysts say that while volumes are still strong, they depend on speculative behavior. This means that the long-term growth potential is lower than that of projects that focus on utilities. More and more, investors are focusing on tokens that have the potential to be used in real life.

Mutuum Finance Presale Growth Accelerates Rapidly

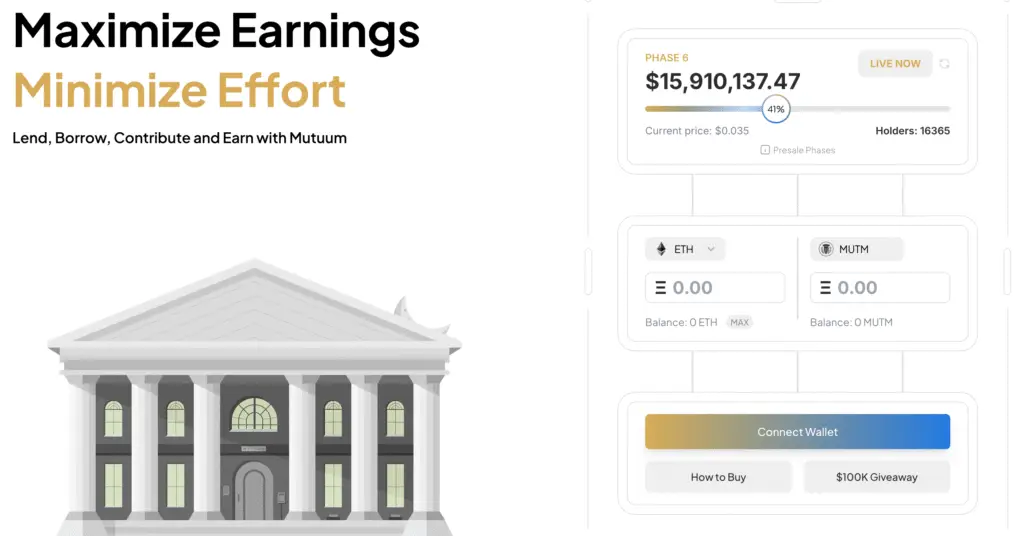

Mutuum Finance is still gaining ground in presale phase six. The project has already raised more than $15.80 million from more than 16,320 backers. These numbers show that more and more investors are interested in DeFi projects that have solid foundations.

The presale shows that a lot of people are interested, which shows that they trust Mutuum Finance’s dual lending model. This design makes it possible to borrow and lend money in the real world. It is different from speculative meme tokens because it is based on utility.

Strategic Rewards for Investors Who Buy Early

People who buy tokens during the presale get access to much lower prices. These investors are setting themselves up for possible triple-digit returns when the product launches. In the short term, gains could be as high as 300%.

As the ecosystem grows, the long-term outlook looks even better. Some of the features are a stablecoin design, open-source transparency, and tokenomics based on scarcity. Together, they make a strong case for investors to put their money into it.

Recommended Article: Russia Plans Crypto Bank as Mutuum Finance Presale Attracts Buyers

Security Enhanced Through CertiK Bug Bounty Program

Mutuum Finance worked with CertiK to make security stronger by starting a bug bounty program. The program gives out $50,000 in prizes at four different levels of severity. This makes sure that vulnerabilities of all sizes get the attention they need quickly.

Allowing outside developers to work on the platform makes investors feel more secure. Regular audits and feedback from researchers make systems strong against possible threats. Security is still a key part of Mutuum’s strategy to put investors first.

Risk Controls Built Into Lending Framework

Mutuum Finance uses tiered loan-to-value ratios throughout its ecosystem. The amount you can borrow depends on how volatile your collateral is. Stable assets let you borrow more money, but riskier tokens have stricter limits.

Reserve multipliers make the system even more stable. The ranges go from ten percent for safer assets to thirty-five percent for more volatile instruments. This balance lets people in while lowering systemic risks.

Comparing Pepe Coin and Mutuum Finance Potential

Pepe Coin depends a lot on cultural virality and speculation. It did well in the beginning, but now its structural problems are holding back future growth. Experts think that performance will be weak in the future.

On the other hand, Mutuum Finance uses practical utility. Its real-world lending features, along with the excitement around its presale, make it more likely to be adopted in the long term. More and more analysts are calling it a better candidate for growth.

Mutuum Finance’s Utility Focus Signals Long-Term Potential

The price of MUTM is now $0.035 in presale stage six, which shows that it is making great progress toward becoming widely used. Its focus on usefulness fits in well with trends in the larger market. More investors are backing the company, which shows that confidence is growing.

Mutuum Finance is a top DeFi competitor because it combines security measures, open governance, and rewards for participation. Momentum suggests that it could do much better than meme tokens like Pepe Coin. The window of opportunity for investors stays open during the presale stages.