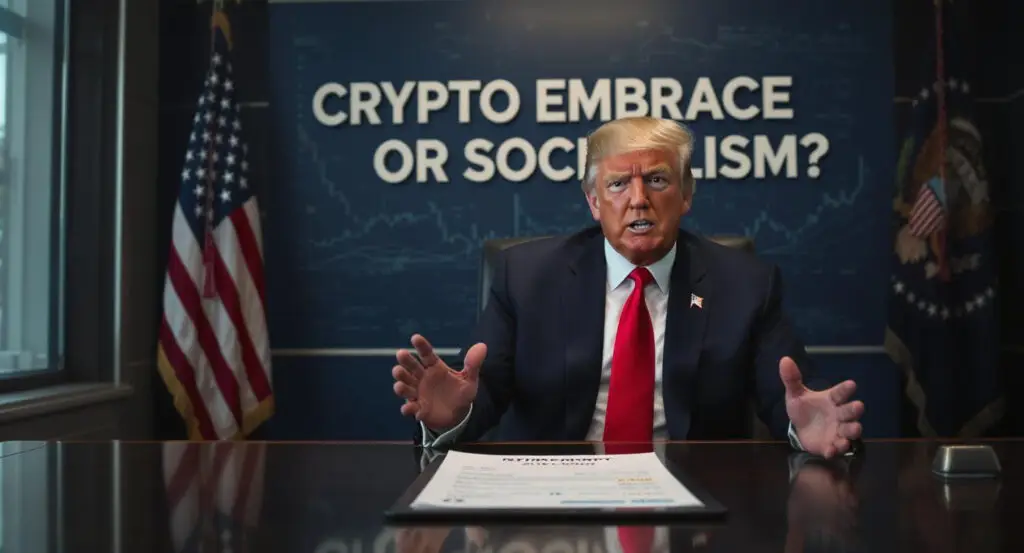

In a striking ideological shift within the United States, merely suggesting caution when incorporating cryptocurrencies into retirement accounts is now being perceived by the Trump administration as akin to socialism. This dramatic recharacterization follows the administration’s recent rollback of previous regulatory guidance that urged fiduciaries to exercise “extreme care” before adding volatile assets like Bitcoin to retirement plans. The move not only signals a significant embrace of digital assets by the current leadership but also highlights how even seemingly mundane financial advice is becoming entangled in America’s ongoing culture wars, where financial restraint is being reframed as an ideological affront to free markets.

Rolling Back Cautionary Guidance

The Trump administration has actively moved to dismantle prior regulatory guidance issued in 2022 by U.S. regulators, which had strongly urged fiduciaries to exercise “extreme care” before including volatile assets such as Bitcoin in retirement plans. This cautious stance has now been emphatically cast aside, with its reversal being framed by the new administration as a triumph for free markets and individual investment autonomy. The rollback directly counters previous concerns about the risks associated with exposing retirees’ savings to the inherent volatility of cryptocurrency markets, reflecting a significant ideological pivot in federal financial oversight.

“Fiduciaries, Not DC Bureaucrats”

U.S. Secretary of Labor Lori Chavez-DeRemer has vocally championed this new stance, criticizing the previous Biden administration for what she termed an “overreach.” Chavez-DeRemer asserted that the Biden administration “should have remained neutral,” implying that direct regulatory caution amounted to undue government interference in investment decisions. She emphatically stated, “We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not DC bureaucrats,” underscoring the administration’s philosophy of minimizing federal intervention in financial planning and placing greater trust in private sector discretion.

Presidential Courtship of Crypto Fans

This policy shift occurs as both the President and Vice-President are actively and publicly courting cryptocurrency enthusiasts, demonstrating a clear strategic interest in aligning with the digital asset community. This engagement includes appearances at major Bitcoin conventions, where leaders directly address crypto fans. In a particularly notable instance, President Trump himself launched a meme coin that experienced a rapid surge to a $15 billion market capitalization over his inauguration weekend, further cementing his personal and political alignment with the cryptocurrency sector and signaling a strong embrace of its culture.

Caution as “Un-American”

The political environment fostered by the Trump administration has created a climate where traditional financial prudence, particularly regarding retirement savings, is being recontextualized through a partisan lens. The article strikingly notes that when “the first lady is flogging her own coin, caution doesn’t just sound dull: it sounds disloyal, unpatriotic, un-American.” This rhetoric suggests that expressing restraint for retirees, once considered common sense, is now viewed with suspicion, bordering on accusations of socialist leanings. Such framing illustrates the deep integration of financial advice into the broader ideological conflicts gripping today’s America.

The Culture Wars and Financial Advice

The current political climate in the U.S. has seen the pervasive “culture wars” extend even into seemingly apolitical domains such as financial advice, making it difficult for even mundane recommendations to escape ideological scrutiny. The notion that suggesting restraint for retirees in their investment choices could be labeled “suspiciously like socialism” underscores a profound shift. This politicization of financial prudence means that objective, common-sense financial guidance risks being dismissed or attacked based on ideological alignment rather than sound economic principles, further complicating the landscape for financial advisors and investors alike.

Trump Administration’s Embrace of Crypto Assets

As president, Donald Trump has visibly and vocally embraced crypto assets, marking a significant departure from his earlier skepticism about digital currencies. This embrace is evidenced not only by his administration’s deregulatory actions but also by his direct engagement with the crypto community and personal ventures into the digital asset space, such as the launch of his meme coin. This strategic alignment suggests a deliberate effort to position the United States as a leader in the crypto industry under his leadership, fundamentally reshaping federal policy towards digital assets.

Implications for Retirement Savings

The Trump administration’s decision to roll back cautionary guidance regarding cryptocurrency in retirement accounts carries significant implications for American workers’ long-term savings. While proponents argue this move offers greater investment freedom, critics express concern about exposing retirees to the inherent volatility and risks of digital assets, especially given that such accounts are intended for secure, long-term growth. This policy shift places more responsibility on fiduciaries and individual investors to assess the suitability of highly fluctuating assets like Bitcoin for retirement planning, potentially increasing their exposure to market fluctuations.