Ripple Expands Digital Custody With Palisade Buy As XRP Tests Support

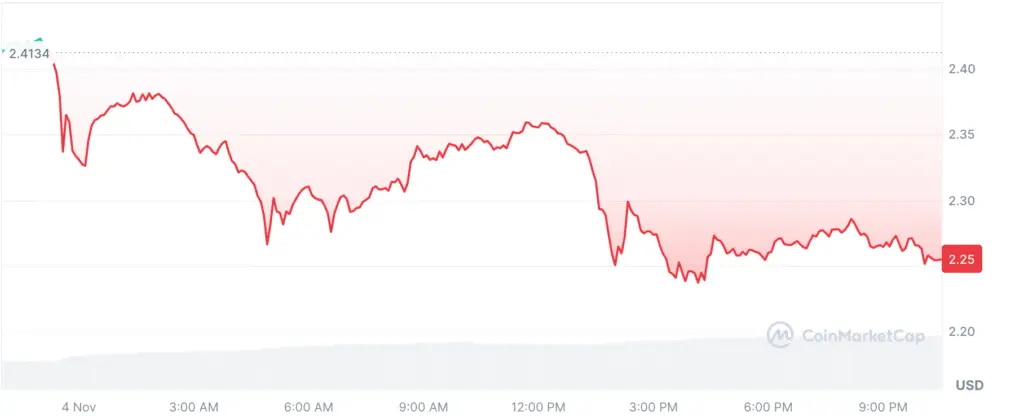

Ripple’s XRP continues its downward trend, trading around $2.26 on Tuesday amid broad market weakness. The asset’s decline mirrors ongoing risk-off sentiment across the crypto sector, as total liquidations surpassed $1.33 billion in the past 24 hours.

Despite the pullback, Ripple has announced a major expansion in its digital custody operations. The acquisition of Palisade, a company specializing in digital asset wallet and custody solutions, aims to enhance Ripple’s capabilities for fintechs, crypto firms, and corporates seeking secure asset storage.

Ripple Strengthens Institutional Custody Capabilities

According to Ripple’s Monday announcement, Palisade’s wallet technology will integrate directly into Ripple Custody, the company’s secure digital asset storage service. The move will broaden Ripple’s offerings for institutions requiring robust infrastructure to manage stablecoins, tokenized assets, and real-world financial instruments.

Ripple Custody was originally developed for banks and financial institutions seeking a secure platform for digital holdings. The addition of Palisade’s wallet-as-a-service architecture provides faster, more scalable storage and transaction processing designed for high-speed global payments.

Enhanced Wallet Integration Into Ripple Payments

Ripple confirmed that Palisade’s system will become a core component of Ripple Payments, powering subscription-based payments and real-time value transfers. The integration will allow businesses to automate billing, settlements, and treasury operations using blockchain technology.

Monica Long, Ripple’s President, said the merger will unify the company’s institutional solutions. “The combination of Ripple’s bank-grade vault and Palisade’s lightweight wallet technology positions Ripple Custody as a complete provider — from long-term storage to global real-time payments.”

Recommended Article: XRP Faces Pressure as Analysts Warn of Potential 50% Price Correction

A Year Of Aggressive Expansion For Ripple

This acquisition continues Ripple’s strategic expansion through targeted investments and partnerships. In recent months, Ripple acquired Hidden Road, now rebranded as Ripple Prime, to offer prime brokerage services, and GTreasury, a treasury management platform for enterprises.

Ripple’s total investments in the crypto ecosystem have exceeded $4 billion this year. These moves align with its long-term plan to integrate banking, payments, and asset custody within a unified blockchain-powered infrastructure.

XRP Faces Mounting Selling Pressure

Even as Ripple scales its business operations, XRP remains under pressure in both spot and derivatives markets. Data from CoinGlass shows the OI-weighted funding rate falling from 0.0085% to -0.0019%, indicating an increasing preference for short positions.

The recent wave of liquidations, primarily targeting long positions, has reinforced bearish sentiment. Of the $1.33 billion in liquidations recorded, more than $1.17 billion involved longs, suggesting traders are exiting bullish bets amid heightened volatility.

Technical Analysis: Key Levels To Watch

At $2.26, XRP is trading below major moving averages, including the 200-day EMA at $2.59, the 100-day EMA at $2.69, and the 50-day EMA at $2.62. These indicators signal that XRP’s short-term technical outlook remains bearish.

The MACD indicator triggered a sell signal earlier in the day, while the RSI stands at 36, reflecting ongoing downward momentum. Analysts identify $2.18 as the next key support, followed by $1.90 if the sell-off continues. A reversal would require reclaiming the 200-day EMA as a first step toward recovery.

Market Outlook For XRP And Ripple

Ripple’s strategic focus on expanding its custody and payments network positions the company for long-term growth despite near-term price weakness. Analysts note that the acquisition of Palisade strengthens Ripple’s infrastructure for institutional adoption, which could help stabilize demand for XRP once market sentiment improves.

If investor confidence returns and buying pressure rises, XRP could regain its footing above $2.50, supported by Ripple’s expanding enterprise ecosystem. Until then, traders remain cautious as liquidity continues to drain from risk assets.

About Ripple

Founded in 2012, Ripple Labs Inc. is a global blockchain company focused on real-time cross-border payments and digital asset management. The company’s blockchain network, RippleNet, connects hundreds of financial institutions worldwide. Ripple’s token, XRP, serves as a bridge asset for instant, low-cost international transactions.