Bitcoin’s Active Supply as a Barometer

The active supply of Bitcoin is a key on-chain metric that serves as a powerful indicator of market sentiment and investor behavior. Specifically, the 30-day active supply measures the number of unique Bitcoin, or BTC, that have moved at least once in the past month. Think of this metric as a kind of “thermometer” for the Bitcoin market. When the active supply rises, it suggests a period of heightened activity, often driven by new capital entering the market or a significant increase in trading volume.

This heightened state of circulation can be a signal that the market is either approaching a local top or bottom, as the emotional forces of greed and fear compel investors to move their holdings. Conversely, a decline in active supply indicates that the market is entering a quieter phase, where circulation slows down and investor conviction remains strong. This quieter period is often seen as a consolidation phase that precedes the next major move.

The Historical Significance of Active Supply Peaks

The 30-day active supply peaks in market psychology are often linked to periods of extreme greed, such as when Bitcoin’s price surges and a speculative frenzy takes hold. This leads to massive coin movement across the network, as seen in the late 2021 bull run. Conversely, sharp downturns in active supply often coincide with moments of extreme fear, known as a “capitulation event.”

These events occur when many investors sell their holdings, leaving coins in circulation held by those with strong long-term conviction. This dynamic is crucial in the market cycle, as it helps shake out weak hands and establish a new foundation for the next rally.

A Period of Calm and Consolidation

According to recent data from Alphractal, the 30-day active supply has cooled off, showing a notable slowdown in market activity. This decline reflects a period of calm that often follows a phase of extreme volatility or enthusiasm. As the market enters this consolidation phase, the immediate volatility is reduced, allowing for a more stable and predictable environment.

Instead of the wild price swings that characterize moments of fear and greed, the market is now in a “reset mode,” quietly awaiting the next major catalyst. This period of calm is not a sign of weakness but rather a reflection of a maturing market. Investors are holding their positions with conviction, and the overall circulation of the asset has settled, creating a foundation for future growth.

Analyzing the Current Market Psychology

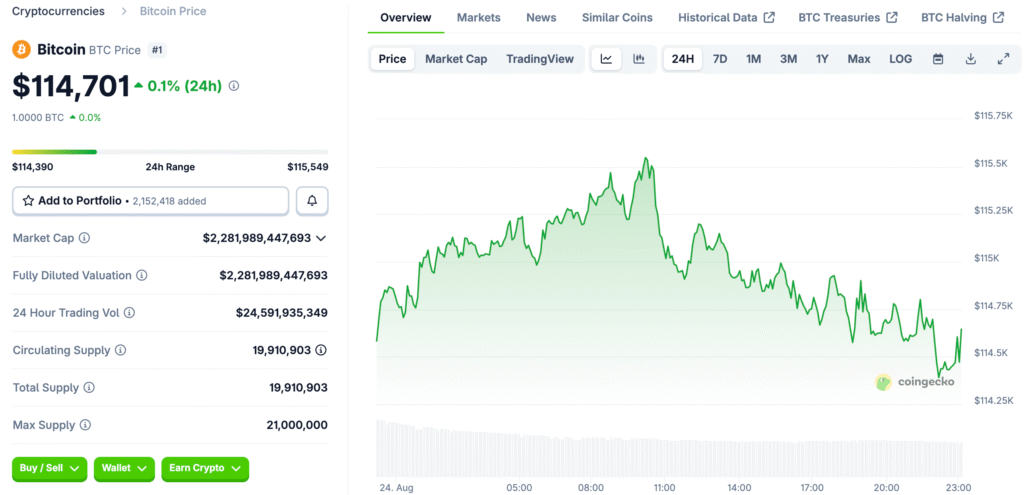

The current decline in active supply provides a clear window into the prevailing market psychology. The fact that the supply has cooled off, even with Bitcoin trading above a significant price level, suggests that investors are not panicking or rushing to take profits. Instead, there appears to be a strong conviction among market participants that the current price is a solid foundation for future growth.

This is in stark contrast to the periods of extreme fear and greed that have characterized past market cycles. The current state suggests that the market is preparing for a new directional push, but it is doing so with a level of patience and stability that has not been seen in previous cycles. This psychological shift from frenetic trading to calm holding is a bullish sign for Bitcoin’s long-term health.

Macroeconomic Factors and Their Influence

While the active supply metric is a powerful on-chain indicator, it is also important to consider the broader macroeconomic factors that are currently at play. The cryptocurrency market is no longer a siloed ecosystem; it is deeply intertwined with global economic trends, including central bank policies, inflation rates, and the performance of traditional financial markets.

For example, recent statements from the Federal Reserve hinting at a potential interest rate cut could be a major catalyst for the next leg up in the Bitcoin rally. A more accommodative monetary policy would likely lead to an increase in liquidity and a rotation of capital into risk assets like Bitcoin. Additionally, the continued interest from institutional investors, as evidenced by ongoing ETF inflows and trading activity, is a strong fundamental factor that will likely contribute to Bitcoin’s next move.

Anticipating Bitcoin’s Next Directional Push

The current period of calm, as indicated by the drop in active supply, is setting the stage for Bitcoin’s next major directional push. The market is effectively in a holding pattern, with a strong foundation built on investor conviction and reduced volatility. The question is not if Bitcoin will make a move but when and in what direction.

A significant catalyst, whether it be a favorable macroeconomic development, a major institutional announcement, or a sudden surge in retail demand, could be the trigger. The market is poised to absorb this new momentum and break out of its current consolidation zone. For investors and traders, this period represents a prime opportunity to position themselves for the next phase of the market cycle.

What This Means for Bitcoin’s Future

The cooling of Bitcoin’s 30-day active supply is a significant and positive development. It signals a shift from a period of high volatility to a state of calm and consolidation. This trend, which has historically preceded major market moves, suggests that the market is now in a “reset mode,” awaiting the conditions to drive Bitcoin’s next big breakout.

The confluence of a stable on-chain environment and positive macroeconomic factors creates a powerful case for a future rally. As the market continues to evolve, metrics like active supply will become even more important for understanding the underlying sentiment and anticipating the next major phase of Bitcoin’s journey.

Read More: The Federal Reserve’s “Dovish” Stance Sends Bitcoin Price Soaring