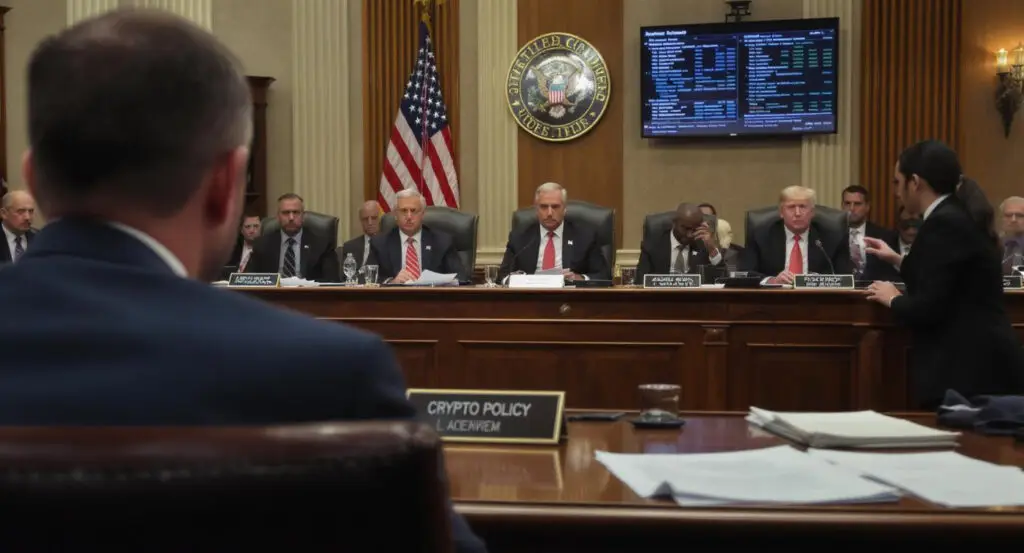

Mounting political scrutiny is targeting federal banking regulators as explosive allegations surface suggesting major U.S. banks may have been pressured to cut ties with lawful cryptocurrency businesses. The controversy has ignited a new investigation by the U.S. House Oversight and Government Reform Committee into whether shifting regulatory stances effectively froze out crypto-linked and politically disfavored firms.

Committee Chair James Comer announced on June 25 that the committee has requested records from the U.S. Office of the Comptroller of the Currency (OCC), the primary regulator overseeing the nation’s largest banks, to determine if financial institutions were indirectly coerced into severing relationships with digital asset companies.

Comer’s Call for Transparency

In a letter addressed to Acting Comptroller Rodney Hood, Comer demanded internal communications and enforcement details related to the OCC’s issuance and revocation of Interpretive Letter 1179. This letter had previously established a framework for federally chartered banks to provide services to digital asset businesses. Comer’s letter made the committee’s objective clear, stating:

“The Committee on Oversight and Government Reform is investigating the improper debanking of individuals and entities based on political viewpoints or involvement in certain industries such as cryptocurrency and blockchain.”

The enquiry builds upon the committee’s earlier outreach, which included a January 24 request to blockchain companies and a February 27 letter to the Federal Deposit Insurance Corporation (FDIC) seeking information about experiences of crypto firms being debanked. Comer cited whistleblower concerns that previous agency responses failed to fully address how the nation’s largest banks chartered under the National Bank Act were impacted.

A Shifting Regulatory Landscape

Central to the investigation is the OCC’s March 2025 release of Interpretive Letter 1183, which formally rescinded Interpretive Letter 1179. The original letter had required banks to seek supervisory non-objection before engaging in activities like crypto-asset custody, stablecoin reserve services, and participation in distributed ledger technology (DLT) networks.

With the new guidance, national banks and federal savings associations are no longer obligated to obtain explicit OCC approval for these activities. However, they remain responsible for ensuring all crypto-related operations are conducted in a safe and sound manner, with comprehensive risk management and full compliance with applicable laws.

The OCC’s revised approach also included withdrawal from certain interagency statements on crypto-asset risks, signalling a recalibration of federal oversight as the industry continues to evolve.

Concerns Over Chilling Effects

Comer emphasised that the investigation aims to uncover whether regulators’ shifting stances on crypto have discouraged banks from servicing digital asset companies, effectively stifling institutional interest in one of the fastest-growing financial sectors. He wrote:

“As the OCC is the primary regulator of banks chartered under the National Bank Act, specifically the nation’s largest banks with assets between $50 billion and $3 trillion, the Committee seeks information about the OCC’s enforcement of financial institutions’ interest and expansion into crypto and crypto-related businesses.”

These concerns echo fears within the blockchain industry that regulatory uncertainty could lead to banks overcorrecting by avoiding crypto clients altogether, even when those clients operate lawfully and comply with existing regulations.

The Road Ahead

The outcome of the Oversight Committee’s probe could have far-reaching implications for the U.S. crypto industry, especially as digital assets become increasingly integrated into mainstream finance. The investigation seeks to clarify whether regulatory overreach or ambiguity has played a role in cutting off access to banking services for crypto firms, a development that could hinder innovation and competitiveness in the digital economy.

While Interpretive Letter 1183 removes previous supervisory obstacles, banks remain under pressure to maintain rigors compliance and risk controls. The coming months will reveal whether the committee’s efforts can bring transparency to federal regulators’ role in the debanking debate, potentially reshaping how digital assets coexist with the traditional banking system.