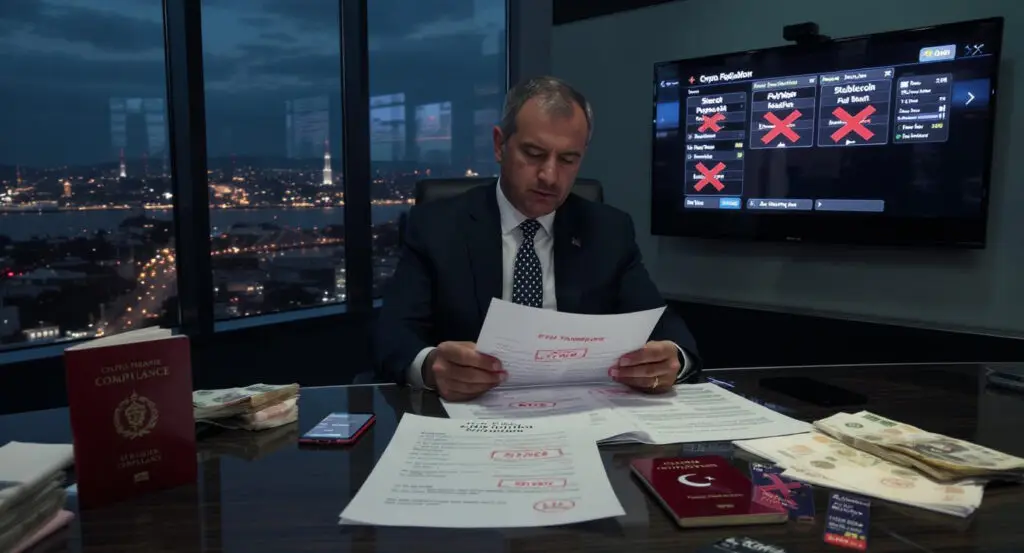

In a sweeping move to rein in financial crime in the digital asset space, Turkey’s Ministry of Treasury and Finance is preparing to implement new crypto regulations that will impose stricter transparency requirements and tighter control over stablecoin transactions.

The new rules, disclosed by the state-run Anadolu Agency (AA) on Tuesday, mark the latest step in Turkey’s broader effort to bring its crypto regulatory framework in line with global standards while targeting criminal misuse of digital assets.

Mandatory Transaction Descriptions and Withdrawal Delays

At the heart of the proposed rules is a mandate for crypto platforms to collect more granular information about all transactions on their networks. Specifically, users will be required to include a transaction description of at least 20 characters for every crypto transfer.

Beyond descriptions, the new rules also introduce mandatory holding periods for withdrawals, particularly when the Financial Action Task Force (FATF) “Travel Rule” does not apply. Withdrawals will be delayed by 48 hours in most cases, with a stricter 72-hour delay for the first withdrawal from a new account. These holding periods are designed to give platforms and regulators more time to flag suspicious activity and assess risks before funds leave the system.

Stablecoin Transfers Face Tightened Caps

Another central element of the regulation is a cap on daily and monthly stablecoin transactions. Users will face a daily limit of $3,000 and a monthly ceiling of $50,000 for stablecoin transfers. These limits aim to stem the rapid outflow of illicit funds, particularly in connection with activities like illegal betting and financial fraud.

Platforms that comply fully with the Travel Rule, including identification of both sender and recipient, will be allowed to offer higher thresholds, doubling the limits for compliant users.

Balancing Oversight With Innovation

While the rules are among the strictest crypto measures Turkey has considered to date, Treasury and Finance Minister Mehmet Şimşek emphasised that the government’s intention is not to stifle the digital asset sector.

“Left-wing space for legitimate crypto asset activities will be maintained,” Şimşek told Anadolu Agency. He also warned that platforms that fail to meet the new requirements may face a range of penalties. “In addition to administrative sanctions, various legal and financial sanctions, including denial of licence or cancellation, may be imposed on platforms that do not comply with the new regulations,” he added.

Certain transactions, such as those involving liquidity provision, market making, and arbitrage, will be exempt from the imposed limits, provided users can prove the origin of the funds and platforms monitor these transactions appropriately.

A Push Towards Global Regulatory Alignment

The upcoming measures represent a significant evolution in Turkey’s approach to regulating digital assets, coming just months after the Capital Markets Board (CMB) introduced foundational rules for crypto asset service providers (CASPs).

In March, the CMB laid out new licencing and operational frameworks that granted it full oversight of crypto exchanges, wallet providers, and custodians. The move brought Turkey in line with global practices, such as the European Union’s Markets in Crypto-Assets (MiCA) regulation.

The March framework set rigors standards for CASP operations, requiring that crypto exchanges maintain a minimum of $4.1 million in capital and custodians hold at least $13.7 million. These financial thresholds, alongside governance and transparency criteria for shareholders and executives, aim to establish a more secure and credible crypto ecosystem in the country.

Addressing a Volatile History

Turkey’s relationship with crypto has been marked by volatility. A surge in adoption amid the country’s inflation woes has been met with concerns about financial crime, tax evasion, and consumer protection. The latest measures are part of the government’s effort to strike a delicate balance: fostering innovation in the fintech and crypto sectors while ensuring compliance with international anti-money laundering standards.

As the global crypto landscape matures, Turkey’s approach may serve as a model for emerging markets seeking to regulate without retreating from digital innovation. By tightening rules on stablecoin transfers and enforcing identity and origin-tracking on all transactions, the country signals its intent to be both a vigilant regulator and an active participant in the evolving crypto economy.