Pepe’s Price at a Crossroads: Whale Selling vs. Technicals

Recent data shows that big whale investors have sold a lot of their holdings, which makes it hard to predict where Pepe’s price will go in the near future. Their sales involved billions of tokens, which made people more worried about heavy profit-taking and made the overall market less confident that bullish momentum would last.

Even though whales are less exposed, history shows that these kinds of actions may not fully determine outcomes, as technical structures are still sending positive signals. Traders are still cautious but hopeful, weighing their fundamental worries against technical confirmations that a potential rally could continue in the coming days, even though there are risks of volatility.

Smart Money Investors Cut Back on Their Holdings

Smart money traders, who are often seen as reliable market guides, recently cut back on their exposure to Pepe. This shows that professional trading communities around the world are being more careful. Their token holdings dropped sharply from earlier highs, raising more red flags and making bearish investors who are keeping an eye on advanced blockchain data even more bearish.

But technical charts often matter more than short-term fundamentals. For example, falling wedge formations suggest that momentum could come back even though people are skeptical right now. This duality shows the ongoing debate: do fundamentals outweigh technicals, or will short-term selling pressure eventually give way to established bullish signals forming on the charts?

Investors in Public Figures Leave Their Positions

Well-known investors and influencers also cut back on their holdings by a lot, which made people even more worried about Pepe’s ability to stay competitive as a meme token. Their liquidations led to more money coming into the exchanges, which raises valid questions about whether retail investors can handle too much supply in the long term.

Even though these exits show weakness, they could also make it easier for committed buyers to start buying again in preparation for rebounds. This situation happens a lot in crypto markets, where exits based on fear set the stage for unexpected recoveries backed by technical market formations that are happening.

Recommended Article: PEPE Bulls Eye 0.000011 Breakout With Strengthening Momentum

Pepe Awaits a Drop in Inflows for a Bullish Rally

The number of Pepe coins going into centralized exchanges has shot up, which means there is more selling pressure that could stop prices from going up. Exchange inflows usually mean more volatility is coming. This is because more supply can make prices less stable as traders sell off their holdings and push prices down for a short time.

Price charts, on the other hand, show that prices may be able to hold up despite inflows. This is because wedge breakouts often beat short-term bearish triggers when momentum picks up. Traders are keeping a close eye on whether inflows drop, which would show that confidence has returned and could push Pepe up toward important technical resistance levels that are expected this cycle.

Technical Analysis Shows Bullish Breakout

Pepe has broken through a falling wedge, which is a bullish pattern that is known for predicting reversals after long periods of declining consolidation structures. Technical traders see this as proof of renewed momentum, which supports the idea that Pepe may rise even though whales are acting strangely.

The relative strength index rose above neutral territory, which meant that momentum had returned and confirmed a breakout. These kinds of signals reassure traders that Pepe’s upward trend is still going strong, especially if support zones stay strong against any bearish moves that might happen.

Price Targets Show Possible Forty Percent Rise

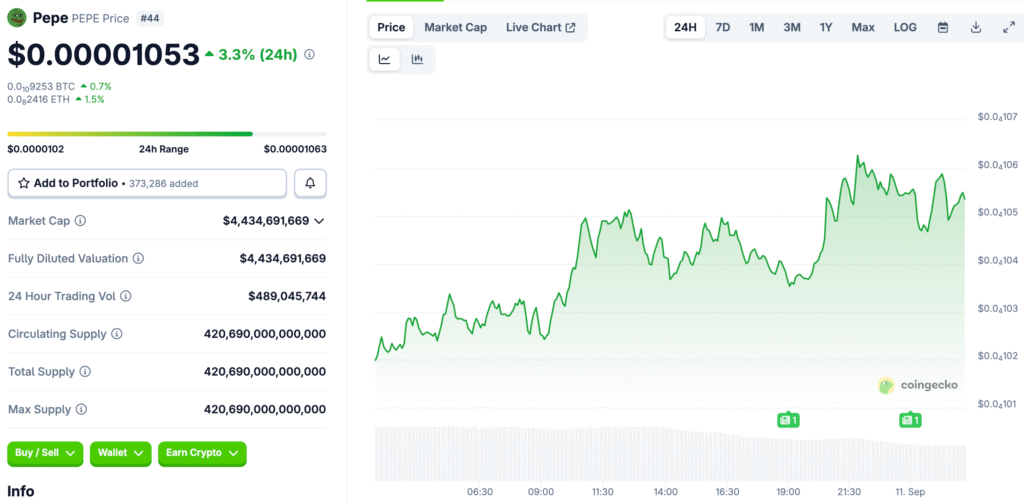

If the market stays strong, Pepe could rise almost 42% and hit a key resistance level near $0.00001475. This fits with chart patterns and Murrey Math indicators, which adds to the technical support for a big rise in the next few trading sessions.

If Pepe breaks below the ultimate support levels, though, bearish invalidation is still possible. This shows how fragile the balance is between bullish opportunity and risk. Investors keep a close eye on things and are ready to change their positions if bullish momentum continues or if recent positive technical signals are invalidated by a possible breakdown.

Pepe’s Rally at Risk Bearish Fundamentals Clash with Technicals

While selling, smart money exits, and exchange inflows all happening at the same time are all signs that Pepe’s rebound may not happen right away. However, technical structures and momentum oscillators suggest that recovery is possible, which makes for a complicated situation that traders must carefully analyze in volatile markets.

Pepe needs to keep breakout support levels, get past red flags by building up again, and get buyers who are sure they will make money in the future. This balance will decide whether Pepe’s rally toward its projected upside targets continues or falters as fundamental pressures rise.