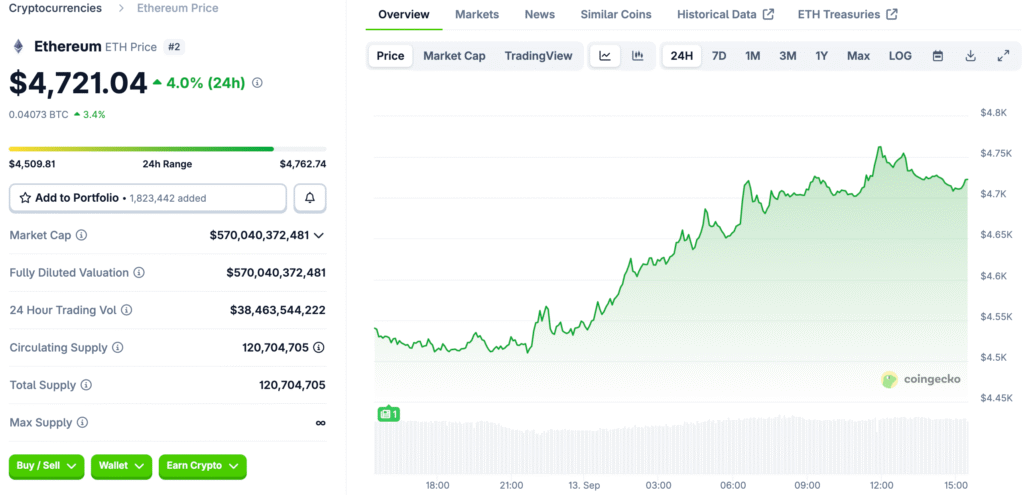

Whale and Institutional Inflows Fuel Ethereum’s Price Rally

Ethereum rose above $4,500 after recovering 10% from September lows. The surge in whale accumulation and institutional inflows support the bullish trend, with traders seeing a breakout towards $7,500 in October. FalconX helped three wallets acquire over $205 million worth of Ethereum, reducing the available goods.

This accumulation is seen as proof that Ethereum will be worth more in the long run. Institutional inflows further support the bullish trend, with steady demand driving the market up through 25. The story in the market is increasingly about institutional adoption driving demand through 25.

Institutions Add to the Rally’s Strength

Corporate treasuries and funds have increased their holdings to more than six point five million ETH, which is twice as much as they had in April. Bitmine Immersion bought more than two point one million tokens for one point one billion dollars. Treasury commitments make it clear how important Ethereum is as a reserve asset.

SharpLink Gaming put $3.7 billion into the Ethereum treasury. Co-CEO Joseph Chalom called the move a “white swan event.” Analysts compared the strategy to Michael Saylor’s approach to Bitcoin. Institutional conviction is shown by treasury holdings. Big money coming in makes bullish expectations even stronger. Whale wallets hold more than twenty million ETH, showing how concentrated top-tier investors are, which is driving the rally.

Ethereum Fundamentals Remain Robust

Thirty-six million ETH were staked, which is a record. More activity on the blockchain made people trust Ethereum’s ecosystem even more. Network is still the best choice for decentralized finance, tokenization, and smart contracts. Strong activity signals long-term usefulness that supports valuations a lot.

Tom Lee, an analyst, predicted that Ethereum would reach between $10,000 and $15,000 in the near future, saying that the merging of blockchain and AI would help. The long-term forecast went up to $66,000. Structural adoption tailwinds make the growth path long-lasting. Fundamentals keep making Ethereum stronger as the main currency in the world of digital finance.

Recommended Article: SharpLink Treasury Strategy Hints at Bullish Moment for Ethereum

Technical Analysis Highlights Key Levels

Ethereum is having trouble breaking through a range of $4,584 to $4,672. Clearing the range would show that the market is moving up. Analysts say that the next big goal is five thousand dollars. OBV, Parabolic SAR, and Supertrend are all signs that the market is bullish on multiple timeframes.

Merlijn saw that a strong breakout above $4,500 could start a parabolic rally toward $7,000. Analysts say that October is a good time for possible quantitative easing triggers. Immediate support was found near $4,387 and $4,300, respectively. Institutional inflows are expected to provide a lot of downside protection.

Whale Buying Shapes Market Dynamics

Whale wallets control over twenty million tokens, holding between 10,000 and 100,000 ETH. This concentration of ownership indicates a strong belief in Ethereum’s future, limiting supply and causing price changes during rallies. Analysts view whale dominance as a clear indication of Ethereum’s strength.

The bullish case strengthens with institutional support and whale behavior, indicating a breakout soon. Traders set their positions based on the expectation of upward movement, supported by steady capital inflows across global markets.

Macro and Policy Factors Support Rally

The Federal Reserve’s anticipated policy easing could boost Ethereum demand, according to investors. The macro environment aligns with bullish technicals, enhancing the upward bias. A dovish policy shift could boost cryptocurrencies’ value. Ethereum’s appeal lies in its easier monetary conditions and increased usage.

Institutional investors see a chance to spread their reserves. Analysts argue that the monetary environment and cryptocurrencies’ fundamentals work together to increase prices. October is seen as a crucial month for Ethereum’s growth cycle.

Ethereum’s Parabolic Breakout to $7,000 Expected in October

Estimates say that by the end of the year, prices will be between $6,500 and $7,000. Analysts say that October is the most important time for a breakout. To keep the momentum going, there needs to be a steady flow of more than $100 million a week. There may be times of consolidation, but the overall trend is still up.

Ethereum’s combination of whale accumulation, institutional adoption, and strong fundamentals shows that a huge bull rally could happen. More and more, investors expect big moves above resistance zones that have been in place for weeks. Predictions put Ethereum at the top of the next cycle. There is a growing consensus in the market that there will be a parabolic breakout toward seven thousand dollars in October.