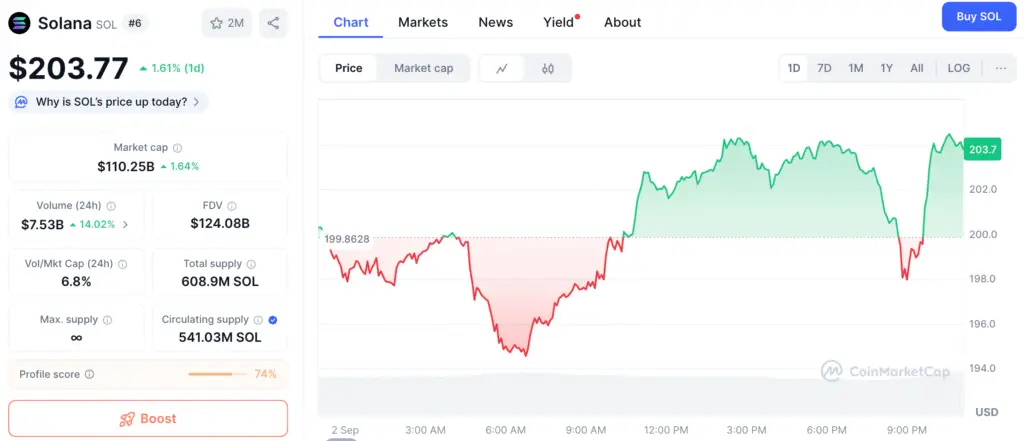

Signs of a Price Recovery in Solana

Solana is starting to get better. This comes after a time when prices were going down. The token tried out the $195 support zone. It is now trying to get back a lot of energy. This is a good sign for all the traders.

The price movement is following a similar pattern. Volatility has also been seen in other major cryptocurrencies. Solana was below a few important support levels. This put it in a short-term bear market.

Solana Breaks Key Fibonacci Level, a New Bullish Trend

Solana has gone above a key Fibonacci level. A lot of people think this is a good sign. There was a big change in technology. The price broke through a line that showed it was going down. This breakout could mean that sellers are losing their grip.

This is a big step forward that is good. It could be the start of a new trend. After the price hit a low, the attempt to recover began. It has now been able to get back up. This shows that buyers are interested again.

Important Levels of Resistance for a Continued Rally

There are still a lot of problems that Solana needs to solve. The price is currently below a key level of resistance. It is also below the 100-hourly simple moving average. Both of these are very important signs.

The first level of resistance seems to be around $202. The $205 level is a bigger barrier. The next goal would be $209 if buyers can get the price above this level. There needs to be a clean close above this area.

Recommended Article: Solana Cloud Mining Guide: An In-Depth Review of SWL Miner and Its Passive Income Potential

Keeping an Eye on Possible Risks for SOL

If Solana can’t get past the $205 resistance, the recovery might stop. This could cause another drop. The first support on the downside is around $200. This is a mentally important level for traders.

Solana could be exposed if it breaks below $195. This would make it harder to sell. The price could then move toward the $188 support level. If the price drops below $188, it would be a very bad sign.

Solana MACD and RSI Show Bullish Signs, but Volume Remains Weak

It looks like the hourly MACD for Solana is getting stronger. This is happening in a bullish area. This means that things are getting better and better. The RSI on the hourly chart is also above 50. This means that buyers have a small advantage.

But the amount of trading has only gone up a little bit. It is still lower than it was during the last rally. This means that the momentum is still weak. This is a very important point for traders.

Solana’s Recovery Enters a Key Consolidation Phase

During the recovery phase, trading volume has gone up by a small amount. It is still below the levels of the last rally. This means that the pressure to buy isn’t very strong yet. The price action in the short term is now in a consolidation phase.

There are a few things that will affect the price action of Solana. Bulls need to keep the recovery going at the same pace. They also need to get past the important resistance levels. This will be the key to a new rise.

What Solana’s Momentum Will Look Like in the Future

The price of Solana in the short term will depend on whether the bulls can keep the recovery going. They need to break through the important resistance levels. If they don’t succeed, the recovery could stop. This could cause the price to go down again.

Recent market data shows that the price is trying to find a new support level. Traders are now waiting for clearer signals about which way the market is going. Solana’s momentum is now in a very dangerous place for the future.