Ethereum Treasury Strategy Getting Attention

Joseph Chalom, co-CEO of SharpLink Gaming, talked about the company’s Ethereum-focused treasury strategy. He called it a “positive white swan event” that would greatly increase institutional confidence. The company got more than 837,000 Ethereum, which is 0.69% of the total amount of Ethereum that is currently in circulation around the world.

SharpLink’s treasury model is similar to Michael Saylor’s strategy of buying up bitcoins. The company sees Ethereum as a reserve asset, not a trade that could go up or down. Focusing on accumulation instead of liquidation makes people think of Ethereum as an institutional-grade store of value, which supports stories about how it will be used in finance.

Company Holds Billions in Ethereum Assets

SharpLink’s Ethereum holdings are worth almost $3.7 billion, making the company a major player in decentralized asset markets around the world. Their consistent purchases show that they are committed for the long term, which boosts confidence in Ethereum’s usefulness and potential for use in mainstream finance.

The approach is still based on openness. SharpLink makes weekly reports public that show holdings, purchase levels, and staking rewards. This clarity is different from the lack of transparency in the past that hurt credibility. Companies that follow SEC rules and Nasdaq rules make cryptocurrency more legitimate, which gives cautious investors who are looking at strategies for adopting it peace of mind.

Transparency Reinforces Market Stability

SharpLink, unlike opaque exchanges like FTX, is transparent and honest, preventing misuse of funds and building trust in the institutional ecosystem. Its compliance with regulations reduces risks, allowing companies to use wealth accumulation strategies without causing issues in less regulated places.

Weekly reports build responsibility, and open models counteract skepticism in the crypto industry. SharpLink improves Ethereum’s reputation by standardizing reporting practices, ensuring investors can trust and understand the adoption process.

Recommended Article: Ethereum Dominates Real World Asset Tokenization Market

Ethereum Set Up as a Reserve Asset

SharpLink views Ethereum as a reserve asset, similar to traditional financial reserves backing national currencies and corporate treasuries. This shift shifts Ethereum from speculation to a stable and strategic role in long-term corporate balance sheets across industries.

Its programmability makes it appealing as an institutional asset, as it supports financial transformation through smart contracts, stablecoins, and tokenized instruments. SharpLink’s focus on these traits helps mainstream adoption and influences market sentiment.

Adoption Narratives Drive Institutional Interest

SharpLink teaches traditional finance professionals about Ethereum’s usefulness by showing how programmable money can lower the amount of money needed and the risks of transactions in global markets. More and more institutions are seeing the benefits of efficiency, which is making people want to learn more about Ethereum’s role in the future of decentralized finance around the world.

Chalom emphasized the inevitability of Ethereum’s adoption, likening its trajectory to the previous accumulation of Bitcoin’s treasury. People who watch the market expect a lot of companies to become interested in Ethereum as regulatory clarity and the digitization of more financial services grow. This will make Ethereum an even more important institutional-grade technology in changing financial ecosystems.

The White Swan Event Marks a Change

Chalom called treasury accumulation a “white swan event,” which means that it was a good thing for the market and for institutions to get involved, not a bad thing that came out of nowhere. The phrase points out rare but positive changes that fundamentally change the market, giving hope for Ethereum’s continued growth among institutions around the world.

Institutional treasuries that hold Ethereum stabilize demand, which makes prices less volatile. Investors see consistent accumulation as a sign of bullishness, which strengthens their faith in Ethereum’s long-term path. SharpLink’s leadership shows a positive feedback loop: adoption leads to stability, which speeds up the process of getting more people to use it in institutional finance.

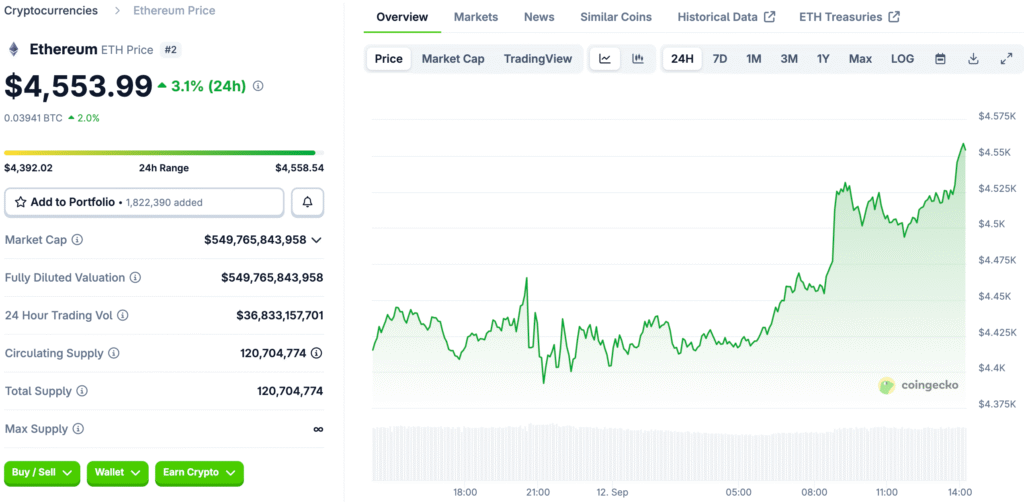

Market Implications for Ethereum Stability

Market prediction sites say there is a 94% chance SharpLink doesn’t sell Ethereum this year, which is a sign of stability. If other companies made similar commitments, it could greatly lower volatility and support slow upward trends in value. These kinds of actions make Ethereum a trustworthy long-term asset around the world.

As more people use it, treasury strategies are an important part of building institutional trust. Ethereum’s role is growing, from being a programmable infrastructure to being a corporate-grade reserve asset that supports the growth of decentralized finance. SharpLink’s plan strengthens the path to legitimacy and has a big impact on Ethereum’s role as a transformative asset in today’s global financial systems.