XRP Price Falls Sharply After SEC ETF Delay

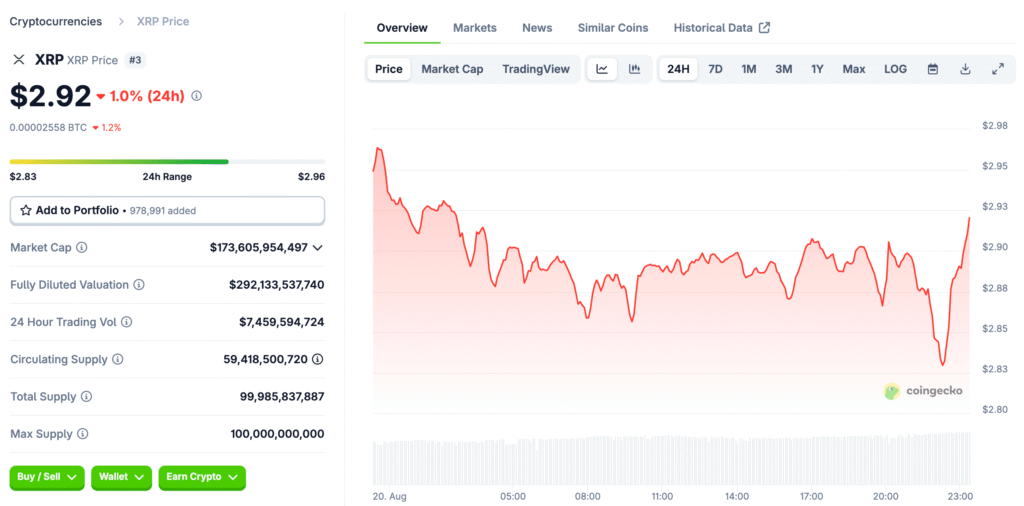

XRP has suffered a steep decline, slipping below the critical $3 mark following fresh regulatory uncertainty. On August 20, 2025, the U.S. Securities and Exchange Commission (SEC) announced another delay in deciding on spot cryptocurrency exchange-traded fund (ETF) applications, now pushed back until October 2025.

The news rattled investors, leading to a 20% weekly loss for XRP and a breakdown to intraday lows near $2.85. The setback comes at a crucial time when broader crypto markets were already facing heightened volatility, amplifying concerns that extended regulatory delays could weigh on investor sentiment well into the final quarter of the year.

XRP Exchange Supply Hits Monthly Low

Despite bearish price action, on-chain data signals that long-term investors may be positioning for a recovery. According to Glassnode, XRP supply held on centralised exchanges dropped to just 5.66%, the lowest in a month and down 3% since August 9.

The trend reflects a shift of tokens into self-custody wallets, a move typically associated with reduced short-term selling pressure. Historically, declines in exchange balances have preceded price rebounds, suggesting that at least a portion of the market remains confident in XRP’s longer-term trajectory despite regulatory uncertainty.

Technical Analysis: Key Levels to Watch

Technical indicators paint a mixed picture for XRP traders.

- Relative Strength Index (RSI): Currently at 32, XRP is in oversold territory. This may indicate that selling pressure has reached exhaustion and a relief bounce could be on the horizon.

- Moving Averages: XRP is trading below its 100-hourly Simple Moving Average, reflecting continued bearish momentum in the short term.

- MACD Indicator: The hourly MACD remains deep in bearish territory, signalling that downside risks persist.

Support levels: $2.85 and $2.74 remain crucial zones. A decisive breakdown below $2.74 could accelerate losses toward $2.70 and potentially $2.65.

Resistance levels: $2.92 and the psychological $3.00 remain the first hurdles for any recovery attempt. Beyond that, reclaiming $3.05 would be essential to flip market sentiment back toward bullishness.

Market Reaction and Investor Sentiment

The SEC’s continued hesitation in approving cryptocurrency ETFs has fuelled frustration within the digital asset community. Many investors had expected clarity by mid-2025, but the latest delay underscores the regulator’s cautious stance toward crypto integration with traditional financial markets.

For XRP, the delay is particularly impactful. Ripple has been actively pursuing regulatory approvals, including a U.S. bank licence application, alongside efforts to strengthen institutional adoption. The prolonged timeline raises concerns that XRP’s institutional growth story could be slowed, even as grassroots adoption gains traction.

Adoption Continues to Expand

In contrast to price weakness, XRP’s adoption metrics highlight steady progress. The token can now be used for booking flights, hotels, and a variety of digital services. Ripple’s recent XRP Rewards Event has further energised its community, incentivising engagement and long-term holding.

Ripple’s partnerships in cross-border payments remain one of the strongest narratives supporting XRP’s utility. With banks and financial service providers continuing to test Ripple’s blockchain-based payment solutions, analysts believe adoption growth could eventually offset the uncertainty tied to U.S. regulatory actions.

XRP Price Prediction: What’s Next?

XRP’s short-term price trajectory hinges on its ability to hold support at $2.85. If bulls can defend this level, a rebound toward $2.92 and $3.00 becomes plausible. Conversely, a decisive breakdown below $2.74 would increase the risk of testing deeper supports near $2.70. From a broader perspective, the RSI’s oversold signal and declining exchange supply suggest that selling pressure may soon ease.

However, as long as the SEC delays loom, XRP is likely to remain vulnerable to market-wide volatility. If the SEC delivers a favourable ETF decision in October, analysts believe XRP could swiftly reclaim the $3.50–$4.00 range. Until then, cautious optimism may define XRP trading as investors balance regulatory risks with the token’s growing real-world utility.

The SEC Delay and Its Impact on XRP

The latest SEC delay has triggered a significant correction for XRP, pushing prices below $3 and fuelling short-term bearish momentum. Yet, on-chain trends like reduced exchange supply and expanding adoption provide a counterbalance, hinting at resilience beneath the surface.

For now, XRP faces a tug-of-war between regulatory headwinds and fundamental strength. The next decisive move will likely depend on whether buyers can defend support at $2.85 or whether bearish momentum drags the token into a deeper correction before October’s critical SEC deadline.