Ethereum Stablecoin Supply Climbs to All-Time Record High

The amount of Ethereum’s stablecoin supply grew from $149 billion last month to $166 billion this month. This is the biggest growth ever in decentralized finance ecosystems. This milestone shows how Ethereum is becoming more and more important as the main settlement network that supports liquidity, stability, and adoption in DeFi around the world.

The growth of stablecoins shows that investors are moving away from speculative assets and toward infrastructure. This shows that Ethereum’s usefulness in financial markets is growing. Experts say that Ethereum’s dominance in stablecoins shows that investors trust its ability to provide institutional-grade, scalable, and long-lasting financial services.

USDT and USDC Dominate Ethereum Stablecoin Market Expansion

Tether’s USDT is still the most popular, with an $87.8 billion supply, followed by Circle’s USDC with $48 billion. Together, these two lead Ethereum-based liquidity. These two stablecoins make up most of Ethereum’s stablecoin activity, which shows how important they are as pillars in DeFi ecosystems.

Their combined presence supports lending, borrowing, and trading activities, making Ethereum the settlement layer that supports the growth of decentralized finance around the world. Analysts say that if Ethereum keeps growing, it could become the main platform for digital assets that are worth dollars in the next few years.

Institutional Adoption Drives Rising Demand for Ethereum Stablecoins

Experts say that more and more institutions are interested in Ethereum’s stablecoin, which shows that its infrastructure is a reliable base for financial operations. Vincent Liu of Kronos Research said that Ethereum’s strong liquidity helps keep markets stable by letting them absorb volatility during downturns.

When institutions use Ethereum as a settlement base, it makes it more trustworthy. This encourages more businesses to invest in Ethereum in search of compliant and scalable DeFi solutions. Growing dependence shows how financial systems are becoming more interconnected, and it shows how blockchain can offer programmable, open alternatives to traditional systems.

Recommended Article: Ethereum Privacy Stewards Balance Regulation And Innovation

Analysts Link Stablecoin Growth to Potential Ethereum Price Appreciation

Nick Ruck of LVRG Research said that the growth of stablecoins shows that institutional liquidity is growing faster, which makes people more confident in Ethereum’s economic design. He thought that more activity in DeFi could lead to more demand for ETH, which could make its price go up as more people use it.

When more people use stablecoins, it has a positive effect on the network. This is because demand for stable assets makes Ethereum’s native token more useful. Analysts think this cycle could lead to long-term growth in the value of ETH, which would strengthen Ethereum’s position as the leader in decentralized finance markets around the world.

Global Stablecoin Market Cap Surpasses One Hundred Seventy Billion

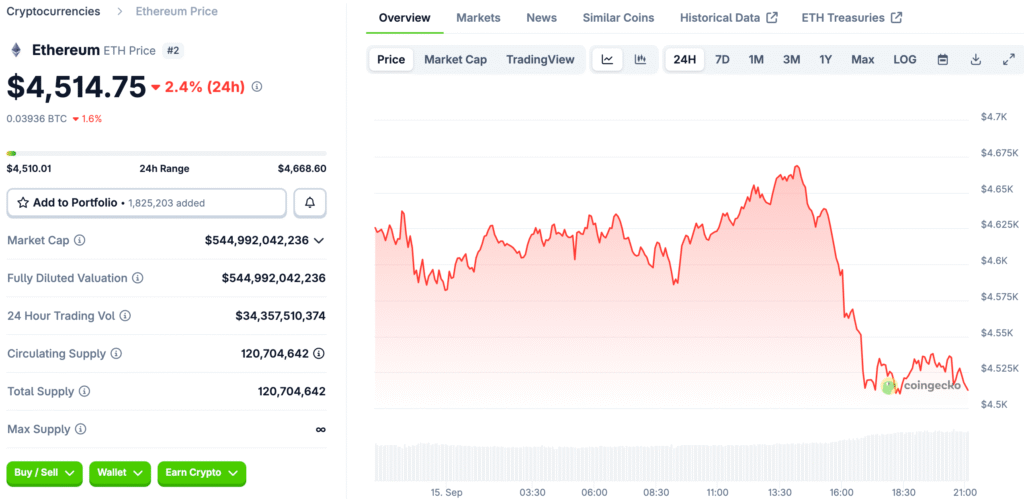

The stablecoin market is still growing, and Tether’s USDT market cap rose above $170 billion during trading in September. CoinGecko data showed that Tether is worth $170.3 billion, making it the largest stablecoin and the one that has the most impact on cryptocurrency liquidity and capital flows.

This growth comes at the same time as more Ethereum integration, making it the settlement hub for major stablecoin issuers and DeFi platforms. Stablecoins connect traditional finance and crypto, making Ethereum even more important strategically as global financial systems move toward digital assets.

Stablecoin Liquidity Enhances DeFi Stability and Investor Confidence

The growth of stablecoins gives liquidity buffers, which keeps decentralized finance platforms running smoothly during times of volatility and builds trust among institutions. Liquidity pools based on USDT and USDC cut down on slippage, which makes DeFi interactions more efficient and attractive to big investors all over the world.

This change in infrastructure supports derivatives, lending, and payment systems, which shows that Ethereum can handle more financial use cases in more markets. Ethereum’s stablecoin leadership is making DeFi a more reliable alternative to traditional financial systems by stabilizing value flows.

Ethereum Poised To Retain Core Role In Decentralized Finance Expansion

Ethereum is the backbone of DeFi, providing scalability, security, and institutional credibility all at the same time, with a record-breaking supply of stablecoins. Its dominance in stablecoin activity shows that its infrastructure is ready like no other, which keeps it at the top of decentralized finance even though new competitors are coming up.

Analysts say that Ethereum’s strong settlement makes it likely to stay at the center of blockchain finance, connecting institutional capital with decentralized innovation. Ethereum is likely to stay the foundation for liquidity, stability, and financial change around the world through 2025 as more people start using it.