Brazil Considers a Bitcoin Treasury Reserve

Brazil is set to make a potentially historic move in the global cryptocurrency landscape. On August 20, the country’s Chamber of Deputies Economic Development Commission will hold its first public hearing on a proposal to create a Bitcoin Strategic Reserve (RESBit) worth up to $18.6 billion. The plan, outlined in Bill 4501/24, is designed to modernise the nation’s treasury management, enhance resilience against foreign exchange volatility, and provide a hedge against global geopolitical and economic instability.

If implemented, the RESBit would firmly establish Brazil as a pioneer in integrating Bitcoin into sovereign financial strategy, putting it in the company of El Salvador and other governments exploring blockchain-backed reserves.

A Push for Financial Modernisation

The legislative session is scheduled for 3 p.m. ET and will feature input from experts in finance, blockchain technology, and public policy. Deputy Luiz Philippe de Orleans e Bragança, who requested the hearing, emphasised the need for diverse perspectives before moving forward. Confirmed speakers include:

- Diego Kolling, Head of Bitcoin Strategy at Méliuz

- Julia Rosim, Coordinator of ABcripto’s policy working group and Head of Public Policy at Bitso

The hearing will evaluate how a Bitcoin reserve could serve as both an economic stabiliser and a forward-looking asset within Brazil’s treasury.

Legislative Framework and Oversight

The bill was introduced by lawmaker Eros Biondini, who highlighted the increasing adoption of blockchain-based financial systems in countries such as El Salvador, the United States, China, Dubai, and members of the European Union. Under the proposal, Brazil’s Central Bank and Finance Ministry would be responsible for custodianship of the Bitcoin reserve.

They would also be required to issue biannual reports on the performance, risks, and long-term viability of the strategic holding. Such oversight mechanisms aim to ensure transparency and accountability, addressing common concerns about the volatility of Bitcoin and its potential impact on public funds.

Brazil’s Position in the Global Crypto Economy

Brazil has already established itself as a regional leader in cryptocurrency adoption. According to Chainalysis’ 2024 Geography of Crypto report, the country ranks first in Latin America and 10th globally. Official data from the Brazilian tax authority revealed that nearly $76 billion in digital assets were transacted in 2024, highlighting both the scale and growth of crypto activity in the nation.

With strong consumer demand, an active fintech ecosystem, and a government increasingly open to digital innovation, Brazil is uniquely positioned to pioneer a Bitcoin-based financial reserve.

Strategic Hedge Against Global Uncertainty

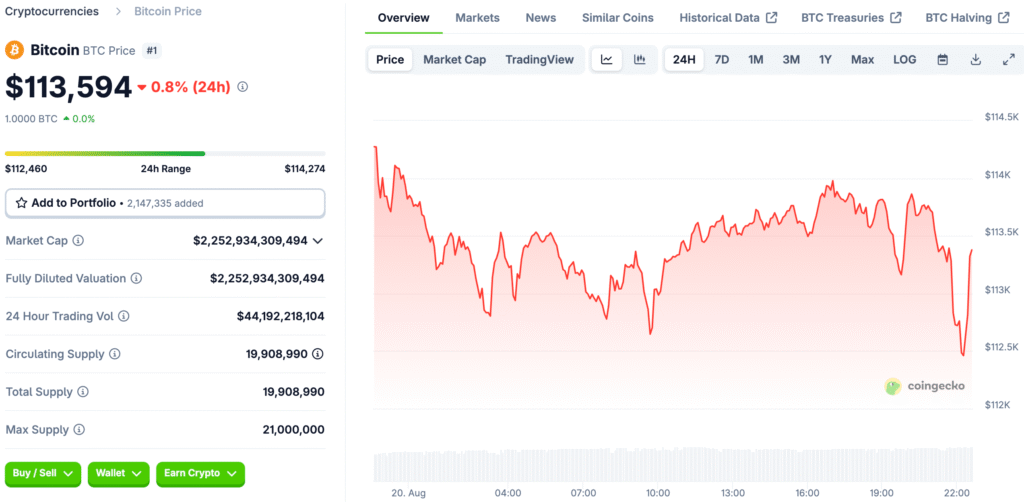

Supporters of the RESBit argue that Bitcoin’s decentralised nature and limited supply make it an effective hedge against inflation, currency devaluation, and geopolitical uncertainty. The proposal comes at a time when emerging economies are searching for ways to strengthen financial sovereignty. By diversifying reserves beyond traditional assets like gold and foreign currency, Brazil could reduce exposure to global shocks and enhance fiscal stability.

However, critics warn about Bitcoin’s price volatility, regulatory challenges, and potential risks if the asset class experiences prolonged downturns. Lawmakers are expected to debate whether the potential benefits outweigh the risks in the context of national reserves.

What’s Next for the Proposal?

If the bill advances, Brazil would join a select group of nations experimenting with sovereign Bitcoin reserves. El Salvador, the first country to adopt Bitcoin as legal tender, has already integrated crypto into its national reserves, though not without controversy.

For Brazil, the RESBit initiative represents not just an economic experiment but a strategic bet on the future of finance. The outcome of this week’s hearing could determine whether Brazil becomes a trailblazer in leveraging Bitcoin as a reserve asset or whether it opts for a more cautious approach.

Brazil’s Bold Move into Digital Assets

Brazil’s exploration of an $18.6 billion Bitcoin reserve signals how seriously major economies are beginning to take digital assets. The debate will likely shape not only Brazil’s economic strategy but also broader discussions on how governments worldwide can adapt to the rise of cryptocurrencies.

If approved, the RESBit could redefine Brazil’s place in the global financial system, anchoring its treasury strategy in one of the most disruptive assets of the modern era.

Read More: The Next Bull Run: Why Institutional Accumulation Is Pushing Bitcoin Toward $160K