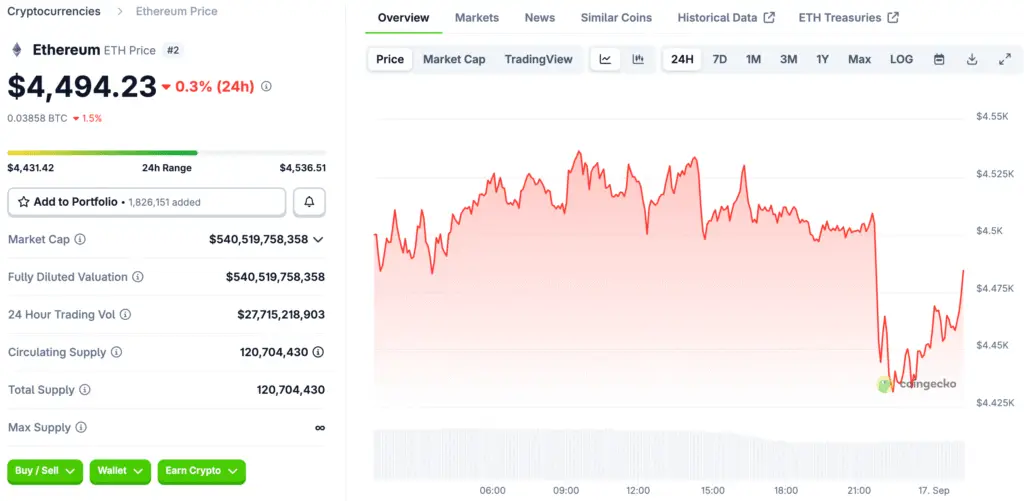

Ethereum Remains Strong After Recent Price Drop

Ethereum recently dropped a little, but investors are still hopeful because strong technical indicators show that it can withstand market volatility around the world. This confidence grows as traders expect the Federal Reserve to lower interest rates. This makes them hopeful that Ethereum’s bullish momentum will continue to rise.

Ethereum is still holding on to important trendlines that support long-term price movements, even though it has dropped almost six percent from weekend highs. This kind of strength shows that Ethereum is still ready for more rallies, especially if macroeconomic policies continue to favor risky digital assets.

Federal Reserve Policy Shaping Ethereum Investor Sentiment

Investors pay close attention to what the Federal Reserve does, and most people think that cutting interest rates will make cryptocurrency markets stronger around the world. Ethereum is at the center of this speculation. The price’s ability to hold steady shows that people are hopeful that a dovish central bank policy will help digital assets.

Market data shows a 96% chance of interest rate cuts in the near future, which strengthens investors’ belief that Ethereum can keep going up. Traders are more interested in Ethereum as borrowing costs go down. They expect more liquidity to flow into digital assets that are sensitive to risk around the world.

Bull Pennant Formation Suggests Ethereum Breakout Potential

Ethereum’s recent consolidation looks like a bull pennant pattern, which has historically meant that rallies are coming when resistance levels break with strong momentum. This chart structure, along with trading volumes that are steadily going down, suggests that the setup is getting more mature and is ready to break out in a big way in the next few weeks.

Based on this pennant formation, technical projections suggest that Ethereum prices could reach around $6,750, which is almost 50% higher. Analysts say that confirmation needs Ethereum to close above resistance, after which bullish continuation patterns usually lead to big price movements up.

Recommended Article: Ethereum Stablecoin Supply Hits $166B Boosting DeFi Growth

Analysts Suggest Ethereum Dips Remain Strong Buying Opportunities

Many analysts see Ethereum pullbacks as good times to buy more, even though there is a chance that prices will keep going down. This is especially true when the market as a whole is bullish. Support levels close to $4,200 give us confidence that the downside is limited and the upside looks very good.

Analyst Ash Crypto said that a drop below trendline support would not end bullish patterns but would instead open up new chances for rallies. Ethereum’s price has held up well in testing environments, which gives investors more confidence that buying dips is still a good strategy during bull markets.

Technical Indicators Support Optimistic Ethereum Price Projections

Ethereum got back to important Fibonacci retracement levels, especially the golden pocket. This is a strong signal that the Bull Market Support Band is working. This alignment suggests technical confirmation, which supports bullish arguments that Ethereum is still firmly in long-term uptrend cycles even though it has been volatile in the short term.

Chartist Luca pointed out Ethereum’s breakout and retest, saying that successful retests usually come before strong bullish continuation patterns in all markets. If Ethereum stays in this golden pocket area, investors should expect the price to keep going up because the market structure is stable and investors are hopeful.

Broader Market Comparisons Highlight Ethereum’s Resilience

When you compare Ethereum to Bitcoin, you can see how strong it is. Ethereum has been able to keep its upward structures even when the market is volatile. Both assets benefit from the expectation that monetary policy will become less strict. However, Ethereum’s unique ecosystem growth gives it more upside momentum.

Ethereum’s booming decentralized finance and staking activity set it apart even more, giving investors strong reasons to believe that its value will rise beyond what macroeconomic stories say. These strengths together make people more sure that Ethereum’s price can go up a lot more as adoption and ecosystem growth continue to spread around the world.

Fed Rate Cuts Poised to Fuel Ethereum’s Rally

The Federal Reserve’s expected rate cuts will probably make more institutions interested in Ethereum, which will make it a better investment asset that can withstand inflation. When interest rates go down, money often moves into other investments. This makes Ethereum a good way to keep digital wealth safe for a long time.

In the end, Ethereum’s strong technicals, good macroeconomic conditions, and ongoing ecosystem growth show that it has a lot of potential for big price increases. Ethereum looks ready to take advantage of better financial conditions as long as support levels stay in place. This will lead to stronger rallies over the next few months.