A Bureau De Change (BDC) operator, Al-Hassan Garba, provided a compelling testimony before the Federal High Court in Lagos, detailing how he facilitated the conversion of cryptocurrency (USDT) into naira. His testimony is central to an alleged N3.4 billion cyber and romance fraud case involving businessman Friday Audu and three other defendants. Garba narrated how the proceeds from these crypto conversions were subsequently paid into the bank account of Genting International Limited, shedding light on the intricate financial maneuvers employed in the alleged scheme.

Witness Testimony on Business Dealings

Testifying before Justice Daniel Osiagor, Al-Hassan Garba, led in evidence by Economic and Financial Crimes Commission (EFCC) counsel Rotimi Oyedepo (SAN), confirmed his extensive experience as a licensed BDC operator for over 10 years, operating under the business name “Hugo.” He explicitly acknowledged his business dealings with the first and second defendants, identified as Mr. Ken and Friday Audu, as well as with the fourth defendant, Genting International Limited, establishing direct links between his operations and the accused parties in the fraud trial.

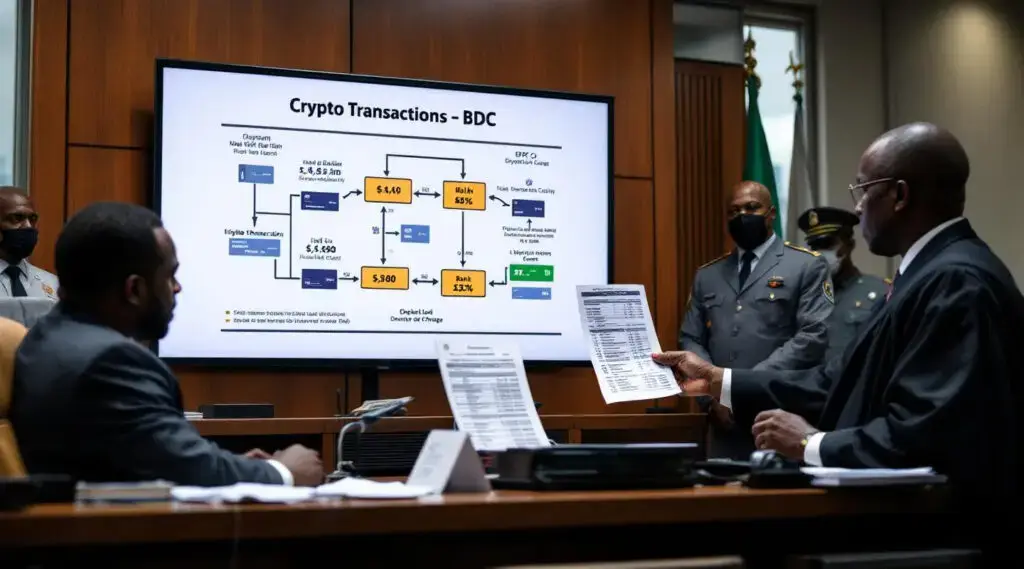

The USDT to Naira Conversion Process

Garba explained the mechanism of the cryptocurrency conversions, stating that in 2023, Ken first approached him to convert USDT, a stable cryptocurrency, into naira. Following each transaction, he was provided with the bank account details of Genting International Limited to deposit the equivalent naira amount. He elaborated on the technical process, stating, “USDT is a digital currency, so I provide a wallet address for them to send the funds. Once I receive the USDT, I transfer the equivalent naira amount into the account of Genting International Limited,” illustrating a clear crypto-to-fiat pathway.

High-Volume Transactions Raise Suspicions

The BDC operator further testified that the frequency of these transactions significantly increased from September 2024, often ranging between N5 million and N10 million on a daily basis. He specifically identified two particularly large transactions: N13 million on August 26, 2024, and N15.9 million on August 27, 2024, highlighting the substantial sums involved. Garba also disclosed that other individuals, including his brother, Sani, and an associate named Ifesinachi, conducted similar transactions utilizing crypto wallets under his control, indicating a network of individuals involved in these high-volume conversions.

EFCC Investigation and Witness Cooperation

Garba confirmed his cooperation with the EFCC during their investigation, stating that the anti-graft agency had contacted him to provide information. Interestingly, he also revealed that Friday Audu, one of the defendants, had reached out to him to inquire whether the EFCC had made contact. The court admitted into evidence several statements made by Garba to the EFCC between January and April 2025, marking them as Exhibits B1 to B8 without any objection from the defense, solidifying their role as key evidence in the ongoing trial.

Charges and Allegations in the N3.4 Billion Fraud

The EFCC had previously arraigned Friday Audu, Huang Haoyu, An Hongxu, and Genting International Limited on a comprehensive 12-count charge. These charges encompass serious offenses including cybercrime, money laundering, and illegal foreign exchange dealings, to which all defendants pleaded not guilty. According to the anti-graft agency, the defendants were part of a sophisticated syndicate, allegedly led by an absconding suspect named Dualiang Pan, which utilized over 792 members employing false online identities to lure victims, primarily through romance scams and other cybercrimes.

Fund Laundering and Forex Violations Detailed

The EFCC further alleged that the syndicate leveraged Nigerian operatives to impersonate foreigners and subsequently laundered the proceeds of the fraud, amounting to over $2.5 million, which were held in cryptocurrency wallets controlled by individuals like Chukwuemeka Okeke, Al-Hassan Garba, and Ifesinachi Jacobs. Additionally, N3.4 billion was reportedly retained in Genting International Limited’s Union Bank account, with N106 million and N913 million transferred to accounts linked to Pan at UBA. The EFCC asserted that these transactions violated foreign exchange regulations, as over N2 billion was exchanged without proper routing through the Central Bank of Nigeria, constituting significant financial offenses.

Legal Framework and Ongoing Trial

The alleged offenses committed by the defendants are said to contravene various sections of Nigerian law, including Section 29(2) of the Foreign Exchange Act, 2004; Sections 18 and 27 of the Cybercrime Act, 2015; and Sections 18(2)(d) and 21(c) of the Money Laundering (Prevention and Prohibition) Act, 2021. Justice Osiagor has adjourned the matter to July 4, 2024, for the continuation of the trial, indicating that further evidence and proceedings will unfold as the court seeks to unravel the full extent of the alleged N3.4 billion cyber and romance fraud scheme.