PENGU’s Bull Flag Pattern

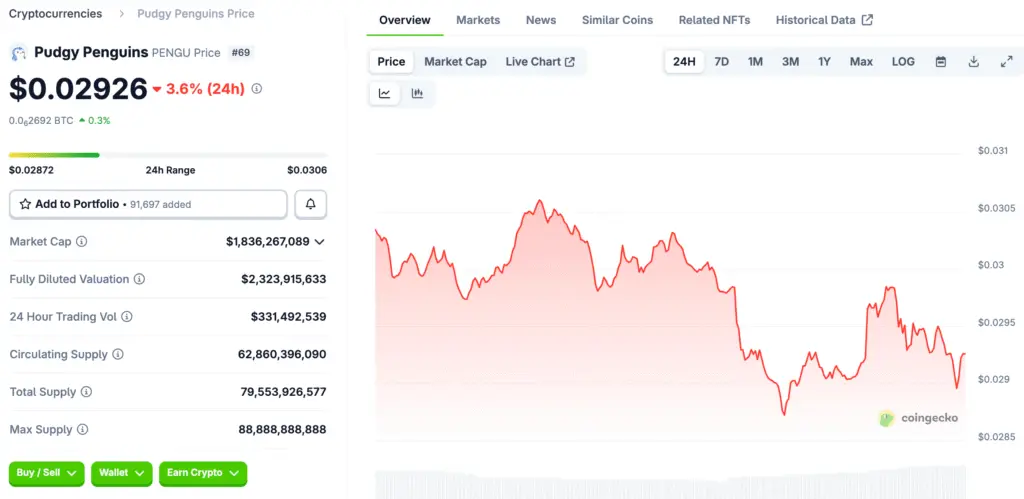

PENGU’s price action has formed a classic bull flag pattern. It is consolidating within a descending parallel channel. This has been happening since late 2024. The pattern is supported by key levels at $0.030 to $0.032.

A breakout above the flag’s resistance at $0.042 could trigger a rally. This would take it toward the $0.10 mark. This represents a huge 26% gain from current prices. The token has also tested a falling wedge pattern.

On-Chain Data Reveals Whale Accumulation

On-chain data reveals a significant surge in whale accumulation activity. Large institutional wallets linked to South Korean exchanges are acquiring tokens. They have acquired 945 million PENGU tokens so far. This aligns with a 4.87% increase in open interest.

The open interest is now at $320.10 million. This reflects growing speculative activity and liquidity. A more recent spike of 30.29% underscores heightened market participation. This is a very bullish sign.

The Deflationary Supply Burn Mechanism

PENGU’s deflationary mechanics have amplified its value proposition. An early 2025 supply burn reduced the total supply. The circulating supply was reduced by 12 billion tokens. This created a great amount of scarcity amid rising demand.

Fundamentally, PENGU-related GIFs have amassed 55.7 billion views. This is nearly triple that of Disney. This activity translates into a projected $50 million in 2025 revenue. There are also plans for a public listing by 2027.

Recommended Article: Meme Coin Market: Pudgy Penguins and Arctic Pablo Coin

Why PENGU Is Positioned for a Breakout

Institutional validation for PENGU is accelerating very quickly. New ETF filings and strategic partnerships are driving this. There are partnerships with South Korean exchanges. This is bolstering the legitimacy of the token.

These developments suggest a broader acceptance of PENGU. It is being viewed as both a cultural and financial asset. The token is now positioned for a major breakout. This is due to its strong fundamentals.

Strategic Entry Points for Traders

For investors looking to capitalize on this multi-phase setup, there are a few windows. The first is an immediate retest of $0.03618. This is a very high probability entry point. It is a great opportunity before the $0.04662 target.

A sustained move above $0.042 validates a new falling wedge pattern. This would unlock a 26% upside to $0.10. A consolidation at $0.046 could set up a rally. This would be driven by institutional buying.

The Bullish Case and Potential Risks

The current price action presents a strong bullish case. The technical and on-chain data aligns very well. There is a strong confluence of signals. This suggests a major rally is very possible. The fundamentals are also very strong.

However, a breakdown below $0.0306 is a risk. This would shift the overall bias to bearish. The downside target would be around $0.025. Such a move would invalidate the current patterns.

PENGU’s Inflection Point

PENGU’s current inflection point is a rare convergence of catalysts. These are technical, on-chain, and institutional factors. For investors, the key is timing entries. This must align with each phase of the breakout.

This is about balancing risk management. It must be balanced with the token’s robust fundamentals. As PENGU navigates its path toward $0.10, it is a great case study. It is a study in strategic bullish positioning.