Bonk Price Reacts From Key Fibonacci Support

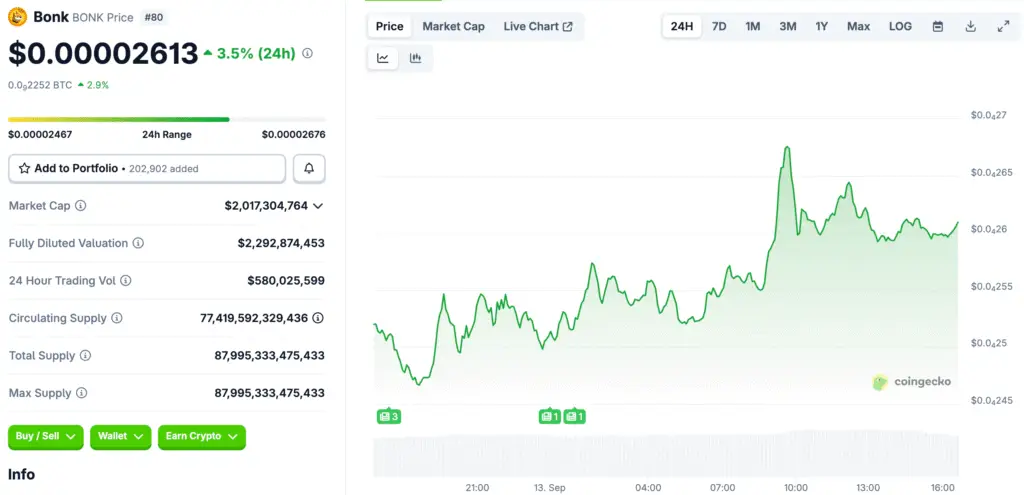

The BONK price rebounded from the point of control support area and the 0.618 Fibonacci retracement level, indicating strong demand and a bullish outlook. Buyers stepped in, changing the bearish trend and ensuring the continuation of the bullish trend.

The rally drove the price above the control resistance point, setting higher lows and affecting the market’s mood. The structural integrity supported the rally’s continuation, and analysts noted a strong technical foundation that allowed for a confirmed breakout. Market participants closely monitored the market’s performance.

Higher Lows Confirm Bullish Market Structure

The fact that Bonk’s market structure is bullish is shown by the fact that the lows keep getting higher. Traders see the sequence as a sign that the trend will continue. Higher lows make it clear that the trend is going up. A lot of people felt more confident. More and more people in the market are noticing a bullish pattern forming over a number of timeframes.

The bullish structure shows that buyers are still in charge. Lessened risks on the downside. Demand accumulation strengthens trend resilience. Analysts think it will keep going. Bonk’s structural performance sets the stage for the rally to continue. Market watchers stress how important it is for support levels to hold up momentum for breakout potential to be very high.

Rising Volume Reinforces Momentum

The way volume changes supports the bullish story. Every time the price went up, there were more people buying. An increase in volume confirms accumulation. A strong demand backdrop was made. Positive volume trends show that people in the market are committed.

Analysts say that volume needs to stay steady for a breakout to work. Previous rejections happened at the same time as volume dropping. To get past resistance, you need steady inflows. Bonk can break through higher resistance if demand stays high. Otherwise, momentum could stop. Traders stress how important it is to keep an eye on volume metrics.

Recommended Article: TRUMP and BONK Meme Coins Attract Investors on ETF Potential

Institutional Participation Increases Sentiment

Safety Shot’s subsidiary, BONK Holdings, started buying Bonk tokens. The fact that a company listed on Nasdaq was involved proved Bonk’s credibility. Buying by institutions boosts confidence. Increasing treasury allocations improves the demand profile. Analysts say that institutional interest is a strong sign of a bull market.

Bonk’s turning point is when institutions start using it. The market sees the entry as a sign that the business will be around for a long time. Having an institution there makes it more legitimate. More and more traders are willing to treat Bonk as an investment. Institutional momentum could keep bullish pressure going for a long time. The story of wider adoption speeds up.

Bonk’s Evolution From Speculation to Utility

BONK added a USD1 stablecoin to the utility ecosystem. Launch helped trading activity grow on many platforms. The growth of stablecoins makes network effects stronger. Analysts stress the need for liquidity. Broader ecosystem development gives investors a lot more faith in Bonk’s long-term future.

The integration of USD1 shows that the roadmap is expanding. Token adoption outside of speculative cycles is important. Ecosystem growth makes sure that demand stays strong. Network development is seen as key to keeping the upward trend going. Bonk puts itself in a good position. The utility layer makes participants more sure that the market will go up.

Resistance Levels Pose Key Challenge

Bonk approaches swing high resistance, which is stronger at higher timeframes. For a breakout to be decisive, volume must keep coming in. Failure could lead to short-term consolidation. Tests of resistance are expected. Traders stress how important it is to stay above resistance.

Upside targets include value area high and swing highs beyond. Breaking through resistance opens up the possibility of continuation. In pullback scenarios, there is a consolidation phase before a new attempt. Analysts stress the need for patience when looking at the results of resistance tests. Overall, the structure of the market is still good.

A Positive Outlook for Bonk: A Breakout Awaits

The market structure is still very bullish. Confluence at support strengthened the trajectory. Volume trends back up the bullish story. Institutional and ecosystem catalysts help things move forward. Conditions are right for an attempt to break out.

If demand isn’t steady, the rally could stall. Consolidation in the short term is still possible. But in general, the signals point to a breakout scenario. If resistance is broken, analysts expect continuation. People are still paying a lot of attention to the market. The outlook for Bonk is getting more and more positive.