A Pivotal Moment for U.S. Crypto Regulation

The U.S. is approaching a crucial turning point in digital asset regulation as lawmakers begin seriously addressing the need for clearer rules. Ripple’s top executive, Brad Garlinghouse, is scheduled to testify before the Senate, marking a significant milestone in the crypto industry’s journey toward legitimacy.

This moment is more than symbolic; it reflects growing momentum in Washington to construct a robust framework for digital asset oversight. As crypto adoption accelerates, the demand for legal clarity has become a priority for regulators and innovators alike. The hearing signifies bipartisan awareness of the risks and opportunities in crypto markets. Stakeholders across sectors are watching closely, hoping this moment brings lasting change.

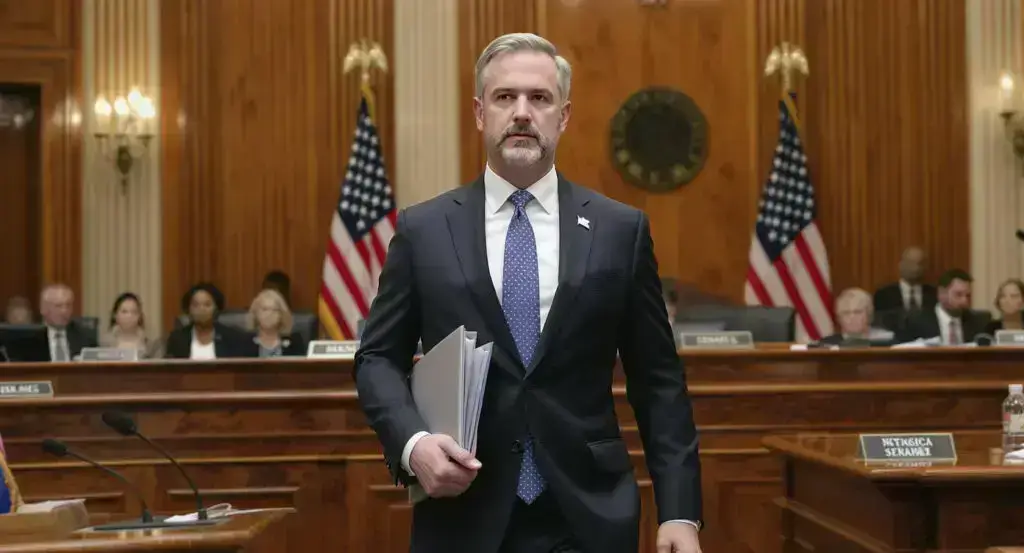

Brad Garlinghouse Takes Center Stage in the Senate

Brad Garlinghouse, CEO of Ripple, will make his first appearance before the Senate Banking Committee on July 9. His testimony will be part of a hearing titled “From Wall Street to Web3: Building Tomorrow’s Digital Asset Markets.”

Garlinghouse will be joined by other key figures from the crypto industry, including representatives from Chainalysis, Paradigm, and the Blockchain Association. Their insights are expected to influence how lawmakers view the evolving digital financial landscape. The lineup reflects the industry’s diverse expertise, from compliance to venture capital. Together, the panel will aim to highlight common-sense pathways for regulation.

Advocating for Constructive Market Structure Legislation

Garlinghouse has consistently emphasized the need for practical, forward-looking crypto legislation in the U.S. He believes clear regulatory guidelines can support innovation while protecting consumers.

According to him, the lack of structure has hindered U.S. competitiveness in blockchain and digital finance. Ripple’s leader sees thoughtful legislation as key to unlocking the sector’s full potential. Without clear laws, companies face regulatory whiplash and uncertainty. Garlinghouse aims to shift the narrative from punishment to progress.

GENIUS and CLARITY Acts as Key Legislative Efforts

The hearing also highlights several legislative proposals aiming to reshape U.S. crypto regulation. Two of the most important bills are the GENIUS Act and the CLARITY Act.

While the GENIUS Act focuses on stablecoins, the CLARITY Act would resolve agency turf wars by clearly defining the roles of the SEC and CFTC. These efforts signal a broader commitment to building a functional and fair digital asset ecosystem. Their passage could prevent regulatory duplication and streamline oversight. Lawmakers hope to bring order to a currently chaotic framework.

The SEC’s Shifting Posture: Towards Collaboration

The SEC, traditionally seen as an adversary to crypto innovation, appears to be reconsidering its approach. Increased dialogue with industry stakeholders suggests a potential move toward cooperative regulation.

This evolving posture could lead to more tailored rules that reflect the unique nature of digital assets. Such collaboration would mark a welcome shift from enforcement-first strategies that have often stifled innovation. SEC leadership is starting to acknowledge the need for a balanced approach. Engagement may replace litigation as the primary tool for policy development.

Ripple’s Legal Milestone: Ending a Five-Year Battle

Ripple recently closed a major chapter in its legal saga with the SEC by withdrawing its cross-appeal. The agency is also expected to drop its own appeal soon, ending a nearly five-year court battle.

The resolution removes a long-standing source of uncertainty for Ripple and the broader crypto market. It could also serve as an important reference point for how digital assets are treated under U.S. law. This legal closure strengthens Ripple’s standing with institutional partners. It may embolden other companies facing regulatory scrutiny.

The Broader Implications for Digital Asset Markets

The outcome of the Senate hearing and Ripple’s legal developments carry broad implications for the entire crypto sector. Greater regulatory clarity could unlock institutional investment and spur innovation.

By addressing jurisdictional ambiguity and asset classification, U.S. lawmakers can help stabilize and mature the market. The ripple effects of these decisions may influence global regulatory norms as well. Investors and builders alike seek predictable policy environments. U.S. leadership here could guide best practices worldwide.

The Future of U.S. Crypto Leadership

Industry leaders like Brad Garlinghouse are helping guide the U.S. toward global leadership in blockchain innovation. Legislative momentum and public-private cooperation are key to securing this position.

If the U.S. can establish a balanced regulatory environment, it will not only protect consumers but also foster technological advancement. The coming months will be pivotal in defining America’s role in the future of digital finance. With the right policies, the U.S. can maintain its tech leadership. Crypto could become a pillar of its economic strategy.