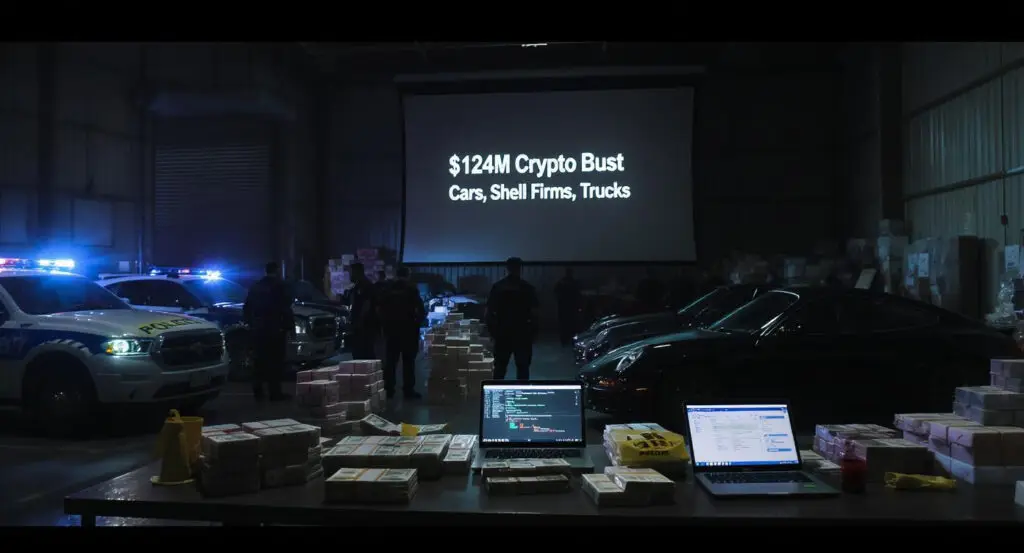

In one of the most elaborate money laundering busts in recent Australian history, four individuals have been charged in connection with an 18-month-long scheme that saw an estimated AUD $190 million (USD $124 million) funnelled through a complex web of shell businesses, bank accounts, and cryptocurrency platforms. Australian authorities allege the operation was meticulously designed to mask the origins of illicit funds and launder them into seemingly legitimate enterprises.

The takedown, led by the Australian Federal Police (AFP), marks a major victory in the ongoing battle against financial crime and cryptocurrency-enabled money laundering. “This was an elaborate and calculated operation,” investigators noted in their official statement, adding that the suspects face the possibility of life imprisonment.

A Coordinated Crackdown

The investigation, which spanned over a year and a half, was anything but routine. More than 70 staff across multiple Australian law enforcement agencies were mobilised to expose the inner workings of the laundering network. The AFP’s Criminal Assets Confiscation Taskforce (CACT) spearheaded the probe, with support from the Queensland Police Service, Australian Border Force, Australian Criminal Intelligence Commission, AUSTRAC, and the Australian Taxation Office.

Working under the umbrella of the Queensland Joint Organised Crime Taskforce (QJOCTF), the authorities executed 14 coordinated search warrants across homes and businesses in Brisbane and the Gold Coast on June 5 and 6. These simultaneous raids culminated in the arrest and charging of four individuals. While some are now in custody, others have been released on bail, pending court appearances scheduled for July and August.

The Mechanics of a Modern Money Laundering Machine

According to officials, the accused constructed an intricate financial and logistical framework to conceal the origins of vast sums of illicit cash. At the heart of the scheme was a diversified portfolio of seemingly legitimate businesses used to launder money, some of which included an armoured truck security company, a classic car dealership, a sales promotion firm, and a cryptocurrency exchange service.

These businesses were allegedly employed to blur the lines between legal and illegal revenue streams. The network is believed to have operated at least seven bank accounts and maintained control over 17 real estate properties and numerous vehicles, all collectively worth millions. Additionally, investigators seized tens of thousands of dollars in physical cash and several hundred thousand dollars in cryptocurrency holdings.

Authorities also allege the use of ‘straw directors’ spouses who were formally registered as company directors but played no actual role in business operations. This tactic, commonly used to distance the true beneficiaries from criminal enterprises, added another layer of complexity to the investigation.

Cryptocurrency: A Double-Edged Sword

While cryptocurrency has been lauded for its potential to transform global finance, its pseudonymous nature and loose international regulation have made it an attractive tool for criminals seeking to obscure transactions. In this case, digital assets played a central role in laundering proceeds from alleged criminal activities.

“The degree of anonymity, speed of transactions, and loose global regulation of cryptocurrency made it instrumental to the income obfuscation efforts in the uncovered operation,” officials confirmed. The integration of crypto into the laundering process made it even harder to track the movement of funds, requiring intensive digital forensic work from authorities.

Looking Ahead: Building the Case

As the legal process unfolds, prosecutors are expected to rely heavily on evidence collected during the June raids, including financial records, seized devices, and crypto transaction data. The court proceedings in July and August will likely determine the scope of each individual’s role within the syndicate and could result in severe penalties, including life sentences.

For now, the bust stands as a stark reminder of the growing intersection between digital finance and organised crime and the complex, resource-intensive efforts required to root it out. As financial crime continues to evolve, Australian authorities have made clear they are prepared to meet it with equal sophistication.