Bitcoin’s Stability Hinges on Short-Term Holders

People who hold Bitcoin for less than 155 days, which is a short period of time, have a big impact on how people think about the market when it is volatile. Their combined actions often set important levels of support or resistance, where even small sell-offs can have big effects on the whole market.

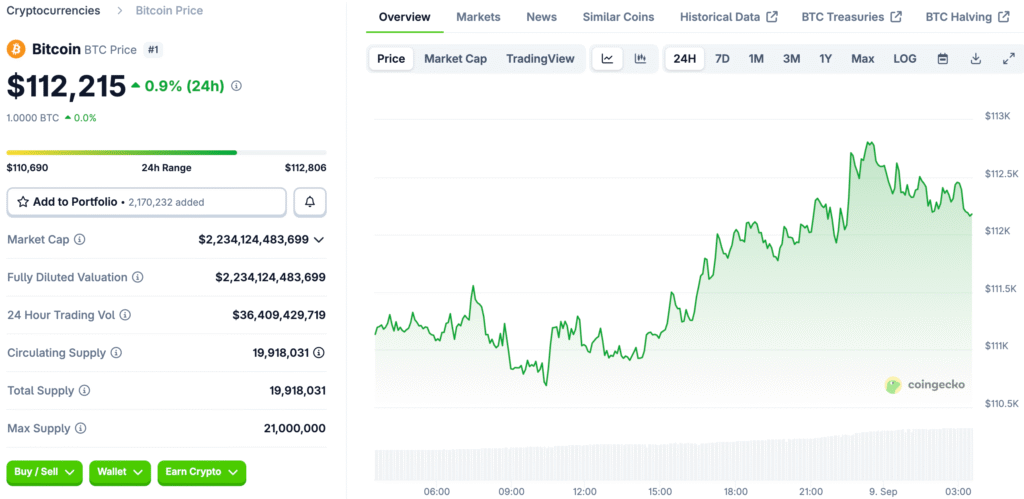

When Bitcoin fell below $111,500, worries about bigger corrections spread quickly, and short-term holders nervously watched their realized price. They hold about 8.8% of the Bitcoin that is currently in circulation, which shows how much power they have to disrupt stability.

The Domino Effect of Market Changes

When important support levels are broken, a domino effect often happens, with quick corrections happening after big sell-offs. These sudden changes often lead to the liquidation of leveraged positions, especially among traders who are too optimistic and rely on margin.

Recent reports said that over $196 million had been liquidated, which clearly shows how weak Bitcoin’s bullish momentum is. As the price flirted with $107,000, the nervousness of short-term holders showed how quickly optimism can turn into selling pressure.

Bitcoin Awaits a Breakout or Drop from Critical Levels

Analysts who closely watch the $111,500 to $113,000 range as important are still hopeful, even though there are concerns. If Bitcoin makes a strong recovery above this level, it could try to break through resistance levels closer to $116,000 and eventually test $118,000.

If Bitcoin can’t take back and keep this area, though, it could drop even more toward important support zones. Traders still know that their hopes for a bullish market are balanced by their fears, which get stronger during weak rebounds.

Recommended Article: Metaplanet Expands Bitcoin Holdings to 20136 BTC After New Buy

Institutional Investors Change What They Care About

Institutions are another important part of understanding Bitcoin’s current momentum because their actions often set trends that last for a long time. Recent changes show that big investors are moving some of their money into altcoins, especially Ethereum, as a way to spread out their risk.

This shift of funds takes some of the pressure off of Bitcoin directly and opens up new opportunities in other assets. Changes in institutional strategy show how important it is to understand changes in allocation and how they might affect the overall market.

The Importance of Market Psychology in Price Action

Psychological support levels are still very important for figuring out why prices act the way they do, especially when sentiment is weak. For traders, the relationship between support, resistance, and realized price is more than just numbers; they’re also emotional anchors that can make them feel confident or scared.

When you add these things to on-chain metrics, you get a constantly changing environment where decisions are rarely based on fundamentals alone. To trade successfully, you need to be able to predict these psychological triggers so you can deal with price changes that are out of control.

How to Deal with the Complexity of Volatility

Volatility in the Bitcoin ecosystem isn’t always a bad thing; it often shows how healthy a market is that is changing and growing. Every quick correction or rebound gives investors who have done their homework and are ready with strategies that fit their risk tolerance a chance to make money.

Being able to quickly adjust to price changes, whether they are caused by institutional reallocations or short-term panic selling, is still an important skill for survival. Traders who use both technical indicators and behavioral insights in their analysis are more likely to do well in this market.

Bitcoin’s Price a Crossroads for Traders and Institutions

Bitcoin’s rise is more than just a short-term rally; it shows that different groups of investors are changing their minds and strategies. Short-term holders are still the main focus of this story, but institutions and altcoin trends make it harder to predict how prices will move in the future.

The next few weeks will be very important in finding out if Bitcoin’s recovery is real or just another bump in its bumpy road. Traders who know about both psychological and structural factors will be better able to deal with whatever the market does next.