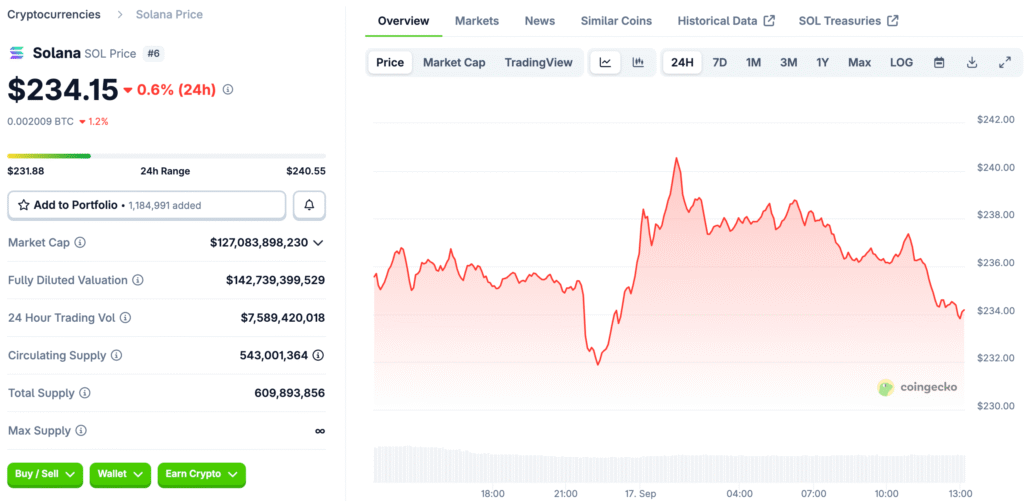

Solana Treasuries Record Significant Growth in 2025 Data

Corporate treasuries based on Solana have grown to over four billion dollars. This shows that institutions are buying more and more of them and that people around the world are becoming more confident in blockchain-based treasury holdings. According to data from the Strategic Solana Reserve, there are 17 million tokens worth $4 billion, which is almost 3% of the total circulating supply.

This rise shows that institutions are starting to use Solana more, which means that the Solana ecosystem is maturing as companies start to use digital assets in their treasury strategies. The milestone shows how Solana has changed from an experimental blockchain project to a popular digital asset that businesses all over the world use today.

Forward Industries Leads With Largest Solana Holdings Globally

Forward Industries was the biggest player, with six point eight million Solana tokens worth more than one point six billion. This allocation shows that people believe in Solana’s long-term value proposition. It also shows how businesses are using cryptocurrency more and more to protect and diversify their treasuries.

Sharps Technology, DeFi Development Corporation, and Upexi are some of the other companies that made big contributions, each building up reserves worth more than four hundred million dollars. These companies all help to strengthen Solana’s reputation as a reliable blockchain ecosystem, which attracts institutional support through impressive corporate treasury allocations around the world.

Institutions Accelerate Solana Accumulation in Recent Months

On September 8, Forward Industries announced its Solana treasury. It was made possible by funding from Galaxy Digital, Multicoin Capital, and Jump Crypto. After the news came out, Galaxy Digital bought more than $300 million worth of Solana in just one day of trading.

Helius Medical Technologies quickly followed suit, starting a $500 million Solana treasury with help from Pantera Capital and Summer Capital. These accumulations show that institutions are becoming more interested in Solana, which shows that blockchain assets are becoming an important part of managing a company’s treasury.

Recommended Article: Solana Breaks $250 as Analysts Eye $460 Bullish Target

Pantera Capital and Partners Strengthen Solana’s Institutional Momentum

Dan Morehead, CEO of Pantera Capital, called Solana the fastest, cheapest, and most scalable blockchain. This made companies even more excited about using it. Morehead confirmed that his company was worth a billion dollars, which shows that big institutions trust and believe in Solana’s ability to change the way blockchain works around the world.

Companies like Summer Capital and other crypto-native investors show how venture funds are becoming more and more supportive of Solana’s role in financial ecosystems. These partnerships give Solana institutional momentum, making sure that it keeps getting capital from established companies and long-term support.

Comparing Solana Treasuries to Bitcoin and Ethereum Holdings

Solana’s four billion treasury is a big step forward, but Bitcoin’s reserves are much bigger, with four hundred billion stored by institutions. Three point seven million Bitcoin are held in treasuries, which is about seventeen percent of the total circulating supply. This shows that Bitcoin is becoming more popular.

Ethereum corporate treasuries are also much bigger, with companies holding almost five million Ether, which is worth more than twenty-two billion dollars right now. Also, the fact that there are six point seven million Ether stored in ETFs shows that big businesses are interested, putting Ethereum ahead of Solana for now.

Corporate Treasuries Reflect Evolving Institutional Crypto Strategies

The growth of Solana-based treasuries shows that companies are branching out beyond Bitcoin and Ethereum and seeing chances in other blockchain ecosystems around the world. Strategic accumulation shows that people believe Solana is better than other blockchain networks when it comes to scalability, transaction speed, and infrastructure that works.

Companies that use Solana show that they are open to using new technologies in their financial systems. This will help blockchain be used more widely for treasury allocations around the world. This strategy of diversifying shows how institutions are becoming more mature and how digital assets are becoming real financial tools for managing treasury around the world.

The Rise of Solana as a Corporate Asset

Solana’s growing presence in corporate treasuries is a sign of a bright future, when blockchain technology will be used in more than just speculation and will become a part of everyday business. The steady flow of billions shows that institutions trust Solana, which means that its role in corporate financial planning is likely to grow even stronger.

As more businesses build up their Solana reserves, demand will rise because of corporate diversification strategies. This could lead to higher prices across all cryptocurrency markets. Solana’s path suggests that it may one day compete with Ethereum and Bitcoin for institutional adoption, changing the way treasury management works.