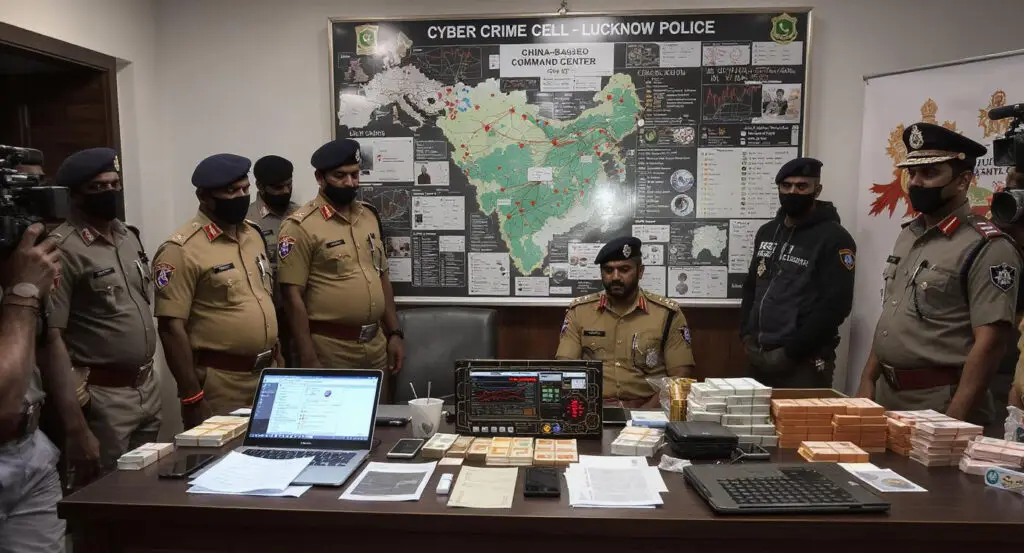

In a decisive blow to cross-border financial fraud, the Lucknow Police on Saturday dismantled a sophisticated cryptocurrency racket accused of syphoning off nearly ₹80 lakh through illicit USDT (Tether) transactions. Acting on digital surveillance and intelligence inputs, a joint cybercrime team arrested eight individuals from different parts of the city.

The case was registered at the Cyber Crime Police Station under multiple sections of the Bharatiya Nyaya Sanhita (BNS) and the Information Technology Act, including sections 317(2), 318(4), 61(2), 111(2)(B), and 66C and 66D of the IT Act. The crackdown was led by Inspector Brijesh Kumar Yadav under the supervision of senior officers, including the joint commissioner of police (crime), DCP (crime), additional DCP (crime), and assistant commissioners from the Gossaiganj and crime branches.

Chinese Handlers and Untraceable Wallets

According to the official press release, the accused operated a highly organised fraud network with foreign handlers primarily from China who manipulated Telegram channels and leveraged the TRC-20 blockchain network to execute unregulated crypto transactions. These operations allowed them to bypass legal scrutiny entirely.

The gang’s activities focused on fake crypto trading schemes that bypassed legitimate exchanges. No transactions were routed through regulated platforms, making detection and accountability difficult. Investigators uncovered that over the past two months, ₹75–80 lakh had been funnelled through such channels, with no traceable digital footprint or tax documentation.

Mule Accounts and Anonymous Transactions

The racket’s modus operandi centred on recruiting Indian account holders on a commission basis. These individuals, sometimes knowingly and sometimes under false pretences, received large sums via NEFT, RTGS, or IMPS transfers. The cash was quickly withdrawn and handed over to underground brokers, who used it to purchase USDT, an increasingly popular stablecoin in peer-to-peer (P2P) decentralised wallets.

“These wallets do not require KYC and operate outside Indian jurisdiction, making them virtually untraceable,” the press note stated. The network enabled criminals to launder money seamlessly, exploiting the anonymity and decentralisation of cryptocurrency platforms.

Suspects Unable to Prove Legal Transactions

During interrogation, the arrested suspects initially claimed they were legitimate crypto traders. However, they failed to produce any valid exchange records, GST filings, or KYC documentation for their wallets. Law enforcement confirmed that the accused had deliberately chosen wallets that operated outside India to evade regulatory detection.

The eight individuals arrested have been identified as Satyam Tiwari (21, Lucknow), Diwakar Vikram Singh (21, Basti), Saksham Tiwari (21, Raebareli), Vinod Kumar (24, Gonda), Krish Shukla (25, Lucknow), Mohd. Shad (31, Barabanki), Laiq Ahmed (32, Gonda; currently in Lucknow), and Manish Jaiswal (40, Lucknow).

Cash, Devices, and Vehicles Seized

Police recovered a substantial haul from the accused, including 16 mobile phones, 2 laptops, a tablet, ₹1.85 lakh in cash, 3 chequebooks, a bank passbook, and four vehicles. The seized items are expected to assist in tracking down further links in the scam.

The Cyber Crime Cell is currently tracing other connected bank accounts and crypto wallet addresses. Authorities believe the racket is part of a larger cross-border network and have signalling that more arrests are imminent.

Crypto’s Legal Grey Zone Exploited

A senior police official emphasised that the group took advantage of existing loopholes in cryptocurrency regulation and weak bank account verification systems. “The gang exploited gaps in crypto oversight to run a cross-border financial crime operation disguised as trading,” the officer said.

As law enforcement continues its probe, the case underscores growing concerns around decentralised financial technologies and their misuse in money laundering. It also highlights the urgent need for regulatory clarity in India’s fast-evolving crypto landscape.

With mounting cases of fraud and foreign infiltration via digital assets, cybercrime units across the country are intensifying efforts to monitor blockchain transactions and expose the hidden layers of the digital underground.