Changing the Way Family Businesses Rate Their CEOs

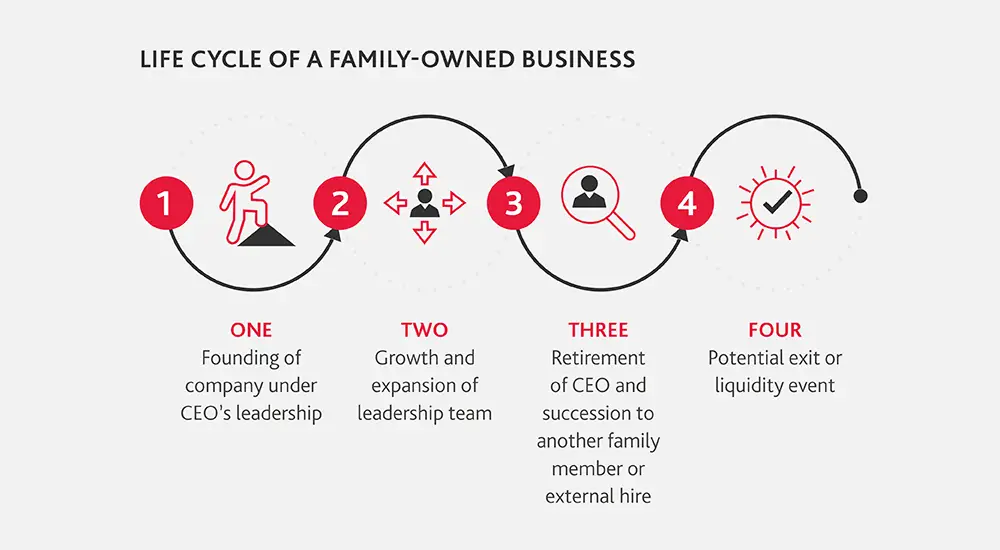

The CEO of a family business has a unique and varied job that goes beyond making money. The leader is often both the heir and the steward. They are in charge of both the family’s legacy and the success of the business. Evaluating performance solely through financial results fails to capture the complexity of this responsibility. The true test of leadership is whether it can keep things going after one person leaves.

Family businesses are facing changes in the economy, technology, and the next generation. Boards need to change as well. Oversight can no longer depend on reviewing budgets or profits after the fact. Instead, it should look more closely at how decisions are made, how leaders are chosen, and how long-term governance systems that make sure institutions are strong and mature work.

Source: Family Business Magazine

From Activity to the Structure of Leadership

A lot of family businesses think that a CEO is effective if they are always visible and involved in operations. While this kind of behavior may show dedication, it can also show that the organization is weak. A structure that relies too much on one executive cannot work on its own.

So, boards need to look at how well leadership is set up, not how busy the CEO is. This includes having a clear strategy, making sure resources are always available, and staying on course even when the market changes. Analytical frameworks like real options theory or game theory help CEOs make better decisions, especially when they do not know what to do. Governance should emphasize discernment and discipline over mere exertion.

Governing Uncertainty Instead of Reacting to It

Family businesses always have to deal with uncertainty because of changes in the law, differences between generations, and the economy. The board’s job is not to demand certainty, but to look at how uncertainty is handled. A good CEO knows what risks there are, comes up with backup plans, and gets the organization ready for change.

Boards should put disciplined processes ahead of making perfect predictions. Scenario planning, stress testing, and contingency modeling ought to be integral to conventional decision-making. Mature governance checks to see if these analytical tools are used in a consistent way, making sure that strategic decisions are based on process rather than gut feelings.

Recommended Article:

Governance Signals Profitability and Cash Flow

Short-term profits may seem good, but they can hide bigger problems with the business. Family boards need to be able to tell the difference between profits that come from long-term discipline and those that come from short-term conditions or investments that are put off.

Good leadership shows itself in steady cash flow, smart use of debt, and a balance between growth, liquidity, and risk tolerance. Boards should ask if profits are a sign of real efficiency or just good timing. In terms of governance, disciplined financial management is a clear sign of strategic maturity and trustworthiness.

Delegation and the Power of the Second Line

The depth and independence of the management team below the CEO are important tests of how long a leader can last. Too much centralization is a sign of weakness, not strength. Boards should keep an eye on how power is shared and if the second line of management is able to work on its own.

A resilient organization has set up rules for who can make decisions and who is responsible for them that work without the need for constant executive oversight. Boards need to make sure that performance is based on how the institution is set up, not on how well individuals do their jobs. The real test of how mature a company’s governance is is whether it can do well without the CEO.

The CEO Board Relationship as a Measure of Governance

The way the CEO and the board talk to each other says a lot about how well the company is run. A good CEO works with the board in a proactive way, seeing it as a strategic partner rather than just a necessary step in the process.

Boards should look into whether information is shared early, whether strategic choices are talked about before they are set in stone, and whether people disagree without causing stress. When board meetings turn into passive exchanges of information, oversight gets weaker. Timing and tone are just as important as substance for good governance.

Long Term Indicators Culture and Reputation

Culture and leadership behavior are two sides of the same coin in family businesses. Boards should watch how the CEO deals with problems, mistakes, and upholds family values. Culture and reputation are long-term assets that need to be watched over all the time.

Erosion often starts slowly, with people accepting small moral failures or ignoring disagreement. Once it starts, it cannot be stopped. The same level of care should be given to monitoring cultural health as to reviewing finances. A resilient family business makes sure that its leaders act in line with the values that started it, which builds trust across generations.

Governance as the Key to Continuity

An annual review is not enough to do a good job of evaluating a CEO. It needs constant supervision that looks at the structure of leadership, the discipline of decision-making, the strength of delegation, and the consistency of ethics. In a family business, long-term success depends on governance systems that can last longer than the people who run the business.

In the end, the board needs to ask one important question. Can the business do well without the CEO being there all the time. The answer not only affects performance, but also whether real generational continuity has been reached.