BitMine Buys 358 Million in ETH

BitMine has bought a lot of ETH. The business spent $358 million on it. This happened in two very big deals. They came from FalconX and Galaxy Digital.

This new buy adds to their money. They now own almost two million ETH in total. This makes them one of the biggest institutional holders. They are now a key player.

BitMine Solidifies Position as World’s Top ETH Holder

BitMine has made its top spot even stronger. They own the most ETH of any company. The second biggest holder has less than half. This is a very important step forward.

This shows that BitMine is doing better than its competitors. They have set a very high record for their institution. It shows how aggressive the company’s plan is. This is a big sign for the market.

Institutional Inflows and Staking Shrink Ethereum’s Supply

More and more institutions are buying ETH. There are now more than five million ETH. This is more than $23 billion in new money coming in. This cuts down on the amount of ETH that is available.

Staking is also a big deal. More people are putting their tokens away. They help keep the network safe and make money. This lowers the amount of ETH that is available.

Recommended Article: Ethereum Sunsets Holesky Testnet After Two Years

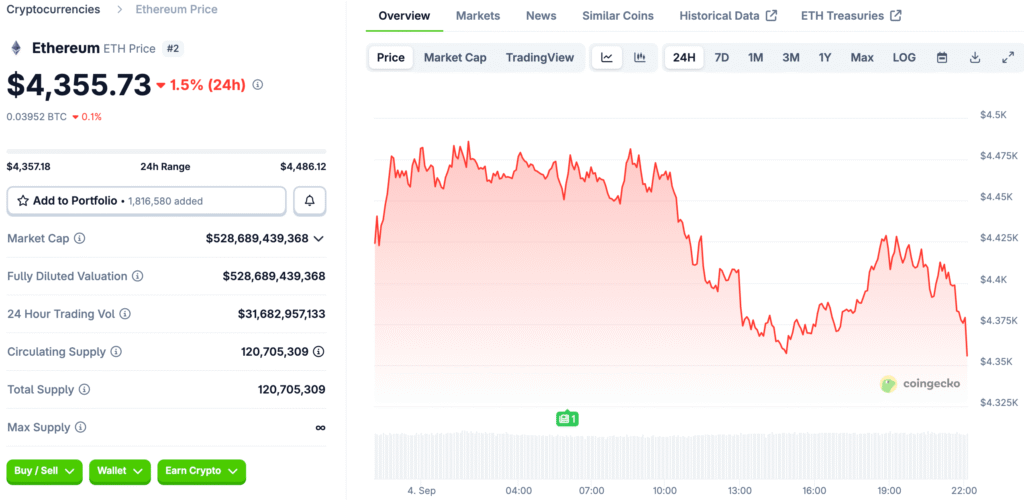

Ethereum’s Price Stability a Sign of Growing Trust

The price of Ethereum went up by more than 2%. This happened only a day after the news. It added to a 21% rise in the month. This shows a strong trend, according to analysts.

The token’s strength is shown by its stability. It could be getting ready to make bigger moves. The market is responding very well. This shows that you trust the token.

The Long-Term Outlook for Ethereum

One Wall Street expert thinks Ethereum is worth more than it is. He thinks it will be used for a long time. He says that right now it is like Bitcoin was in 2017. He says that investors can get a lot out of it.

He believes that now is a good time to build a strong ETH portfolio. He thinks that investors will make a lot more money. This is a long-term look at the crypto. It has a lot of promise.

Historical Parallels with Bitcoin

Tom Lee makes a very important comparison. He says that Ethereum is like Bitcoin in its early days. He believes it is at the same point now. It is just beginning to get big investors.

He also thinks that things will get better. It is possible that the Federal Reserve will lower interest rates. In the past, this has been good for assets. It might help ETH grow very quickly.

Ethereum’s Future: A New Rally Fueled by Fed Rate Cuts

The Fed might cut rates soon. This could make things easier. In the past, rate cuts have led to higher asset prices. This is a good thing for the economy as a whole.

This could start a bigger rally. Ethereum could grow as quickly as Bitcoin. It had a very strong early adoption phase. ETH has a very bright future ahead of it.