SEC Meeting Highlights Regulatory Importance

As deadlines for spot ETFs get closer, Mysten Labs talked to SEC officials about how important Sui is for regulating cryptocurrencies. The meeting stressed the need for a balance between encouraging innovation and enforcing strict compliance standards in digital asset ecosystems, which is important for long-term adoption in the U.S. market.

The SEC’s involvement shows that they are open to looking at each blockchain project on its own, instead of using old frameworks that don’t work for all of them. This recognition shows that we are moving forward with modernizing regulations in a way that works. It shows that people are more willing to accept technology-specific traits, which makes it easier for blockchain companies to get mainstream financial access in regulated environments.

Mysten Labs Shows What Sui Can Do

Mysten Labs talked about Sui’s performance strengths, focusing on its high-throughput and low-latency infrastructure that is built for decentralized products and services all over the world. Some of the most important projects were the Sui Name Service, the decentralized trading layer DeepBook, and the storage protocol Walrus, which helped people use a lot of different financial apps.

Sui was presented as more than just another blockchain; it was presented as a technology enabler that would help build the next generation of decentralized ecosystems all over the world. Mysten said that Sui was necessary for the wide adoption of secure, innovative, decentralized products that want to keep growing while still following the rules.

ETF Filings Put Pressure on SEC Deadlines

The SEC has deadlines coming up soon for ETF applications from 21Shares and Canary. This makes it even more important for Sui’s financial adoption to get clear rules. As deadlines get closer, the pressure builds. People are predicting that the outcomes will set important precedents that will affect how new blockchain ETFs are evaluated.

Experts in the field think that approvals could make Sui more legitimate, while rejections could slow down momentum even though more people are buying it. Final decisions are very important for getting institutions involved. The outcome will either speed up growth or make people more skeptical, which will change how people see Sui’s investment potential both at home and abroad.

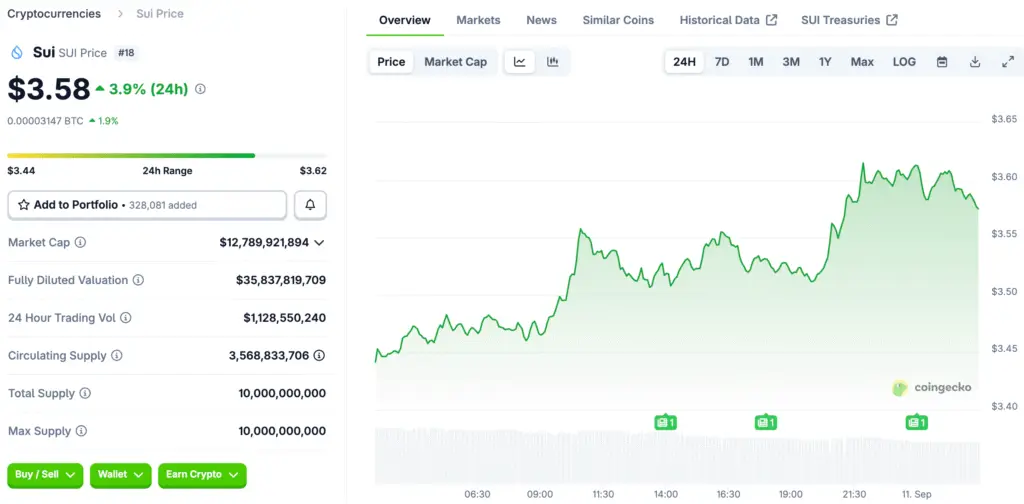

Recommended Article: SUI Price Rally Builds Toward Three Fifty Breakout Target

Legal Counsel Improves the Results of Dialogue

Sidley Austin LLP helped Mysten talk to the SEC, showing that they were making professional efforts to find regulatory paths that fit Sui’s technology structure. Legal involvement made things more serious, which helped Mysten push for innovation while staying within the rules that regulators like.

Having legal knowledge makes your arguments more credible because they are fair and regulators can trust them. This makes sure that conversations stay positive, creating pathways where innovation and compliance can work together. Effective legal advice helps Mysten reach its goal of promoting Sui’s adoption under clear rules that protect both innovation and investor safety at all times.

Industry Pressure on Regulators Intensifies

The policies of the Trump administration have made it more important to move blockchain innovation forward. This has put more pressure on regulators to create flexible frameworks. Many people say that delays could make the U.S. less of a leader because other countries are moving quickly to set clearer standards that help crypto adoption.

The SEC’s direct contact with Mysten shows that they are aware of this outside pressure and that they need to act quickly while still protecting their rights. The rules and regulations are changing quickly, and everyone is waiting for clear answers as regulators try to find a balance between political commitments and the need for market integrity that investors around the world are demanding more and more.

Sui’s Contributions Emphasized for Recognition

Mysten emphasized Sui’s real-world contributions by pointing out products that are already being used in its ecosystem, which show how blockchain technology can be used in real life. These examples made a strong case for Sui to have regulatory pathways that recognize the potential for innovation without putting up barriers that are too strict or using old categories.

This kind of emphasis shows that blockchain is not just a theory; it is changing industries in real ways. Mysten strengthened the case for constructive regulation that meets the needs of innovation by showing operational results. This recognition greatly strengthens Sui’s case by showing that it can power scalable decentralized applications in many different industries around the world.

Sui ETF Decision a Bellwether for Future Blockchain Innovation

The SEC’s decision on Sui ETF applications could set a standard for how new blockchain projects that want to get approval from regulators across the country are treated. Approval may help growth, but rejection could hurt the U.S.’s ability to compete in blockchain innovation and make investors less interested in cryptocurrencies.

In the end, the decision will show how open regulators are to decentralized technologies. Sui’s decision about the ETF is a bellwether that helps people understand what to expect when future blockchains are combined. This choice will have a big impact on long-term growth across the crypto ecosystem because it will affect investor confidence and institutional participation.