The SEC-Ripple Legal Battle Ends After Five Years

The cryptocurrency world has been watching the legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple with bated breath since 2020. This week, that five-year legal slugfest officially came to an end. The SEC agreed to settle its lawsuit against Ripple, a decision that aligns with the new political climate under President Donald Trump’s pro-crypto administration.

This resolution is being hailed as a major victory for Ripple and the broader crypto community, as it provides a new level of clarity on the regulatory status of cryptocurrencies. For many, the end of this long-standing legal battle removes a significant overhang that has been weighing on the XRP token, and it signals a potential shift in the way the U.S. government views and regulates digital assets.

The Foundation of the Lawsuit: XRP’s Unique Nature

The SEC’s lawsuit was centred on the unique nature of the XRP cryptocurrency. Unlike decentralised cryptocurrencies such as Bitcoin, which are “mined” by a network of computers, XRP is issued directly by Ripple, the company that created it. This corporate control and issuance model led the SEC to argue that XRP should be treated as a financial security, subject to the same strict regulatory framework as stocks or bonds.

This would have placed significant costs and restrictions on Ripple’s business model. In August 2024, a judge issued a partial ruling that XRP might only be a security when sold to institutions, but not when traded on public exchanges. While this was seen as a win for the crypto community, the SEC’s subsequent appeal threatened to prolong the legal battle. The recent settlement, however, has finally put an end to that uncertainty and has been met with relief by the crypto community.

Ripple’s Payment System and Its Core Utility

Ripple developed a payment system called Ripple Payments that allows banks to settle cross-border transactions instantly, without the need for intermediaries. This system dramatically reduces the time and cost associated with international payments. XRP is designed to standardise these transactions, acting as a bridge currency between different fiat currencies. For example, a bank could send XRP to another bank, which could then instantly convert it into its local currency, bypassing expensive foreign exchange fees.

The transaction cost for this is a fraction of a U.S. cent. This utility-driven model is at the core of Ripple’s business and is why the company has attracted so much attention from the financial industry. The SEC’s lawsuit had the potential to derail this business model, but with the settlement, Ripple can now move forward with its vision of using XRP to facilitate a more efficient global payment system.

The Pro-Crypto Administration and the SEC’s Shift

The resolution of the lawsuit is a direct result of the new political landscape in the U.S. President Trump had campaigned on a pro-crypto agenda and appointed industry advocate Paul Atkins to run the SEC. Under Atkins’ leadership, the agency has already demonstrated a shift in its approach, pausing or withdrawing several active cases against major crypto companies like Binance and Coinbase. The official withdrawal of the appeal against Ripple on August 7th was a clear and decisive action that ended the five-year legal struggle.

This signals a new era of regulatory engagement in the U.S., where the government appears to be taking a more favourable and accommodating approach to the cryptocurrency industry. This policy shift is great news for crypto companies and investors, as it provides the certainty needed to innovate and grow without the constant threat of regulatory action.

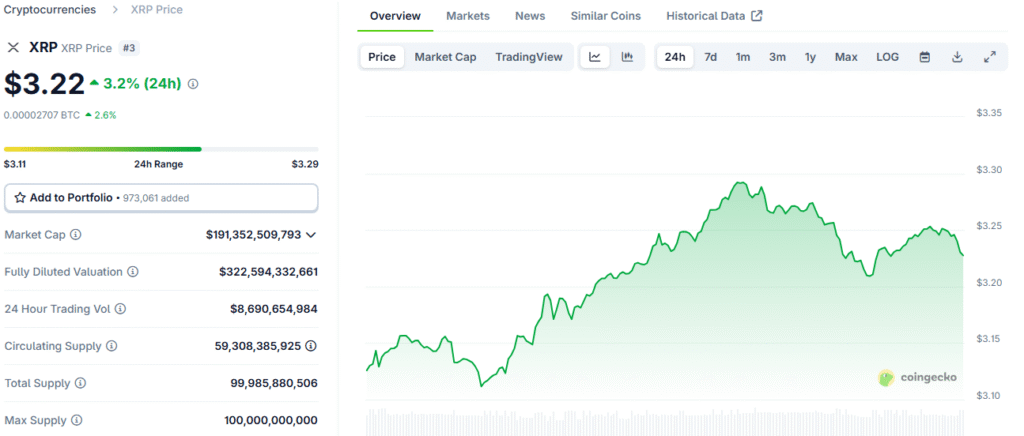

The Price Rally and the Role of ETFs

XRP’s price had already begun to rally in anticipation of a favourable outcome in the SEC lawsuit. In July, the token hit a new record high for the first time since 2018, a move that was fueled by a widespread expectation of an imminent resolution. The token also benefited from the approval of the ProShares Ultra XRP ETF last month. This leveraged exchange-traded fund, which invests in XRP futures contracts, is seen as a major milestone.

Investors view futures-based ETFs as a stepping stone to the eventual approval of spot XRP ETFs, much in the same way that futures-based Bitcoin ETFs preceded the launch of spot Bitcoin ETFs. This new financial product provides a regulated way for investors to gain exposure to XRP, attracting a new wave of capital and further solidifying the token’s place in the mainstream financial system.

The Long-Term Challenge for XRP

Despite the positive news and the recent price rally, some analysts remain cautious about XRP’s long-term upside. One of the main arguments is that the success of Ripple’s payment platform does not necessarily translate into a higher price for XRP. Banks and financial institutions can use the Ripple Payments network to settle transactions with fiat currencies, meaning they are not required to use XRP. This decoupling of the platform’s utility from the token’s value is a potential headwind for its long-term growth.

Furthermore, unlike Bitcoin, which is seen as a legitimate store of value due to its decentralised nature and capped supply, XRP has a history of volatility and a track record of spending years trading below its all-time high. The fact that Ripple controls a significant portion of the token’s supply also makes it vulnerable to downside when the company experiences issues, as was demonstrated during the five-year legal battle with the SEC.

XRP’s Newfound Clarity Paves Way for Institutional Adoption

The end of the SEC lawsuit is undeniably a fantastic piece of news for XRP and the Ripple company. It provides the clarity and certainty needed to move forward with its business model and to continue building its global network. However, the long-term success of the token will depend on more than just this legal victory. The market will be watching to see if Ripple can successfully drive widespread adoption of XRP within its payment network.

The debate over whether XRP’s value is tied to the platform’s success remains a central question for investors. While the legal uncertainty has been lifted, the challenge now lies in proving that XRP has a sustainable path to creating long-term value for its holders. The recent settlement is a major step forward, but the ultimate future of the token will be determined by its ability to gain widespread utility and a clear, compelling reason for investors to hold it for the long term.

Read More: Nature’s Miracle Announces Ambitious XRP Integration Across Industries