A Tumultuous Week for Ethereum ETFs

Ethereum is facing one of its most turbulent weeks in recent months as exchange-traded funds (ETFs) tied to the cryptocurrency recorded heavy outflows. Over the past three days, Ethereum ETFs have shed a staggering $678 million, sparking renewed concerns about whether institutional confidence in ETH is starting to crack.

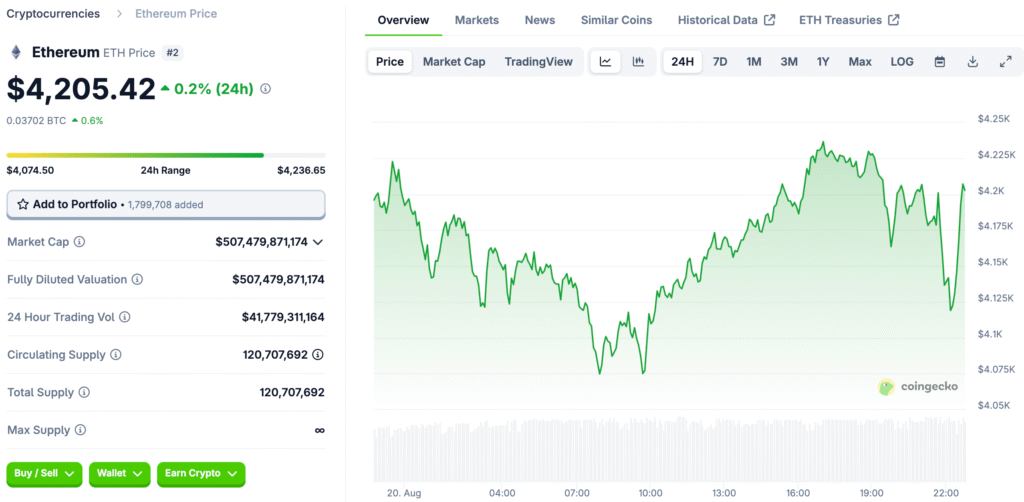

The biggest blow came on August 19, when outflows totalled $422 million in a single day, the second-largest since these financial products launched. The sell-off coincided with a sharp price drop for Ethereum, which slid to $4,180, marking a 10% weekly decline. The sell pressure is pushing ETH toward a crucial technical level at $4,135, now considered the primary support zone.

Key Players Driving the Redemptions

Not all issuers were equally affected, but the largest names led the withdrawals:

- Fidelity saw $156 million in redemptions.

- Greyscale lost $122 million.

- Bitwise recorded $40 million in outflows.

Smaller withdrawals ranging from $3 million to $6 million also hit products from BlackRock, Franklin Templeton, and Invesco. Combined, these outflows represented a sharp reversal in sentiment after weeks of accumulation.

Blockchain analytics firm Arkham Intelligence confirmed that BlackRock, Fidelity, and Greyscale collectively sold nearly $160 million worth of ETH on-chain, signalling that institutional managers are not just trimming ETF balances but actively liquidating Ethereum positions.

Technical Picture: Ethereum at a Crossroads

Ethereum’s technical indicators reflect the mounting pressure. ETH has fallen from $4,750 earlier this month to the current $4,180 level, where traders are watching support at $4,135, aligned with the 20-day Exponential Moving Average (EMA).

- Relative Strength Index (RSI): At 54, momentum is neutral but showing signs of cooling.

- Short-term EMAs (20-day): Threatening a bearish break.

- Longer-term EMAs (50, 100, 200): Still trending upward, suggesting underlying strength.

If ETH holds above $4,135, analysts believe it could rebound toward the $4,500–$4,700 zone. However, if that support fails, focus will quickly shift to the 50-day EMA near $3,690, opening the door to a deeper correction.

The Bigger Picture: Ethereum ETFs Still Hold Weight

Despite the recent sell-off, Ethereum ETFs remain major players in the market. Collectively, these investment vehicles hold over 6.3 million ETH, valued at around $26 billion, accounting for nearly 5% of the total Ethereum supply.

This large position means ETF flows have significant influence over Ethereum’s price. Even small shifts in investor confidence can spark sharp moves in the spot market. For now, outflows suggest caution, but if prices stabilise, these same ETFs could once again become a driver of bullish momentum.

Read More: Ethereum Plunges as Macroeconomic and Technical Factors Align for a Sell-Off

Market Sentiment: Fear or Opportunity?

The heavy redemptions reflect broader investor caution. Macroeconomic uncertainty, regulatory scrutiny of digital assets, and Ethereum’s own technical weakness have all contributed to short-term bearishness. Yet some market participants view the sell-off as an opportunity.

“Ethereum ETFs controlling 5% of supply is not a bearish signal in itself—it’s a sign of deep institutional involvement,” said one crypto strategist. “Yes, outflows are happening now, but if ETH finds support, those same institutions may re-enter aggressively.”

Others warn that sentiment could worsen if ETH breaks below $4,135. “That level is critical. Losing it would signal more than just technical weakness; it would show that institutional selling pressure is overpowering spot demand,” another analyst noted.

What Comes Next for Ethereum?

The next few trading sessions will be critical. If Ethereum maintains support, ETF issuers may see renewed inflows, particularly from investors who view the dip as a buying opportunity. However, if selling continues, ETH could face a drawn-out correction.

Regardless of short-term moves, Ethereum’s long-term outlook remains anchored in its dominant role in decentralised finance (DeFi), smart contracts, and tokenisation. Even after this week’s turbulence, Ethereum’s ETF ecosystem demonstrates the asset’s growing importance in global markets, cementing its place as the second-most influential cryptocurrency after Bitcoin.

Ethereum ETFs Under Pressure

Ethereum ETFs are under pressure, with $678 million withdrawn in three days and ETH prices hovering near crucial support. Whether this marks the start of a deeper downturn or just another shakeout before the next rally remains to be seen. One thing is certain: institutional flows are now a powerful force shaping Ethereum’s price trajectory, and the market will be watching ETF activity closely in the days ahead.