Ethereum Strengthens Through Institutional Funding

Etherealize got $40 million to help Ethereum become more widely used in businesses. The startup connects Wall Street to decentralized blockchain infrastructure. Investors such as Paradigm and Electric Capital support projects that focus on tokenized assets, privacy settlements, and compliance-focused systems to help businesses use them.

Ethereum is still the most important part of decentralized finance around the world. Institutional capital proves that it can last in blockchain industries that are becoming more mature. Recent increases in balance sheets show that companies are aggressively buying Ethereum. This trend makes Ethereum even more trustworthy as a financial infrastructure.

Retail Traders Seek Higher Growth Alternatives

Ethereum is stable, but it doesn’t have as much potential for big gains. Retail investors often look for tokens that are still in the early stages and have the potential to make a lot of money. Mutuum Finance has become a strong competitor. It offers chances at low prices with a lot of room for growth before the sale.

Retail preferences match up with opportunities with uneven risk. When strong tokenomics and scalable ecosystems are in place, smaller tokens can offer big upside. Ethereum is still the most popular cryptocurrency, but traders who want aggressive multipliers may not find it as appealing. Alternatives like Mutuum meet that need for speculative growth.

Mutuum Presale Gains Investor Confidence

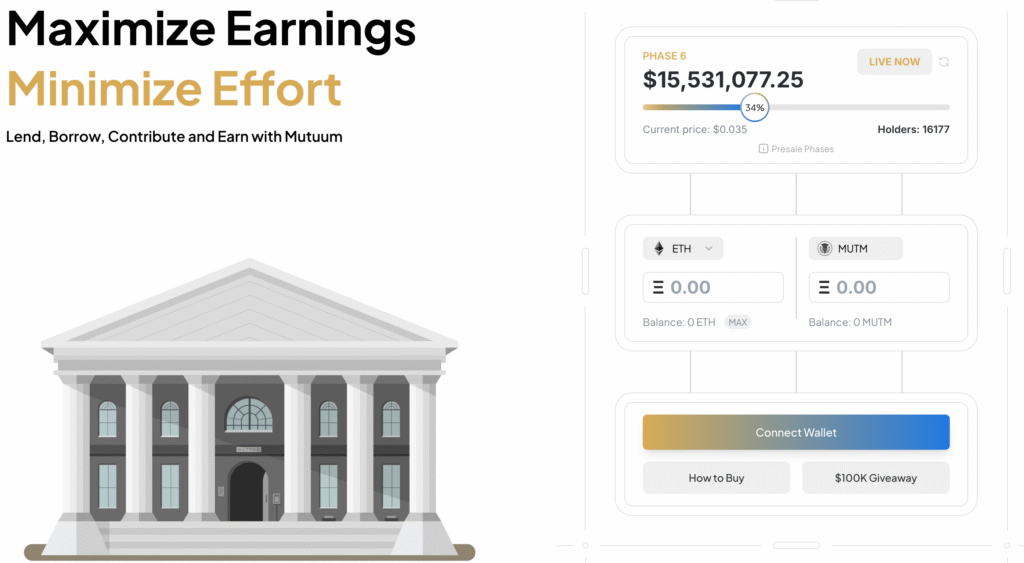

The presale for Mutuum is now in Phase 6, and tokens are available for $0.035. The project got $15.4 million. Even though it’s still in its early stages, its community of more than 16,000 holders keeps growing. Demand shows that people are confident that the token will be around for a long time.

People who took part in the presale already made a lot of money. Phase 1 investors who bought in at $0.01 are making a lot of money and still have room to grow. Presale mechanics always reward people who get in early. Each new phase makes the value of the tokens go up, which builds momentum before the official exchange listings come out.

Recommended Article: Mutuum Finance Gains Whale Interest While XRP Price Stalls

Lending Protocol Offers Dual Market Access

Peer-to-contract and peer-to-peer lending are both part of mutuum. These models strike a balance between being flexible and reliable for different types of users. P2C helps liquidity pools that pay interest. P2P connects borrowers and lenders directly and lets them choose between stable and variable rates.

The dual model makes it more appealing to both institutional and retail users. It strikes a balance between steady income streams and agreements that can change. Compared to other DeFi protocols, Mutuum is very flexible. It meets a variety of lending needs, which greatly increases growth potential.

Mutuum’s Tokenomics: A New Standard for Long-Term Value

Mutuum uses a buy-and-distribute model, putting fees back into buying tokens. This keeps demand high and creates constant buying pressure. Utility is directly related to what happens on the platform. As demand grows, adoption automatically helps the value of tokens go up.

Tokenomics sustainability is like what Aave and Compound did before. A clear link between use and value makes the market more stable in the long run. Investors see this mechanism as very good. Strong tokenomics are often the basis for projects that give long-term multipliers that matter.

Stablecoin Plans Expand Use Cases

Mutuum is also working on a stablecoin that is overcollateralized. It uses minting and burning to keep lending ecosystems stable. Stablecoins act as anchors for liquidity, which makes them more popular. Their addition makes them more appealing to markets that need reliable ways to trade.

A stablecoin greatly increases users’ trust. Liquidity support makes it easier to borrow and lend money during times of high volatility. Mutuum is ready for more use now that it has entered the stablecoin markets. This increases the chances of adoption and the chances of long-term value growth.

Mutuum Finance’s Innovation Lures Investors Seeking Big Profits

Ethereum is still gaining credibility in the business world thanks to startups like Etherealize. Stability makes sure that it will be a part of blockchain infrastructure for a long time. Retail traders, on the other hand, look for chances with more risk. Mutuum is a strong candidate for making big profits in the early stages.

Ethereum is safe because it has been around for a while. MUTM gives you opportunities through new ideas. More and more, investors are splitting their portfolios between the two options. 2025 could be the year that Mutuum becomes more well-known, similar to how powerful new DeFi leaders have come to the fore in the past.