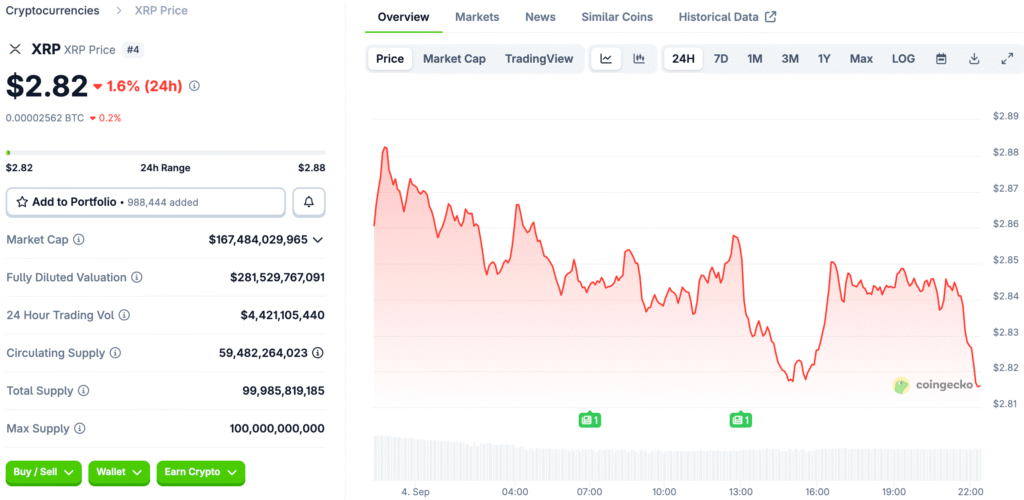

XRP Price at a Key Level of Support

XRP ended August on a low note. It fell to a low of $2.7 for several weeks. This price range is a very important support level. To stop bigger losses, buyers stepped in.

A rebound could happen if this support stays strong. But it could drop if sellers get control again. The next big level of support is at $2.5. It would be dangerous to break below that.

The Price Downtrend That Keeps Going

The chart shows that a clear lower low has appeared. This means that the larger downtrend is still going on. There has also been a pattern of a descending triangle. The base support is at $2.7.

This is a bad sign for technical traders. It means that more pressure might be coming. A breakout is likely to happen by the middle of September. This could be more or less.

Bearish Momentum in Trading Activity

Volume trends point to a bearish outlook. Sellers have been in charge of trading. This has been going on for many weeks. There isn’t enough demand from buyers.

Buyers need to come back for a reversal. They need to come with more people. If this doesn’t happen, the bearish mood will stay. For a long time, the price will probably stay below $3.

Recommended Article: The SEC Lawsuit Outcome Strengthened XRP’s Narrative

The MACD Indicator Shows Weakness

This bearish bias is also supported by momentum indicators. The MACD has made lower highs. It shows that momentum is slowing down over time. The moving averages are close to a bearish cross.

A bearish MACD cross means more pressure. It makes it hard for XRP to go up. Bulls need both price and volume to go up a lot. They need to make up for this bad sign.

XRP Price Outlook for the Short Term

It’s clear what XRP needs to do right away. It has to get back to the $3 resistance level. Success could lead to $3.6. Then it could go after the $4 price level.

But the way the market is set up right now is weak. Traders need to be very careful. If $2.7 doesn’t hold, a deeper phase could start. This would make more people want to sell.

Long-Term Basics and Possible Outcomes

Even though the market is bearish in the short term, the fundamentals are strong. Ripple is becoming more popular for payments. There are good changes in the rules. This could be a chance for long-term investors.

But the technical picture needs time to develop. The next few weeks will be very important. They will show if XRP can hold its value. Or if it will go deeper into its correction.

XRP Faces Crucial Test Amid Bearish Momentum

Ripple’s XRP has a very important week ahead of it. It is having a hard time between important levels. Bearish momentum is still in charge. The price is low because sellers are holding it down.

But a rebound could happen if buyers come back. A breakout above $3 could change how people feel. Traders need to keep a close eye on the $2.7 support. If this goes down, it could confirm the downtrend.