Whale Accumulation Starts Speculation in Solana

As September begins, there has been a noticeable increase in whale activity in Solana. Large holders are once again aggressively buying tokens at important support levels. Historically, this renewed interest means that stronger moves are on the way.

Crypto experts say that whale inflows often come before big price jumps. The current accumulation makes people more sure that Solana will soon break through higher resistance. People in the market are closely watching for confirmation.

Institutional Flows Back Up the Solana Story

Institutional investors have also become more interested in Solana. This week, Folius Ventures bought more than $600,000 worth of SOL. These actions are in line with the larger trend of diversifying funds beyond Bitcoin and Ethereum.

The fact that whales and institutional wallets are in sync makes people feel better. Both groups agree on something, which could lead to big rallies. Solana is still strong near key support levels.

Fractal Patterns Indicate Larger Move Ahead

Analysts point out that Solana’s chart structure has fractal similarities. The price has stayed the same for 504 days, like it did in previous cycles before it went up. Long periods of building up a base like this often come before big rallies.

When you look at the past, it seems like Solana might be getting ready for a breakout leg. Predictions say that $500 could be the target for a larger cycle. This trend could start in September.

Recommended Article: Solana Staking Surges as DeFi Development Corp Expands

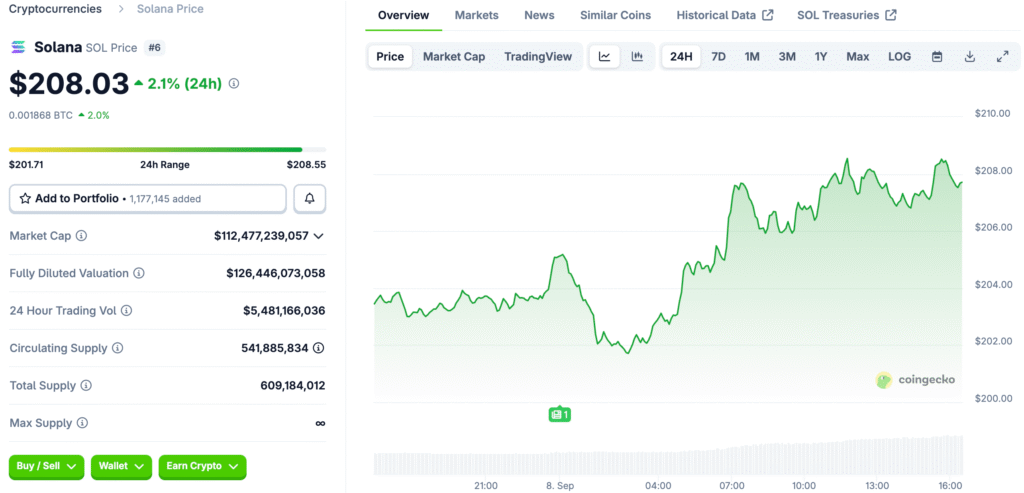

Technical Resistance Levels at $213

The $213 resistance zone is still an important barrier. On the weekly chart, Solana has tried this level many times. A breakout above it could change the momentum strongly in favor of buyers.

Support is still close to $197. Keeping this floor in place keeps the positive outlook going. Traders think that the next logical upside targets are between $240 and $250.

Solana Riding Key EMAs on Daily Chart

Solana is trading well above important exponential moving averages on the daily time frame. These EMAs give ongoing bullish momentum dynamic support. Every time it is tested again, buyers come back.

The RSI indicator is close to neutral, which means there is room for more upside. The setup supports continued growth because there are no signs of exhaustion right now. The trend structure is still very positive.

Whale and Institutional Trust Are Aligned

Whale accumulation and institutional buying together are a strong sign. These things show that people really believe in Solana’s long-term potential. Past rallies have often followed the same patterns.

As trading picks up in September, confidence could lead to higher demand. Traders and investors are both waiting to see if this alignment causes a big price breakout.

Solana’s Bullish Momentum Signals a Breakout to $250

As September begins, Solana is gaining momentum in both technical and fundamental areas. Strong support levels, whale flows, and institutional allocations make a strong base. The fractal setup makes it look like a breakout move is coming soon.

If the price goes above $213, it is more likely to go to $240 to $250. After that, bigger cycle targets like $500 may come into play.