Solana’s Breakout Signals a Path to New Highs

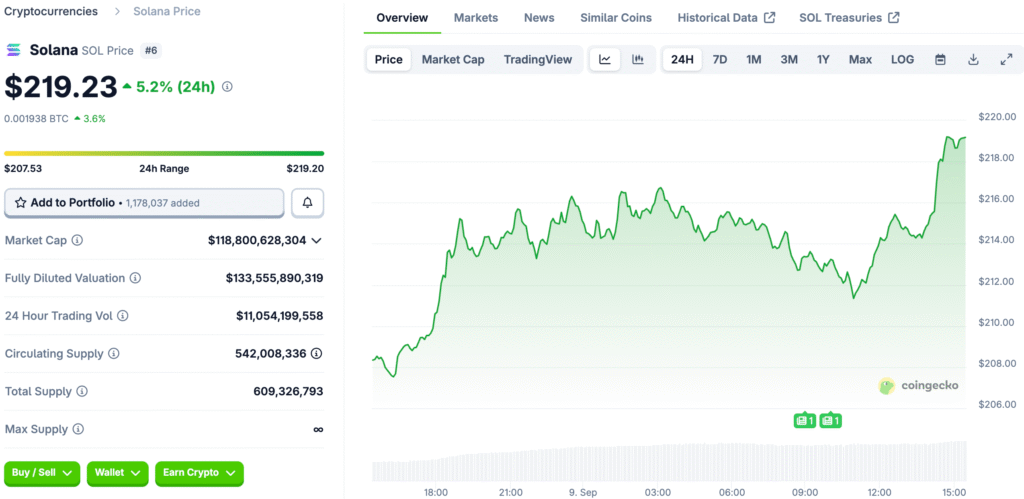

Solana has confirmed an Adam and Eve chart pattern by breaking above the neckline at $217.93, which means that the price is going up quickly. The pattern shows that buyers are becoming more sure of themselves as accumulation phases come to an end. This supports the bullish trend of price action over the past few weeks.

Fibonacci projections show that there is resistance at $262.92 and a top target at $320, which strengthens the technical structure. The 50-day SMA is still holding up, keeping the momentum going while traders keep an eye out for higher lows.

Nasdaq Approval Paves a New Way for Solana Institutional Access

The Nasdaq’s approval of SOL Strategies is a big step forward for institutional investors who want to join Solana’s ecosystem. On September 9, trading will start under the ticker STKE. This will give Solana’s blockchain more credibility and new ways to get money.

Leah Wald, the CEO, said that being recognized by Nasdaq makes the company more credible and helps it get more institutional customers. As validator infrastructure becomes more well-known, the listing opens the door for more money to come in.

Price Levels Affect Short-Term Goals

Solana stays steady at $202 and stays above important support levels. If the price breaks through the $233 resistance level, it will open the way to higher Fibonacci levels, which would be in line with bullish momentum.

If the price stays above $262, it would confirm the long-term projection of $320. As long as support near $188.50 holds, momentum will stay strong.

Recommended Article: Solana Price Prediction Signals Bullish Breakout With September Gains

Adoption by institutions expands the market’s reach.

By being listed on Nasdaq, institutions get more exposure, which supports Solana’s larger story as a trustworthy digital asset. These new vehicles make it easier for people from traditional finance to get involved, which is good for retail adoption and broadens the base of stakeholders.

Institutional rotation into assets linked to validators improves long-term prospects. As liquidity rises, Solana becomes more and more popular among major networks.

Technical Support Says the Market Is Bullish

Price action has been making higher lows since April, showing that it is going through consistent accumulation phases. Breakouts happen when volume increases and network upgrades get better, which confirms upward trends on many time frames.

A drop below $188.50 could change the projections, but a broader alignment of chart signals supports more upward movement. Above short-term moving averages, bullish momentum is still strong.

Ecosystem Growth Improves Market Position

Alpenglow and other upgrades have made Solana’s network faster and more scalable, which has made developers and institutions more confident in it. These changes fit with its growing reputation as a blockchain ecosystem that works well.

Expanded institutional access greatly helps validator operations, which strengthens the foundation of Solana’s decentralized infrastructure. This synergy makes people more sure that it will last.

Solana’s Bullish Path to $320 Backed by Nasdaq Recognition

With Nasdaq recognition and chart structure in sync, Solana’s price path is still strongly bullish toward $320. Breakouts above resistance zones show that the momentum is still going strong.

Investors are keeping a close eye on support levels to see if they hold, which would mean the next wave of gains is coming. The combination of institutional access and technical strength makes people feel good about this target.