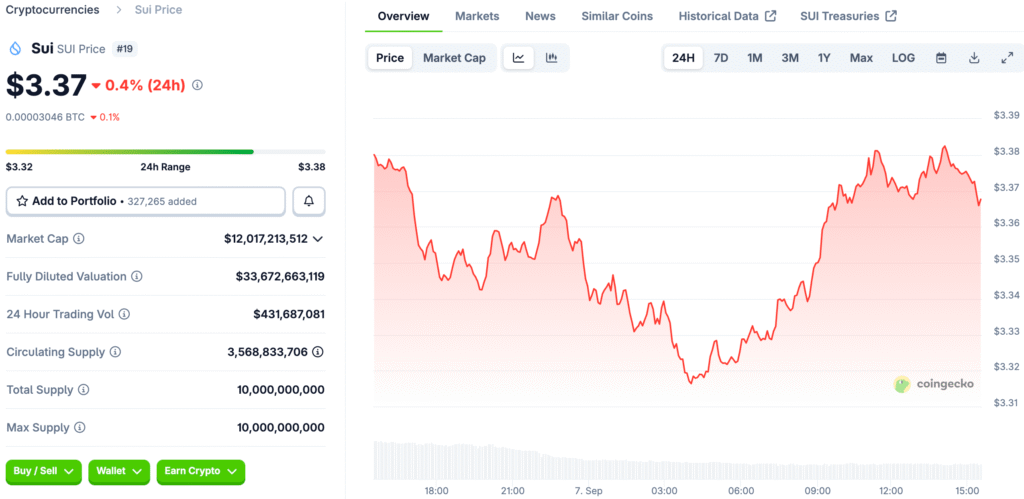

Sui Price Strength Holds at $3.35 Support

Sui has recently stabilized at $3.35, which gives traders confidence after weeks of unpredictable movement. This level has served as a base for new momentum. The fact that it hasn’t broken below has kept bullish sentiment alive in the short term.

The fact that $3.35 has held up for so long shows that a lot of people want to buy it. This floor lessens bearish pressure and lets upward momentum build. Traders are now cautiously optimistic about the next resistance levels.

Key Resistance Levels to Watch for Sui

Sui’s next big problem is the $3.50 resistance line. If this level closes above it, it could lead to higher targets. Analysts think that $3.85 and $4.88 are still the most likely short-term levels.

If bulls can break out, the next leg could go up to $5.00 and beyond. But this depends a lot on how much trading is going on and how the market feels. Resistance may be hard to break through without strong momentum.

Technical Indicators Suggest Bullish Continuation

Momentum indicators suggest that Sui’s price action is getting stronger again. The RSI has gone up from being oversold, which means that more buyers are coming into the market. At the same time, the MACD has turned positive, which is more proof of a bullish structure.

Sui is also trading above its short-term moving averages, which is a sign that it is bullish. Staying above these averages often makes investors feel more confident. This alignment makes it more likely that the rally will last longer.

Recommended Article: SUI Blockchain Welcomes Tokenized Gold as XAUm Goes Live

Institutional accumulation helps growth.

Buying by institutions keeps Sui’s market confidence high. Reports show that big companies have bought a lot of shares, which shows that they are in it for the long haul. This buildup usually happens before big price increases.

This kind of activity lowers the amount of money in circulation and increases investor trust. When institutions get involved, it also makes the token more credible, which makes retail traders more likely to follow. This trend makes the case for continued growth stronger.

Sui ETF Decision Brings Uncertainty

The U.S. SEC has put off making a decision on the Sui ETF application again. Delays are common in crypto, but they make investors feel bad. But an approval could open up new ways to get cash.

If it gets the green light, the ETF could help it become more popular and get more attention. Until then, the market may be uncertain because of changes in the law. Even though the trend is going up, traders need to be careful.

Sui’s Short-Term Price Goals

Right now, analysts are looking at the $3.35 to $3.50 range. If the price breaks above $3.50, it could start a run toward $4.88, with more targets going up to $6.20. If the volume goes up, the momentum could push the token even higher.

If it doesn’t hold $3.20, it will show that sentiment is getting weaker, and $3.05 and $2.73 could be lower supports. If these levels break, bears could take back control. The direction in the near future will depend on the volume surges that are coming up.

Last Thoughts on Sui’s Market Outlook

As long as $3.35 stays the same, the overall Sui outlook is good. Technical indicators, institutional buying, and trader confidence all point to a bullish structure. There are some risks in the short term, but it’s clear that the price could go up.

If you’re an investor wondering if Sui is a good chance, the signs point to yes. But you have to be patient until the resistance zones are broken for good. Managing risk is still very important when dealing with unstable crypto markets.